Forgiving student debt is a terrible idea

Oren Cass points this out. It is kind of obvious, but the solution is to allow student debt to be discharged in bankruptcy. Lenders have to have skin in the game. The absolutely worst thing is to destroy the information embedded in prices.

Stimulus bill pork barrel and other morsels

- hardly a morsel: the Toomey amendement that gives even more discretionary power to the un-elected Fed,

- Dr Doom isn’t getting any more cheerful: While there is never a good time for a pandemic, the COVID-19 crisis has arrived at a particularly bad moment for the global economy. The world has long been drifting into a perfect storm of financial, political, socioeconomic, and environmental risks, all of which are now growing even more acute.(Written in April 2020),

Hopping on the bitcoin bandwagon

$GBTC and $ETHE are two stocks which invest in bitcoin. It’s an insane idea: if anyone wanted to hold bitcoins, why wouldn’t they just download a wallet and buy some. It’s like buying an ETF which just holds dollars, but charges you 5% a year for the privilege. But, in this completely crazy world, it makes perfect sense. Ordinary people (aka ‘bagholders’) want to get some of this stuff in their 401Ks, PEPs, and other tax-advantaged savings accounts. Even into their pension savings (wtf?). These things, in spite of employing armies of IT geeks, can’t actually do the simple thing. So money flows into these fatuous collective investments. Well, it could be worse. Investors could be putting their savings in to $TSLA.

More conspiracies against the Internet-using public

After discovering that Google pays Apple a large fortune to make it difficult for iPhone users to use any search engine other than theirs (e.g. here), (Who woulda thunk it??) it turns out that Google and Facebook were collaborating to undermine an anti-trust investigation into the online advertising market. You almost think that the guys in charge of these giga-cap companies, in the same trade, meet together, even for merriment and diversion, and the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.

BCX

BCX is a closed ended mutual fund that invests in miners. It’s hard for a European to own this, but the performance can probably be replicated with the main constituents:

- Total SE,

- BHP Group,

- Vale SA,

- CF Industries Holdings,

- Chevron Corp,

- Anglo American PLC,

- FMC Corp,

- BP Plc,

- Royal Dutch Shell PLC,

- Bunge Ltd.

Mainly European companies.

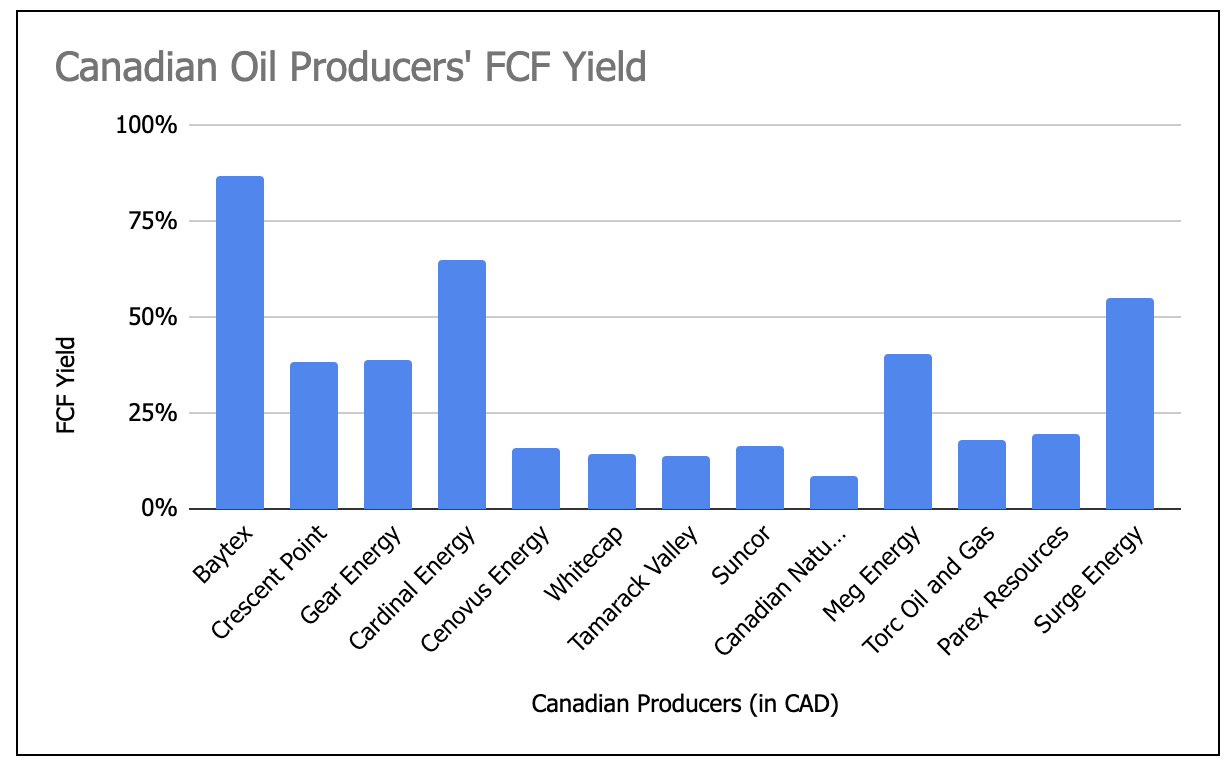

Canadian oil producers look cheap

You can read all about it here.

You can read all about it here.

Pluto-populists are destroying capitalism from within

This is no accident. It is the logical outcome of the political and economic strategy of the “pluto-populist”. Mr Trump is a natural outcome of the strategic goal of the donor class — tax cuts and deregulation. To achieve this end, they have to convince a large proportion of the population to vote against its economic interests by focusing on culture and identity. This strategy has worked and will continue to work: Mr Trump may have gone; Trumpism has not. Not entirely dissimilar patterns can be seen in Brexit Britain. The focus of the university-educated left on their form of identity politics plays into the hands of their rightwing counterpart.

Martin Wolf writes a more interesting article than usual. It’s about the fact that democracy isn’t becoming more common as countries get richer, contradicting a popular theory of the seventies. Part of the problem is that democracies are much more vulnerable than totalitarian regimes to hijacking. Groups with anti-democratic aims simply have more freedom of association in democracies than subversive groups in other types of regime. I am not really sure what the solution is. Clearly, many people can be cheaply and easily persuaded to vote against their economic (and personal) best interests. Groups that set out to do this are getting better at it all the time.

Comments !