Crumbs

- Jeff Bezos is bowing out,

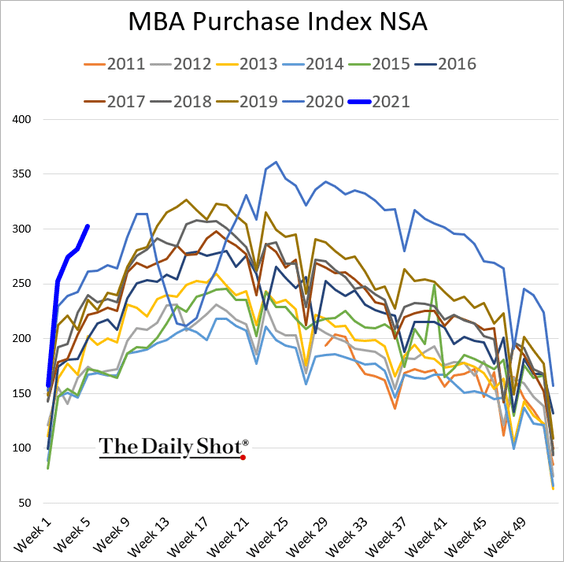

— bullish for US housing.

— bullish for US housing.

- DX is experiencing a short squeeze!

- Gold is experiencing the polar opposite (just crashed below the 200 day MA).

- Musk pumps DOGE. Seriously, I don’t like to take potshots at guys who are not in a position to answer back, but this is beyond irresponsible. Again, crypto prices exploding is a direct result of Fed balance sheet expansion.

- Martha Stewart is selling CBD snacks for pets,

- A vineyard is going public via a SPAC,

- 23 and Me is going public. How? Via a SPAC, of course!

Trading Ideas

All real assets have benefited tremendously from the massive injections of liquidity carried out by central banks generally, but the Fed in particular. Stan Druckenmiller has made some comments about where he sees value going forward(See this tread by @DivergentVentur for the detail).

TL;DR:

- M2 explosion will trigger inflation,

- the Fed will start yield curve control, so there is no point in going short long-dated Treasuries,

- the monetary expansion will eventually bleed through into USD (not yet tho!),

- commodities (maybe via miners/producers) is a way to profit,

- FAANG could do well, because a lot of other stocks are terrible,

- Asia, especially Asian tech and currencies will be a good place to shelter from the fallout of the exploding deficit.

Energy is likely to benefit. Coal (especially) and oil (quite a lot) have been beaten down a lot by the assumption that everyone in China and India will be driving around in a Tesla in a year or so’s time. I can’t quite believe it myself, and — in any case — those batteries ain’t gonna charge themselves, and will largely depend on smokey old power stations to generate the electricity they need.

Chart of the day

The value plotted is the instantaneous expectation of average inflation over a five year period, that period starting in five years time. It’s derived fromt he prices of regular treasuy notes and bonds, and TIPS — inflation protected securities. It shows that the market expects that the rate will be above 2% for a sustained period, and that expectation is not reversing (over a smoothed timescale).

Wrap

Risk on, again:

- All major equity markets up, except UK and Germany. Russell 2000 hits and all-time high,

- Govt. bond yields up almost everywhere (exception: Italy and France, due to credit effects); general steepening,

- All crypto up,

- DXY down, 0.6%, reaction to yesterday’s strength, presumably.

News was not heavy:

- US consumer credit a bit weak (nowhere open to spend on your credit card),

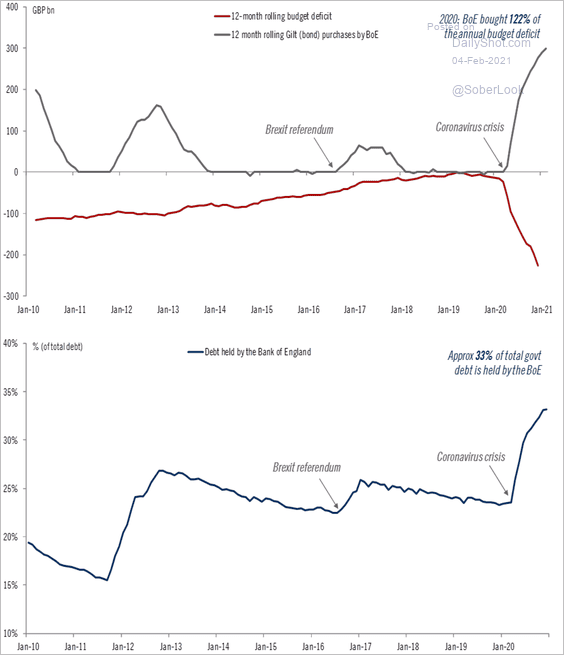

- Bank of England ruled out negative rates and lowered its forecast for the rest of the year,

- EM currencies strong (MXP & BRL).

Reflections

A universal characteristic of humanity since the invention of agriculture has been organized religion. Many, if not all, political movements have a strong religious affiliation, and almost no mainstream politician ever dare say anything negative about religion. Observance, if not unconditional faith, has been the norm in ‘civilized’ societies. Communities and ‘faith-based’ communities used to be the same thing. Societies with shared culture and norms function better than those with atomized ones. Along with the collapse in religious observance has been a failure of the nuclear family as the bedrock of society. I sound like the a boomer I am, but these changes in the way we live have occurred without debate, political or otherwise. Institutions like the Roman Catholic church, which have weathered the storms of millennia have suddenly experience a hemorrhage of members, without anyone having a convincing explanation.

A quick google throws up some explanations (e.g. this one) but I am not convinced.

The obvious question for anybody who spends at least two seconds looking at the graph above is: What the hell happened around 1990?

According to Christian Smith, a sociology and religion professor at the University of Notre Dame, America’s nonreligious lurch has mostly been the result of three historical events: the association of the Republican Party with the Christian right, the end of the Cold War, and 9/11.

These simply do not explain the UK experience.

Comments !