Wrap

A 10Y and a 3Y auction didn’t run smoothly, with the result that yields are up. This buoyed SPX, and also boosted USD.JPY. It didn’t knock NDX back, but the Nasdaq didn’t rise any more than the SPX, which is unusual. $SPCE, Virgin Galactic had a successful space flight, but crashed 17% on news that it was trying to raise $500MM via some sort of equity issuance. $AMOM – an AI-driven momentum ETF has started buying $AMC and selling $FB and $WMT. This is going to end in tears!

Mike Wilson expects a correction

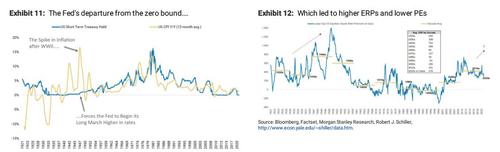

Zerohedge talks about a 20% correction. The thesis is that we are past midcycle, and it’s downhill from here. The argument is that we’re in for a re-run of the forties, when the equity risk premium went up as inflation spiked.

Thoughts

The backwardation in WTI prices is washing out. People are stopping believing that deflation of energy prices is happening.

Comments !