Crumbs

- Shipping predicted to shape up. Again.

- trade is picking up again nicely, thanks:

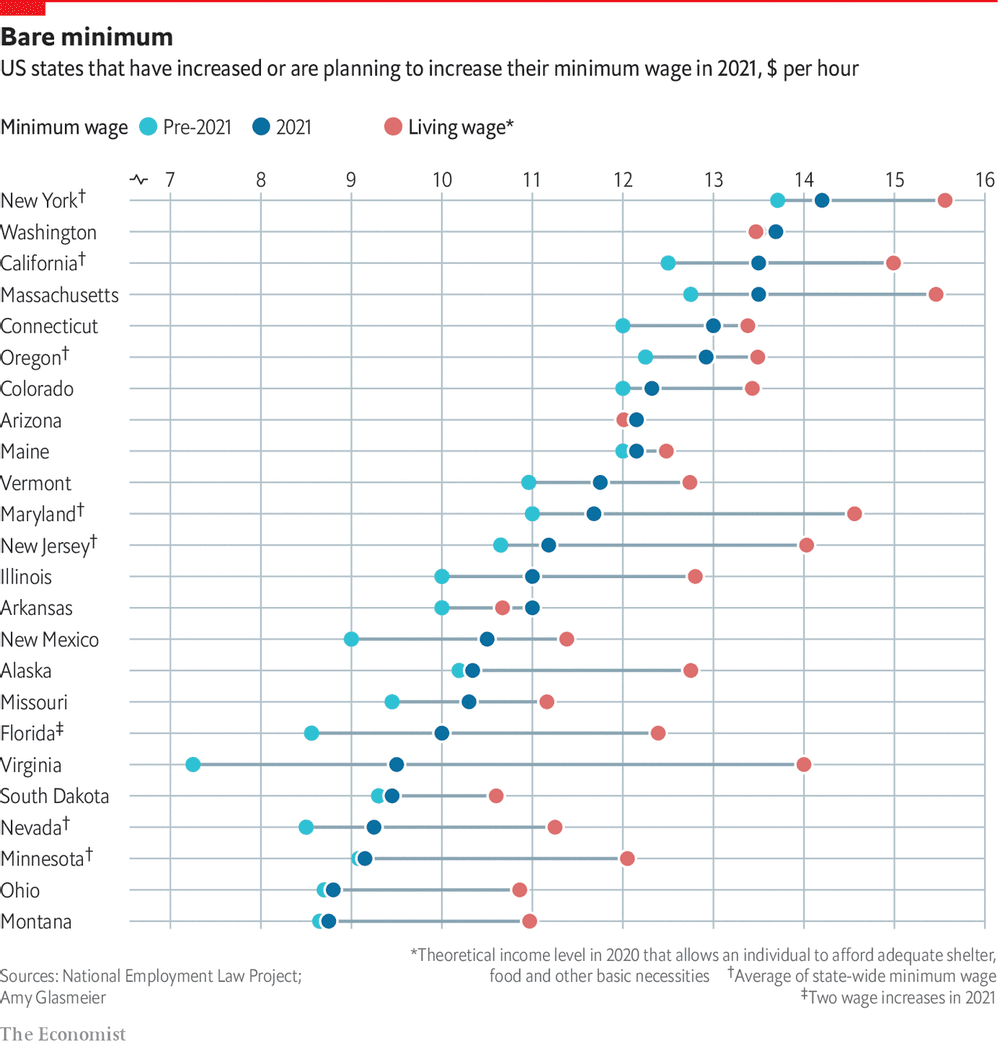

- it’s a better time to be a low-paid worker in many US states:

The US is getting much more comfortable about interfering the the labour market — The Economist.

The US is getting much more comfortable about interfering the the labour market — The Economist. -

it’s always worth reading Kuppy’s latest blog post.

- base metals starting to glitter

Bitcoin

Bitcoin is on a tear. It is the ultimate momentum stock. It has no intrinsic value, beyond what people are, rationally or irrationally, prepared to pay for it. Soros’s theory of reflexivity describes this phenomenon perfectly. The price has gone up, so lots of people are aware of it as an asset that people want to own. Most people are not like homo economicus. They do not have an internal value they attribute to all items they can consume. They judge value by looking at price. For an economist, price and value are two totally different concepts: one is what you have to pay, the other is what you get. For a man dying of thirst, a glass of water may be worth his life savings. The value is huge, because of what he gets: relief from life-threatening thirst. The price has nothing to do with what the water cost to collect. For most people, a Porsche is worth more than a Skoda because ‘everyone knows’ that people pay more to own a Porsche. There is no internal calculation of utility, that is gained by the ownership of the Porsche vs the utility that is gained by putting the resources needed to buy it to some alternative use.

It’s the same with Bitcoin. People pay $30K for one bitcoin because others are willing to. There is liquidity, in theory, that a Bitcoin can be sold for something close to this price. And there is some latent utility that makes the crypto currency worth as much, even though there are thousands of other crypto currencies with superficially similar, or superior, attributes.

Bitcoin is an outstanding example, because it’s so clear that the valuation is not based on some spurious rationale of escalating earnings, unbeatable competitive advantage that are wheeled out by analysts to justify their price targets for $TSLA or others. Nerdy analysts are probably uncomfortable about this, because there is nothing external to anchor the price to. It becomes purely a function of fashion and psychology. There is no basis for knowing when, if ever, ‘fundamentals’ will become relevant once more. It’s normally after a market crash. It’s no surprise that Graham and Dodd got attention after the 1929 crash and its aftermath, when animal spirits were low and investors proceeded very cautiously and only when they were confident they would get a real return on their money.

REITs

If inflation is going to take off, real estate should be a good investment. Buying an office block is a bit expensive, and doesn’t do much for diversification of assets. Buying a REIT in theory offers the benefits of the exposure without the costs of illiquidity and concentration. However, REITs come in many shapes and sizes. The REIT Forum has a mass of useful data. I have always felt that Sam Zell knows a thing or two, and anything controlled by him is likely to survive any downturn.

2021 Stock Plays

I picked up this list from somewhere, can’t remember where now. I’ll be interesting to see how these perform.

- Vaccine play - $VXRT

- Virus cure play - $CYDY

- Telehealth play - $DOCRF

- Solar play - $FSLR

- Solar / EV play - $VVPR

- Marijuana play - $CBDD

- 5G play - $INSG

- AI play - $AITX

- Augmented reality play - $NEXCF

- Consumer play - $CWH

- Cyber play - $VISM

- Rare Earths play - $MP

I have no idea what these stocks are, and I certainly don’t have any positions in any of them!

Wrap

News: - Trump supporting rioters break into the Capitol, - Pence refuses to overturn Biden’s election, - Bitcoin price exceeds $36K, - GA election polls suggest at least one Dem gain.

Tone:

- energy and small caps continue to gain. Rotation out of tech,

- nearly all global equities up, except IBEX (my pick!),

- slightly bizarre combination of gold miners, comms, software, and real estate all down, remaining sectors up,

- momentum, growth and IPOs all (as indexes) down,

- Mexico wins the country equity market race,

- German Bund yields are down. Apart from a few Eurozone countries in its orbit, all other yields up. GB broadly flat,

- Euro up vs USD,

- commodities strong, except gold & co,

- credit flat,

- curves steepening,

- $CAT (Caterpillar) is up 5.6% on very high volume.

My takeaway: political changes in the US may result in a pivot towards a more value oriented equity market, which is consistent with stirring inflation (value is shorter duration than growth). One swallow doesn’t make a summer, and one day of moves does not make a trend, but everyone is talking about inflation. The lack of a reaction in the gold price is a mystery, but it may be that all the gold bugs have pivoted to bitcoin. Maybe 2021 after all will see strong growth, with the chairman of the Fed enthusiastically refilling the punch bowl.

Comments !