Crumbs

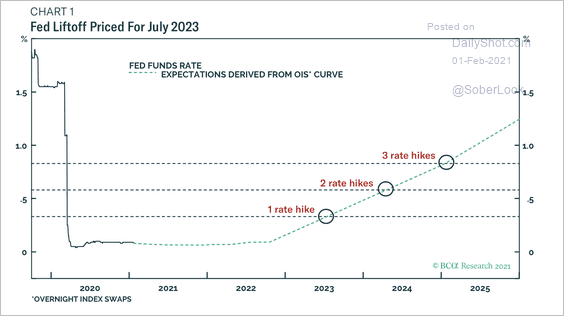

BCA — who they? But it’s nice to know I’m not the only one seeing Fed funds rates going up in the next few years. This prediction puts rates at 8% by end 2024. Seems incredible now, but it’s not that long ago we saw higher.

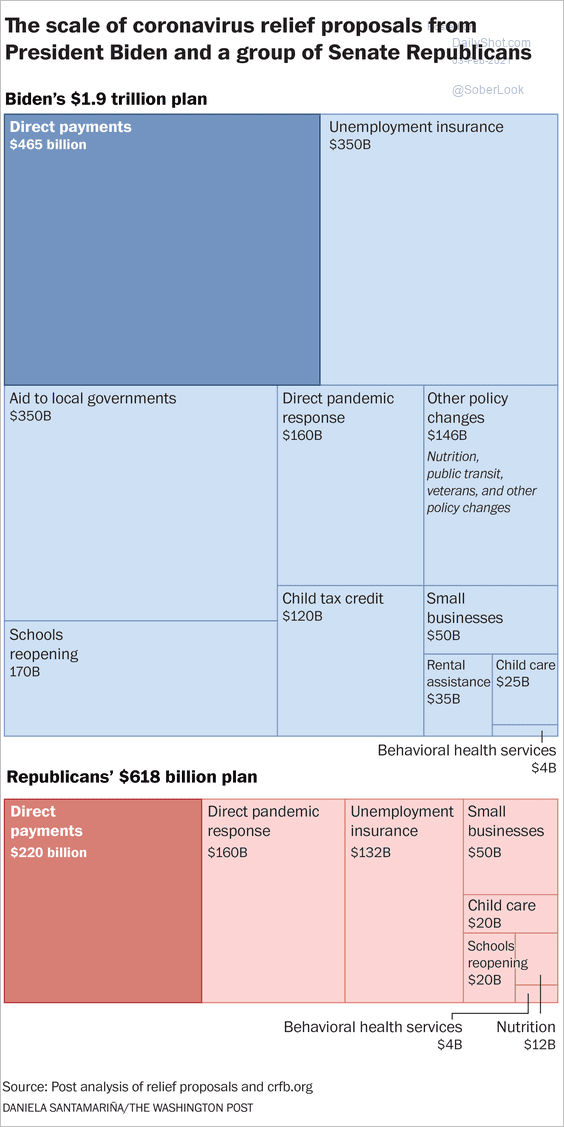

Janet Yellen is “going big:”

Tin shines brighter than gold!

Crumbs

- $IYR:ARCA (iShares US REIT ETF) has short interest of 19.15% and an IV of under 20%. Just sayin’.

- There is some evidence that a $1.9T stimulus package will make a difference. Would would have thought it?

- Stanley Druckenmiller thinks this is the wildest time he’s ever known:

“In three months we increased the deficit increase more than if you took the last five recessions combined and those were big ones… The Fed in six weeks bought more treasuries than they did in ten years under Bernanke and Yellen when people like me were screaming about how excessive QE was during that period. Corporate borrowing, which almost always goes down during a recession as corporations reliquefy, and had already gone from $6 trillion to $10 trillion because of the free money going into the period, actually went up $400 billion. Just to put that in perspective, it went down $500 billion during the Great Financial Crisis…”

“It’s possible, in fact probable, that all this stimulus is still going to be in place and frankly increasing just when we release the biggest increase in pent up demand globally that we’ve had maybe since the 1920s, which could make the world look extremely different than today.”

“I would say that my overriding theme is inflation relative to what the policy makers think.”

Wrap

Risk on, again:

- US equities at all time highs (most indexes),

- DX up 0.4%, putting pressure on commodity prices, although oil and gas continue to climb with promise of vaccine-driven recovery. Supposedly, this is a result of treasury yields rising, but, in my day, covered interest arbitrage was a thing!

- 10 year Treasurys reach 1.14%. Up 0.8bp!

- European equities strong,

- cryptocurrencies are exploding (Elon Musk pumped Dogecoin ).

Generally, the economic recovery is still driving a risk-on take. Long duration stocks like the Famous Five (aka FAANG, aka FAANGMAN) were all up strongly. At some point treasuries must weaken, or the stronger dollar will kill the recovery and treasuries will strengthne, but the current setup doesn’t seem stable.

Tweets of the day

Dogecoin fixes this. Wait. pic.twitter.com/8KYXjxhVdr

— Rudy Havenstein, How dare you? (@RudyHavenstein) February 4, 2021

Damn short-sellers! https://t.co/ut3KGwdB9B

— Diogenes (@WallStCynic) February 4, 2021

Comments !