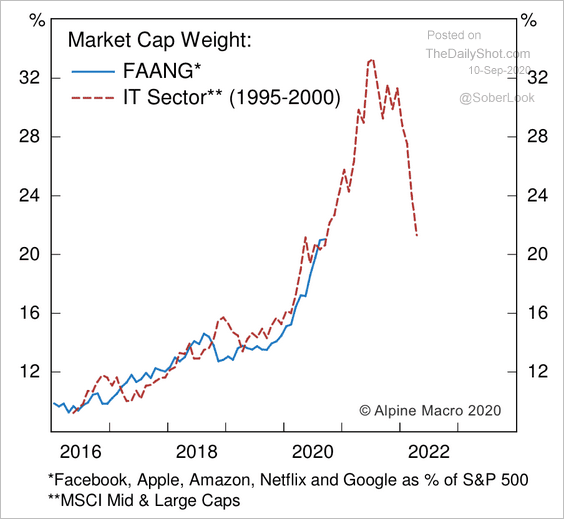

FAANG Weighting

I saw this neat chart on the Daily Shot (cheapskate edition):

Of course, history doesn’t repeat, or even rhyme, as stonks only go up nowadays.

Worth a look

George Selgin on supply side shocks.

If inflation rises with this, the Phillip’s Curve will be dead and buried.

Fed liquidity swaps coming right down.

Weekly wrap

Equities down quite heavily: 3.2% for the Russell and the same for the SPX. The NDX is down double that, and the drop seems to be accelerating, although on Monday the direction might change violently. Almost incredibly, the VIX is down 14% over the week, to close to 20% (which is still high in terms of realized vol.). My understanding is that there has been a ton of call buying by retail which is (presumably) unwinding or expiring, creating a downward pressure on vols, but this is wild speculation on my part.

Of the sectors, energy continues to get hammered. Presumably, this is transport (and particularly air travel) related. I feel that there is value in energy (XOM yields 9%!), but downward momentum is hard to shake off.

World equity markets have been relatively flat, apart from Europe, which has been surprisingly perky. In spite of the never ending omnishambles that is Brexit, the FTSE has done pretty well, up 4% on the week, presumably because of the tailwind provided by the weak pound.

Long and short term risk free rates have remained largely unchanged, with the same true for investment and low grade credit. Convertibles are down, as you’d expect given their seniority.

Commodities are down apart from corn, cotton and cattle (and soybeans). Wheat is down, but from a recent strong run. Gold is fractionally up, but nothing else. Silver is still sliding down from it’s amazing run.

EM currencies held up fairly well (commodities related?). The pound is sinking, as it has a chronic trade deficit which can only get bigger. The Euro, which spiked against the dollar when Lagarde didn’t cover herself in glory at an ECB event, has slumped back to where it was. I am not a connoiseur of these things but I saw a commentator say something to the effect of “I never thought I’d say this, but now I long for the time that Mario Draghi did these things.” One of these days they’ll actually let an actual banker run the ECB. Well, maybe not this century.

Morris Sachs, interviewed on the Market Huddle made a few good points:

- gold is a commodity, but trades a vol which is very low for a commodity (more like a currency). This makes calls attractive,

- the yield curve is flat, with negative real rates going out for a long way, which makes forward prices cheap (off which all options are priced),

- gold is under-held by most institutions,

- gold may have a role in evading estate taxes (I don’t fully understand this as it’s a US-tax thing, but it may be a factor),

- it’s a “story” stock,

- it’s no longer overbought (because it’s been flat for a while),

- the dollar may go down (there is a lot of M2 creation), but it’s hard to see which alt. currency to trade against, since all CB’s are following the Fed’s lead (possible exception is China, but that is a difficult currency to trade).

I think that the conclusion from all this is to go long via long-dated options, maybe on $GLD.

South Sea Bubble

Three hundred years ago the South Sea Company failed. The story is well worth reading: most of the important points are found in Wikipedia, but it’s entertaining to listen to Patrick Cerezna talking about it in the Market Huddle, mentioned above. The “story” of the stock was that the company had been granted a monopoly of trade with south America, and would, in time, come to exceed even the East India Company in terms of profits. The govt. was happy, because the company took over the national debt, and the granting of “golden shares” to insiders and regulators ensured that there would be no close scrutiny of its operation. The company was the original Public Private Partnership. Its failure lead to the creation of the Bubble Act which made it very difficult to create joint stock companies which resulted in very few being created until the advent of the Industrial Revolution and the numerous joint stock companies set up to finance railway building in Britain and abroad (I think there were some created to finance the digging of canals, but the issue of vast numbers of railway shares was the big event).

Share price history of the South Sea Company (from Wikipedia), log scale.

Comments !