Crumbs

Today was President’s Day: a holiday for many US Americans.

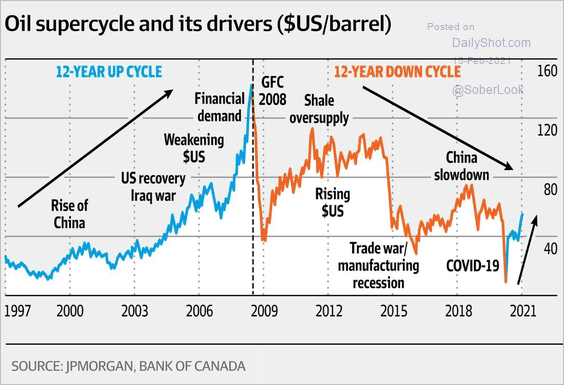

Shipping, both container and bulk, is a very unloved sector. There cycle is long, and it takes a long time to build a ship. I think we’re going through a cyclical up phase, as commodities (oil, LNG, coal, lumber, grains) start to move after the pandemic. $SB and $NMM might be a way to play this, although I like $STNG, which has a 9.5% short interest, and yet a free cashflow per share of $2 on a share price of $16.

Platinum seems to be going hyperbolic (in coverage, at least). It is spiking higher:

If we ever get fuel cells to work properly, we may need a lot of this, and in any case it might have a considerable use in hydrogen transport.

Wrap

Risk-on, deflationary day today:

- every global equity market up (especially Japan),

- commodities (non-monetary) all up, except soybeans. Brent crude is pushing $60.

- DX down (90.333), GBP being the winner (up to $1.39)

- Govt. bond yields up absolutely everywhere.

Basically, stocks will use any excuse to rally. Central banks are all saying they’ll tolerate any level of inflation to get unemployment down, which is enough to light the fire under commodities and equities. Bonds weaker as a result.

Chart

Comments !