Thursday 14, July 2022

Equities are still very expensive!

Longtermtrends is a great resource. It comes out with a monthly newsletter. This relatively low frequency washes out most of the noise which is characteristic of so many market price measures.

The current edition has some measures of where the stock market is, after its bruising fall. The answer is: still pretty expensive, according to most metrics. On a trailing p/e and dividend measure, it doesn’t look too bad, but with interest rates rising, it’ll have to look better still to avoid having to fall further.

Inflation, again

The NY Fed underlying inflation gauge measure does not show any hint that inflation is coming under control. Underlying inflation seems to be running at 4.8%, which is a lot lower than 9.1%, which was yesterday’s CPI print, but it’s well above the Fed’s 2% target, and is the highest reading of this measure ever, in a series going back as far as 1995.

The whole concept of ‘the price level’ is slightly flawed, as some prices, notably commodities have been collapsing later, but it would appear that most goods and services requiring a large labour input are getting more expensive. However much central bankers and government ministers plead for pay restraint, once the genie of double-digit percentage annual pay increases is out of the bottle, it will difficult to put it back without very serious civil unrest.

Financial crime

Some books about financial crime, recommended by The Economist

I am currently reading “Lying for Money” by Dan Davies. It doesn’t simply describe the frauds. It uses the fraud to illustrate how the legal and financial system are supposed to work. As the author explains, if you want to understand how the brain works, it’s good to examine patients with various types of brain injury.

Oil

I’m obsessed with oil right now. Callum Thomas has produced a Chartstorm one-off about it. Oil is by far the most important commodity. Any general commodity index, like the CRB or GSCI, has a heavy weighting of oil, and anyway a lot of the other products, such as agriculturals, are strongly correlated with oil, because … oil drives the modern economy. Oil has been falling steeply lately, which suggests that the oil market is expecting a recession. Surely, the oil price now fully prices in a recession, so that the future of oil prices depends on whether the recession is harder or milder than expected. My guess is that it is milder. We haven’t really recovered from the 2008 GFC. Unless central banks really crunch the money supply, demand will surely continue. OK, construction will be slammed, but our economies now are physical capital light. Interest rates will not affect them so much. But, who can say, and do your own due diligence.

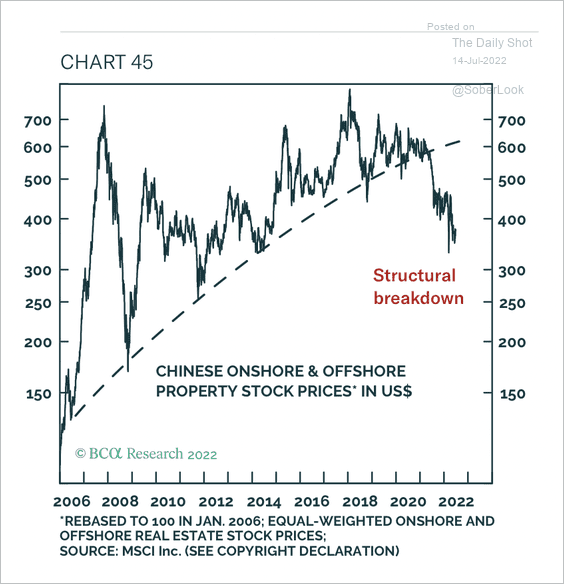

China

.

This is from BCA Research via The Daily Shot. I probably don’t have permission to share it, so don’t tweet it.

All the actual news out of China seems bad this, about how mortgagors on uncompleted developments are refusing to service their loans is an example.

.

This is from BCA Research via The Daily Shot. I probably don’t have permission to share it, so don’t tweet it.

All the actual news out of China seems bad this, about how mortgagors on uncompleted developments are refusing to service their loans is an example.

And now there were five

The selection process for the new leader of the UK Conservative Party must be torture for those taking part. Not that anyone has any sympathy for the candidates, all of whom share a healthy lack of self-awareness. The set now is Rishi, Mordaunt, Kemi, Truss and Tugenhat. Rishi is the guy to beat. He appears to be out of touch and arrogant. And very small. Mordaunt is the outsider, gaining on the favourite. She had the advantage of some prominent attributes, including not having been in the Cabinet, and therefore having implicitly endorsed the previous PM. This is more of an advantage than one might think, given that all the candidates seem to want to put as much distance as possible between their own policies and his. Truss is a familiar face, but one that is in visible decay. Whereas none of the candidates is loved by the press, Truss seems positively to be hated. Her habit of never travelling anywhere without her personal photographer (allegedly) does not endear her to anyone. Her enthusiasm for Brexit is the zeal of a new convert, but my perception is that she is considered to have performed badly in her previous cabinet roles. Tugenhat seems a tough, no-nonsense soldier who doesn’t pretend to understand economics. It worked well for Churchill, but I’m unconvinced it’ll work today. At least he has the merit of consistency, as he’s uniquely amongst the surviving candidates, never agreed to serve in a Johnson government. Finally, we come to Kemi. She gets some respect from me for saying that she opposes the ‘online safety bill’. (I know that it would entail the repeal of some even more repressive laws, but that’s not a compelling argument for keeping it.) Like all the others she’s emphasized her youthful struggles, but being privately educated and married to a senior investment banker does not exactly make her working class.

I suppose you expect me to say that one is at least less bad than the others. Sorry.

How are the sanctions on Russia going so far? (Spoiler: badly)

Russia Makes More Money on Fossil Fuels Than One Year Ago

Oil is a valuable stuff. China and India, which together form a large part of global demand, are not imposing sanctions on Russia. It is hardly surprising that Russia is laughing at the West’s efforts to close down its exports. Europe needs Russian gas. It’s going to import it. The alternative is for Germans to freeze in their own homes this winter.

Wrap

Intra day swings in commodities have become horrendous. WTI (near month) futures went from $96.4 down to $90.6 — a swing of 6.4% — before ending the day almost unchanged. What was odd was that further out on the curve there were equally violent swing of price.

It was a mixed day. The dollar was up further, stocks were generally down (not Nasdaq), silver, gold and copper were down. Yields were up moderately.

The expectation is that the Fed will hike by 100bp next month. JPM announced it would halt stock buybacks. Neither of these signals a buoyant economy.

Comments !