Sunday 27, March 2022

Weekend comment

For most of my long adult life, yields have trended down. This is explained in a variety of ways, but mostly in terms of an ever declining productivity of capital and excessively tight monetary conditions. In the developed world, credit creation has been extremely weak, as banks have much preferred to lend to governments than to the private sector. The collapse of yields has been a symptom of this. This chart illustrates the history.

The recent rise in 10Y yields is not, on this timescale too scary. However, a few things are different now:

-

debt levels have never been higher, because of a massive spend by many governments to offset the collapse in demand from the pandemic,

-

There is a shooting war in Europe that a major nuclear power is directly involved in and might lose,

-

ESG and the war have pushed up energy prices to the highest levels seen in decades,

-

globalism has gone into reverse, as a result of the pandemic and the war, as manufacturers have discovered the extreme fragility of their supply chains,

-

food prices in some very unstable nation states are spiking, at exactly the same time as the governments of these countries will have a great deal of problems financing these deficits,

-

MMT, the economic theory that says that in the developed world governments can spend essentially without limit, has become widely known and popular,

-

the collapse in spending power has change the political climate in many countries, with Friedmanite policies extremely unpopular, especially among the youth.

I don’t know if this stuff is true. I just think it’s interesting:

A suggestion that the EU will try to ban transactions to unhosted crypto wallets.

1/ I hate to ring the alarm bell again, but the EU Parliament leaves us no choice 🚨🚨

— Patrick Hansen (@paddi_hansen) March 26, 2022

This time it concerns a crackdown on unhosted wallets in the upcoming crypto AML regulation (TFR).

The ECON committee vote is on Thursday and the draft includes some absolute red flags 👇

Why India supports Russia (basically, because the US supports Pakistan, but there is a lot of interesting other history here):

It helped India during India-Portugese standoff. In our space programme, submarine programme, nuclear programme, Russia has been always supportive to Indians. USA n West only looked towards India when Pak failed them and China became a threat. Still till date no one dares to 5/n

— Unknown alien (@391a6e870374480) March 26, 2022

What the movie Flight Club is all about (I tried to read the book, but gave up):

— ♚ Sherif ★ ★★ (@1EZZAT1) March 26, 2022

— Jawa.pls 🌲 AN APPEAL TO HEAVEN (@Sicklee) March 26, 2022

Some super photos tweeted by this account:

Wolfgang Suschitzky, London 1934 pic.twitter.com/Edx6v0A3vJ

— Iconic (@Iconic___Images) March 23, 2022

This explains the title of today’s post:

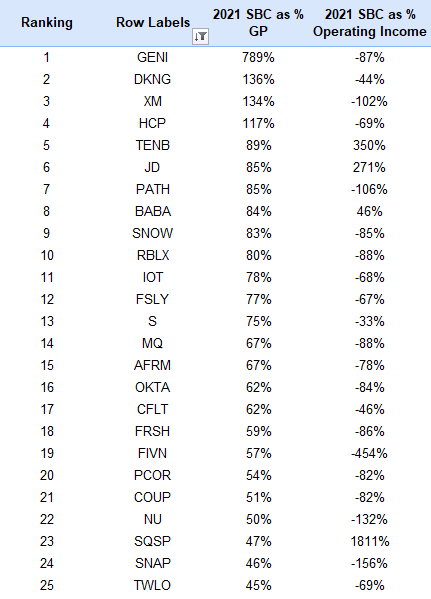

SBC is stock-based compensation:

Comments !