19 Aug

Afterpay analysis

Net Interest is a wonderful blog. Marc Rubinstein is a smart cookie. I always enjoy his missives, but I enjoyed this writeup of why Afterpay in particular, and why this sort of retail finance fintech is so sought after. Afterpay has been snapped up by Square, for $33 billion. That’s a lot of money.

People want a frictionless life nowadays. Having something automatically provide finance for a capital purchase is a nice thing. It’s not a new idea, and it hasn’t always been profitable, but it makes a huge difference to the seller. The article explains how the Singer Sewing Machine company achieved its dominance by providing finance. The same was true of General Motors, which overtook Ford because old man Ford thought debt was evil.

The article referenced above has a link to another article Rubinstein has written about Klarna. You can read it here. Key takeaways: - Klarna is a bank, ‘unashamedly’, - the merchant pays for the whole operation (6%, exactly the same figure as was used in the earliest days of the credit card), rather than having some consumers free-riding off others, - the model is very cash flow positive except for defaults, which run at 7.6%, even in a rapid growth, low interest rate environment.

I am not a fan of BNPL companies. The seem an absurdly expensive way of getting credit. But I’m not representative of the customers they target.

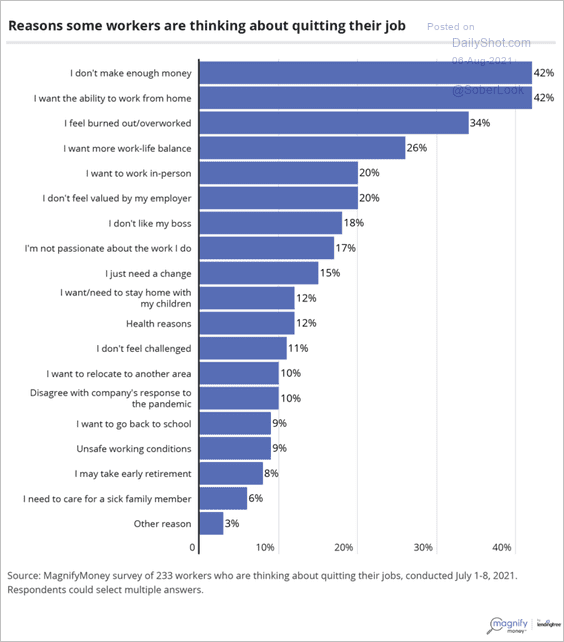

Why do people quit their jobs?

What is happening to the markets?

Wall Street and politics

I subscribe to Wall Street on Parade. Even though it’s well-written and usually says something new, the unvarying underlying message can be depressing. That message is that the US government is now a creature of the finance industry and that the Fed and the US Treasury are run to benefit the managers of Wall Street firms. Today’s edition is fairly typical. It cites two examples of Congressmen who have rotated, through the revolving door, into jobs with the finance industry after having participated in sabotaging legislation which would have limited the power of large banks. I don’t know enough, or care enough, to check the details, but I never see any rebuttals of this work, and I imagine that if it contained any factual inaccuracies the individuals named would seem some sort of redress. The Internet is a dangerous place, as it’s easy to miss the arguments from the other side. But nobody really seems to be making those arguments, as far as I can see.

Wrap

Today was a distinctly risk off day, in spite of the major US equity markets looking as though they will finish flat. It seems that these days, the SPX and NDX are sort of risk-off proxies. Equity is no longer seen as risk capital. I don’t know why, but the Twitter consensus is that the Plunge Protection Team of Yellen and Powell can always be counted on to ride to the rescue of the US equity markets if they should show signs of having more than a couple of down days on the run.

The main casualty of the risk off sentiment was commodities. Essentially every commodity that is traded was down, from energy to food to precious metals. The sole exception was Natural Gas, which was up 40bps. Most of the energy complex was down by ~2%, after a run of six down days. Crude is now at $64 a barrel. The dollar was a beneficiary of this risk off mood, hitting 93.5, above where it peaked at the end of March, and not far off where it was last Nov.

The main economic news was US new unemployment claims were down at 348K, about 15K fewer than expected. I would have thought this would be positive, but it may make the hinted-at Fed tapering more likely. The Delta variant is still with us, and there are lots of cases, but by any objective measure not many people are dying.

Bonds were not very active today, 10Y yields down just a couple of bp. I’ve always accepted that the bond guys may be the most miserable traders on Wall Street, but they are also the most well-informed. One bond guy who certainly qualifies is Jeff Snider of Alhambra Investments. He writes extensively about the shadow money system, the TIC (Treasury Internation Capital System) and what these repo madness episodes really mean. He thinks the world is going to hell in a handcart, which would be miserable but is music to the ears of bond investors.

My bias is to think that bond yields cannot go much lower. They are already deeply negative, at least in real terms, and for most of Europe and Japan they are negative in real terms. The simple-minded me who thinks that global debt hitting USD 300 trillion is hard to square with a shrinking money supply which would lead to deflation. But guys like Snider and Lacy Hunt have been right more often than they’ve been wrong, so maybe I am just missing something. There is certainly a risk that a collapse of demand will cut inflation, which will then push up real rates to the point where they form a self-reinforcing deflationary spiral.

Image for the day

This beautiful picture was taken by Ed Freeman

Images

For some reason, the new version of Pelican I’ve installed can’t find any of my (stolen) images.

I’ve moved to Anaconda to install Python packages. It seems to be an improvement on Pip and virtual environments, but for some reason it doesn’t want to install the latest version of Pelican (4.6.0) and instead installs 3.7.0, which doesn’t support the {attach} syntax that I have used throughout.

There must be a way of fixing this, but for the time being my images are all borked, but at least I know why, at least in principle.

Comments !