Email from the desk of the junior clerk

Berkshire Hathaway

Francine McKenna is not a huge fan of Warren Buffett as you can read here. I think the guy is great, and his sidekick Charlie Munger even greater, but they are both way, way past their ‘best before’ date. I think the stock probably is a buy, because when one or other of these guys kicks the bucket, the conglomerate will be broken up and this will produce a huge re-rating of the shares. That’s not an original idea of mine. Warren said it himself, decades ago.

It seems pretty icky taking a position that will benefit from someone’s death, but let’s face it, anyone who owns a stock with pension liabilities is doing the same. The problem is, as McKenna points out, that Warren has been buying stuff at inflated prices lately. He’s invested in Apple, and gold miners, and various things that do not add value to the investor. If I want to want to own these things, it’s easy for me to do so. It seems odd that a guy so knowledgeable about the markets does this kind of thing. It’s the same as fElon buying bitcoin.

Anyway, I don’t have a position, but the post is an interesting read, and it’s probably worth setting up an alert to be informed about Warren’s state of health.

Fragile currencies

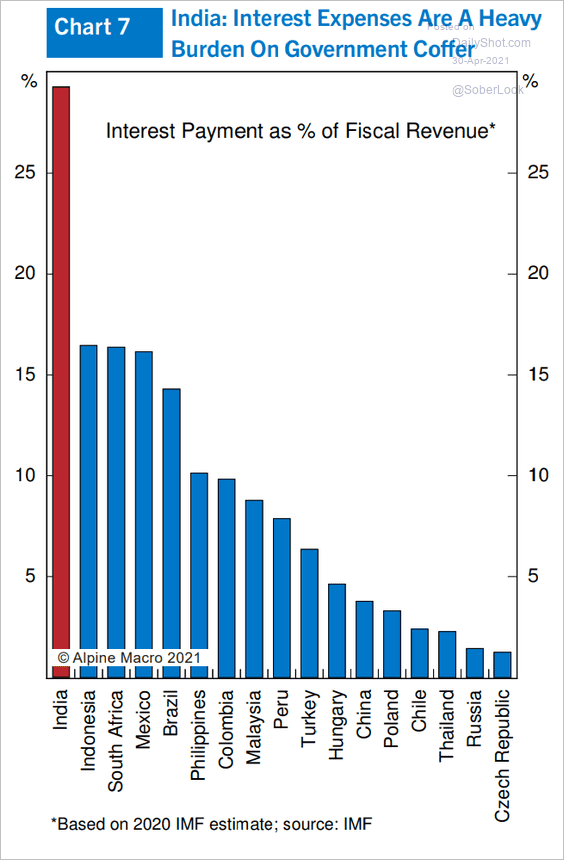

.

It’s not convertible, and India is a very closed economy, but it is big enough that even the modest links to the rest of the world’s economy might tip a few others over the edge.

The fragile five are India, Indonesia, South Africa, Mexico &Brazil. Some big names.

.

It’s not convertible, and India is a very closed economy, but it is big enough that even the modest links to the rest of the world’s economy might tip a few others over the edge.

The fragile five are India, Indonesia, South Africa, Mexico &Brazil. Some big names.

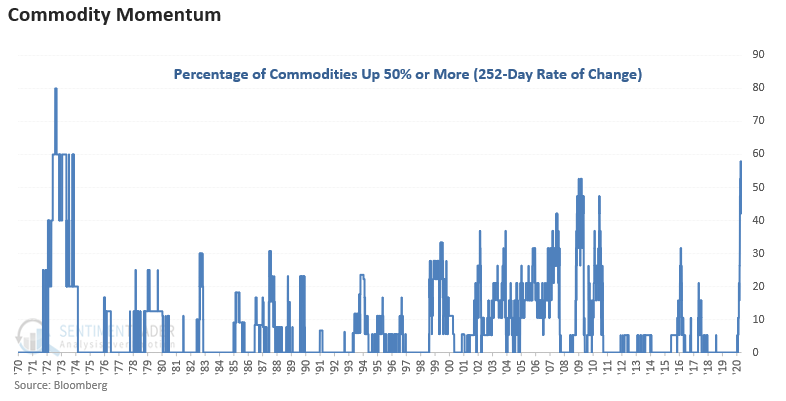

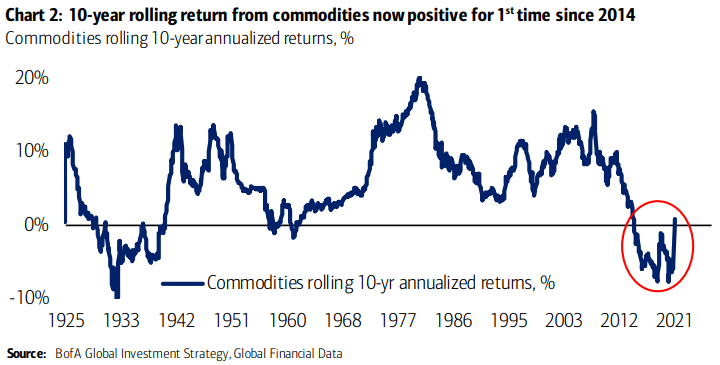

It’s not just your imagination. Commodities are on fire

Sentiment Trader says so. The question is: how long can this bull trend run, and will gold finally join in with the fun?

KEDM picks

- $TSX:MDI – drilling co. which has dropped off everyone’s radar,

- $ADVM – no idea what it does, but insiders are buying,

- $SLGD – change of long-standing CEO. Kuppy thinks the stock has always had potential, and that the new guy may unlock it,

- $FYBR – new ticker for stock exiting bankruptcy.

Visit KEDM for more info. Kuppy is the king of small-caps, IMHO and his newsletter is free for the time being.

Child care industry

This Propublica article explains why it’s so tough to make childcare work. It’s hard work to look after kids, but it’s also a highly regulated industry. Barriers to entry, for unregulated substitutes for daycare centres are practically non-existent. The tax wedge between a formal arrangement and an informal one is huge, especially if the provider is receiving means-tested benefits. The professionals who draft the rules have almost certainly never worked in minimum wage jobs and have no concept of the challenges that those without their advantages face. So, in the US and the UK, childcare is a bad experience for customer and worker.

European Value

Verdad thinks European markets are value plays. I’ve been of this opinion for a while. Russia perpetually disappoints, but has a lot of energy and minerals. This is supported by the analysis in a post by Taps Coogan.

The Queen’s Speech

The speech is not actually written by the queen. It’s full of buzzwords, and she almost certainly weeps over the grammar and syntax. It is usually couched in vague, imprecise terms, with an emphasis on making lots of things better than they were without any metrics, and without explaining how diverting resources will avoid making other things worse. But this month’s speech contains a lot of bills promised in the manifesto, including a new planning bill. I read the white paper on planning. You can read about it here. The legislation is very good on what is wrong, and is not about about what must be done to put it right. But there are so many vested interests in keeping it wrong, I’d give it a 1% chance of not being totally hobbled by the time it comes to its second reading. A lot of the economy of the UK is dependent on creating large economic rents from the artificial scarcity of development land created by the planning process. It’s really very hard to see how the govt. can buy off that interest in order to get some sensible legislation through. This is not a party political point: Labour never did anything about this, even though fixing planning would be hugely effective in reducing inequality.

Wrap

A lot of Europe was shut, because it’s Labour Day. European equity markets were strong, US ones less so. Oddly, bonds were flat, but NDX did much worse than SPX, with RSP (equal-weighted SP500) doing best of all. There were weak performances put in by SPACs. I don’t know why, but most most comment I’ve seen barely conceals it’s contempt for the craze. The dollar seems to resumed its downward trend.

Comments !