Tuesday 19, April 2022

Chicago Fed National Financial Conditions Index

A lot of macroeconomic theory is about whether we are above or below full employment. If we are above, the appropriate policy response is to tighten. If we are below, the correct response is to loosen. A a lot of inputs go into measuring whether or not conditions are tight or not. For more detail, go here.

The upshot of all this hard statistical slog is that the US is still running a loose monetary policy. The conclusion that may be tentatively drawn is that inflation is not going to be controlled by this sort of policy response. However, the trend is towards tightening, so we may well get there within a month or two.

NB: below the line (< 0), loosening, above the line (> 0) tightening. The line represents the equibrium position corresponding to full employment.

Algorithmic Stablecoins

Crypto is a ecosystem of Ponzi schemes. It’s not just me that says so, it’s Matt Levine, here.

Here is how an algorithmic stablecoin works. You invent two tokens, call them Dollarcoin and Sharecoin. You list them on the crypto exchanges. Sharecoin trades for whatever price is determined by supply and demand. It might be $0.01 per Sharecoin, or $1, or $100: who knows? But Dollarcoin is supposed to trade at $1. If it trades at $0.99, you have some automatic process in which you print more Sharecoins and use them to buy Dollarcoins until it is back to $1. If it trades at $1.01, you have some automatic process in which you print some more Dollarcoins and use them to buy Sharecoins until it is back to $1. The result is that Dollarcoin is firmly pegged to the dollar. The process is sometimes compared to algorithmic central banking, where the central bank maintains the value of the currency (Dollarcoin) by adjusting its supply.

Clearly, as Levine explains, this can only work if the thing you just made up has some value, which rationally you’d think it doesn’t. But clearly crypto doesn’t work like that. There is a whole financial ecosystem of lending, trading, exchanging these tokens, all of which someone just made up. OK, dollars used to have value because the Fed used to say you could swap them for gold. Even when it said “No, we’ve changed our minds. You can’t exchange dollars for gold any longer,” it didn’t make much difference: the dollar is still the world’s reserve currency, and it generates huge revenues (‘seigniorage’) for the Fed & US Treasury, even to this day. So, it sort of works, until it doesn’t.

I feel that it’s a skyscraper built on blocks of expanded polystyrene, but it’s stayed up so far, so I’m not going to short it.

Matt has a fantastic explanation of how poison pills work. You can read it here. Really, I think I could learn more about how finance works by reading Matt Levine every day than by doing a Harvard MBA.

Wrap

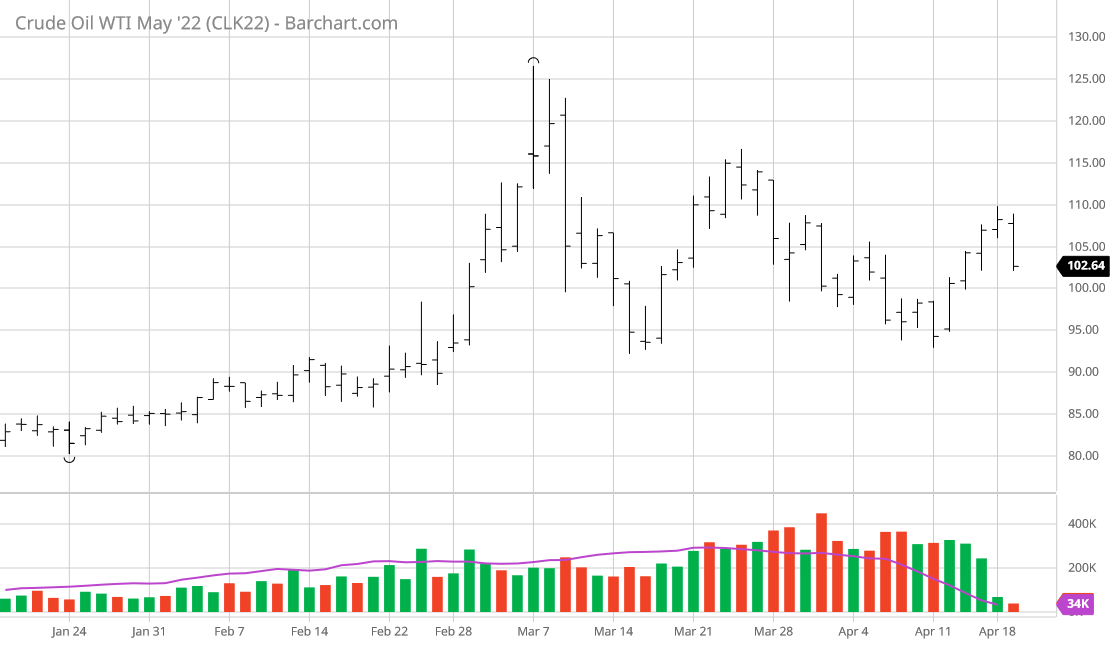

Oil futures fell by 5%. Supposedly, the catalyst for this was the IMF downgrading growth forecasts for 2023. I guess the weakness in the oil bull thesis is that the world will have weak or negative growth in a year or two. The strength of the dollar ($DXY now above 101) also doesn’t help.

Yen continues to be very weak. Bonds are still weak, which seems counter intuitive given the strength of the dollar. The same goes for most commodities, but again, since they are priced in dollars, in real terms they didn’t change much.

Equities were strong. The US indices seem to trade like some sort of safe asset now. Today was the first day back for many bourses. I feel that some of these movements reflect developments dating to before Easter.

I haven’t quantified this, but volumes seem very low. WTI near month futures traded about 300K lots.

The Macro Trading Floor

Alfonso Peccatiello & Andreas Steno Larsen have a new podcast, The Macro Trading Floor. Their first guest was Jim Leitner. The thesis was that commodities are still underpriced, the backwardation we see in most commodity futures markets is not justified, and that this will benefit currencies such as the Brazilian Real. This seems logical, but is hardly original (Vicent Deluard of Stone X has been saying the same thing for years). The problem is that the market is not buying it. Forward markets are pricing in a bad recession. Although they are not infallible, markets have a habit of being an unbiased forecast.

Tweet of the day

Porsche, 1967 pic.twitter.com/xqrjlaSoj5

— Best Ads Of All Time (@BestAdsTime) April 18, 2022

My, how times change!

And a bonus tweet:

It hurts to watch. pic.twitter.com/3Dc0h9Hhbh

— Travis.web1 (@coloradotravis) April 17, 2022

Image of the day

— Architects Against Humanity (@arch_crimes) April 17, 2022

A reminder that nearly all the buildings and districts we admire for their layout and architecture were created before architects (in the modern sense) and town planners existed as separate disciplines.

Comments !