Wednesday 25, May 2022

Found in The Rational Walk’s weekly digest for last week

Worth a read:

- Madoff and FTX. Pam Martens draws parallels between a crypto exchange (FTX) and the Bernie Madoff Ponzi. As ever, the SEC were extremely reluctant to act. What was remarkable was how Madoff kept his scheme running for many decades. It’s simply not the case that the first downturn will flush out the Ponzi schemes. A well-run Ponzi will have enough liquidity to keep going for a long time after people get suspicious. It definitely helps if you have a stable of celebrities associated with your operation, something that has not gone unnoticed by the present generation of Bernie act-alikes. (I think Madoff Securities kept running from around 1973 until it finally crashed in 2008. It’s in the article.)

Threat to US Treasuries

This was in the FT today. It’s really saying that the yen carry trade may be dead. I am somehow missing something, because I never understood why the USD.YEN was so stable when there was such a gap between the yields on the two currencies. It seemed like covered interest-rate parity wasn’t a thing. Maybe now it is. For securities so liquid and heavily traded as currencies, it just doesn’t make sense. Well, maybe now the market is behaving rationally, but this could prove a problem for Biden. Maybe the so-called ‘safe asset shortage’ is the one shortage that this panic will eliminate.

As the dollar rises, foreign investors have to pay more for currency hedges, which cuts into their returns. Although the yield on the 10-year US Treasury briefly hit 2.97 per cent this month, the yield in effect falls to just 1.32 per cent once you factor in yen-dollar hedging costs. These now stand at 1.65 percentage points, a two-year high.

Japanese institutions sold a hefty $74bn of Treasuries in March, say data released last week. While the Asian country remains the largest foreign holder of US government bonds, its $1.23tn holding is at its lowest level since January 2020. The sell-off may have been exacerbated by Japanese money managers booking profits for the fiscal year, which ends in March.

Even so, the fall is 2.5 times greater than the largest previous sale by Japanese investors in a single month, according to TD Securities.

China, the second-largest overseas holder of Treasuries, in March also cut its holdings for the fourth straight month. Since November, it has sold more than $41bn of US government debt. Sustained selling would be a problem for the Federal Reserve. The US central bank is counting on foreign investors to help absorb the increased supply of Treasuries that is coming on to the market as it ends its pandemic-era bond-buying programme.

WEF and Internet Safety

Davos is in full swing. Fleets of private jets have transported legions of billionaires to Davos (although maybe fewer Russian oligarchs than in the past). They have gathered to decide how to run our lives. For such a powerful bunch, it’s amazing how negatively they are portrayed in the mass media. Anyway, even plebs like me can sign up to their regular, and rather boring bulletins. One of their current campaigns is online safety. The linked article seems pretty anodyne. It’s not obviously the work of an evil genius. I have a feeling that it will end up in all content being passed through some sort of corporate filter, which will remove stuff kids shouldn’t see, including stuff which is critical of billionaires. But, there again, maybe I’m just paranoid.

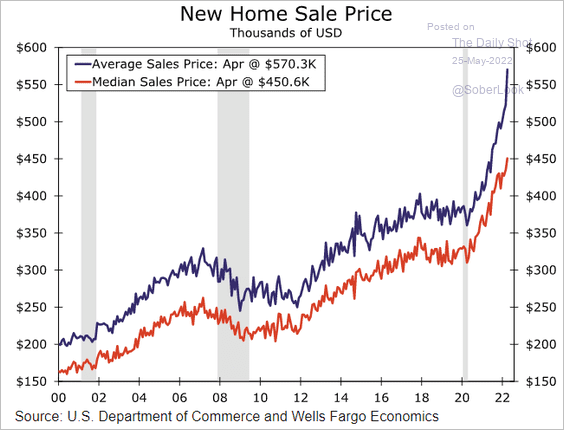

Housing

I had been planning to write something more about housing. It has gone absolutely bananas in the USA. I think it’s going to happen in the UK, which chronically fails to build enough houses for a variety of reasons. I think that inequality arising from house price appreciation is almost more politically toxic than billionaires never paying any tax. People notice things which are local, and notice when they cannot afford to buy even a basic house. For most goods, the cure for high prices is high prices. But for housing, it’s different, and the expansion of credit for house purchase (which is usually the proposed solution for house price unaffordability) just makes the problem worse. I’ll get down off my soap box now.

Wrap

Another risk-on day. Fed minutes didn’t say anything very scary (other than that 50bp hikes are coming, which is hardly a surprise). The dollar has been falling for a couple of weeks, which is continuing to support equities and commodities. 10Y yields are back down to 2.73%, signalling that the market has decided that this time really is not different after all.

Absolutely legendary fact check pic.twitter.com/wvBkrYr1FR

— Chris Freiman (@cafreiman) May 24, 2022

Image of the day

Reloading by Six N. Five pic.twitter.com/9xkg5G7ikY

— Abstract➿Natalija (@Unique_Abstract) May 25, 2022

Comments !