Crumbs

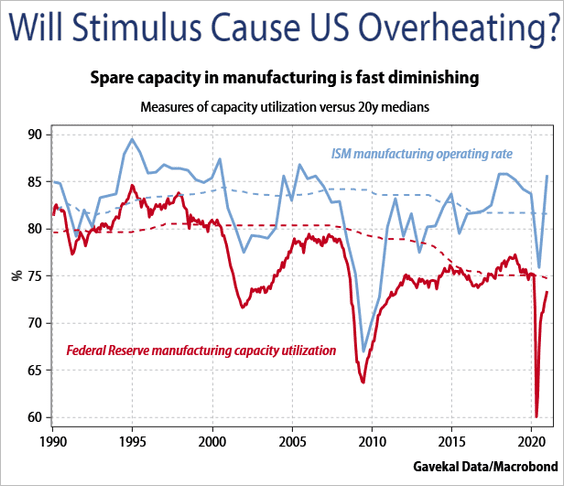

Are we close to hitting capacity constraints in the US or UK economies? Not even close! We have abundant physical capital, and financial capital for materially net negative interest rates. We have labour utilitization which is way below 100, even for prime age workers, not to mention the reserve army of the recently retired (which have done a lot of the vaccine administration in the UK).

I know the mass media in the US is not the most trustworthy, but when 90% of the supporters of any mass appeal party don’t believe what they read in the papers, we are in serious trouble. One dreads to think about what they believe is a trustworthy source of news.

Wrap

Equities pretty flat. Bonds up (i.e. yields down). Pretty much no change in yield curve steepness. Curves still very flat: DE has 26bp between 2s and 10s. Currencies pretty flat: EURUSD no change.

No real news. Some political wrangling. Some Big Tech co’s investing in EVs. FB coming out with a Clubhouse clone.

Chart of the day

The UK has had a pretty terrible economic time since 2008. GDP per capita, on a PPP basis, has gone up by only 5% since 2008, over the course of more than twelve years, i.e. around 40bp a year. A most miserable decade (or so).

source: tradingeconomics.com

Comments !