The day in the rear view mirror

Hwang’s extraordinary returns

The following was copied from the latest Bear Cave newsletter. It’s well worth signing up to this weekly, free service.

The Unbelievable Archegos Story

Bill Hwang reportedly grew assets in his family office from $200 million in 2013 to $20 billion in 2021. That’s 100x in eight years or a 78% annualized return after tax. How?

Netflix, one of Hwang’s best performing reported holdings, increased 35x from 2013 to 2021. Amazon increased 12x over the same time period. But those fall well short of Hwang’s reported returns. Hwang’s past returns at Tiger Asia don’t seem to fit the bill either. Tiger Asia reportedly annualized 16% around from its 2001 inception to its 2012 closing and reportedly annualized 40% during the bullish years of 2001 to 2007.

Yet, after pleading guilty to illegal trading, losing access to some Asian markets, and losing access to some prime brokers, Hwang supposedly trounced his past performance and amassed a fortune greater than Steve Cohen and Julian Robertson combined, all without a whisper of publicity.

Maybe the starting figure of $200 million is wrong, maybe Hwang successfully used serious leverage throughout all eight years, or maybe the ending $20 billion was not all Hwang’s own capital as some on Twitter have theorized.

Hedging against interest rate risk

www.convexitymaven.com/images/Convexity_Maven_-_The_Helicopter_Defense.pdf

this is a way to access interest rate hedging at a low cost.

There are a lot of ways of hedging against this risk, including eurodollar futures options, but this is probably cheaper and better. Currently, it doesn’t seem to be a problem, something that will continue until it is.

Wrap

There is a lot of anxiety surfacing about the 266K jobs report from last Friday. The statistic is difficult to interpret because of various programmes which exist to support those who are not in employment. But with such a disappointing number, when there are still 16 M people unemployed makes people wonder how strong the recovery is.

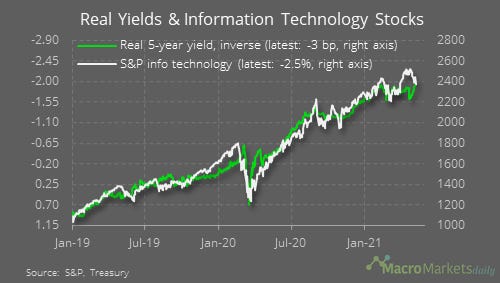

Equities have been choppy for a couple of days. The markets are not synchronized, and the NDX did well today (about flat) because, presumably, investors reasoned that with a weak jobs recovery, rates will stay lower for … ever, thereby making growth stocks infinitely valuable. (Maybe.) This is borne out by the performance of gold, which was flat, consistent with no growth. Crude was up modestly (0.5%), but food was up quite a lot: SB futures (‘Sugar No. 11’) was up 3.6%.

Bonds were in line: 10Y flat, and currencies ($DX) the same.

For some reason, quoted land exposure ($LAND and $FPI) were down heavily. These are not really a proxy for land, they are rather niche farm leasing companies. A better exposure is probably achieved via a fertilizer stock, like $YAR or $MOS.

$ARKK and loss making tech stocks are struggling generally, although $ARKK was up 2% today, presumably bounce after the steep declines of yesterday.

Info Tech is just a very long-duration fixed rate bond

Personal Note

I am still catching up after being away. I will post something more original, I hope, tomorrow.

Don’t to forget to sign up to my newsletter.

Steve.

Comments !