17 Sept 2021

JPM is bullish on equities

I am, by nature, bearish. I’ve outlined the bear case, or at least referenced articles which make it, many times. There are counter arguments, though, which are largely based on the argument that we are in an early stage of the post-Covid global economic recovery. Detailed points, made by JPM and relayed by The Market Ear are as follows:

-

The recent slowdown is temporary and primarily driven by the Delta variant. “We see these risks as well-flagged and in some cases overdone”.

-

cross-border activity has the potential to more meaningfully rebound for the first time since the onset of the pandemic

-

Central bank policies should remain growth-oriented

-

China’s slowdown YTD is likely to be countered soon with a policy pivot.

-

low probability of significant corporate tax policy change

-

periods of significant market weakness are likely to get dampened by accelerated buyback programs (current daily buyback run-rate is at ~$3.5 billion and rising) and positive retail flows given “excess” savings

-

the inventory (~25 year lows) and capex cycles (post-GFC low), while not tracking their usual cyclical behavior, are still in early innings with ample room to drive growth

-

The state of the US Consumer is super strong. JPM thinks the market underestimates the robustness of consumer balance sheets and more pointedly the savings war chest in place to support future spending. “The cumulative “excess” savings for consumers since onset of Covid (2/2020) is at $2.4T excluding the likely boost from rising asset values”

-

Consensus is currently assuming a very conservative earnings compression of -1.3% for 2H21 compared to 1H21 (seasonally demand has been much stronger during 2H compared to 1H in the US). “In our view, the street estimates do not fully account for this seasonality and the cumulative effect of ongoing global re-opening with rising mobility as Covid eases, expanding labor market with wage gains, higher operating margin and falling interest expense, and reduction in share count from buybacks”

JPM are raising their EPS estimates from $205 to $210 for 2021 (consensus at $201.03) and from $230 to $240 for 2022 (consensus at $220.35), as well as slightly increasing 2021 year-end S&P 500 price target to 4,700 and sees >5000 in 2022.

I think that it’s likely that interest rates will continue to fall, and debt-financed buybacks will accelerate, as above, and that this will be a big driver. It’s hard for a stock price to go down when the CEO can borrow funds to manipulate the market in his company’s stock at a negative real cost.

JPM certainly doesn’t benefit from a bear market with crashing liquidity and transaction volumes (and therefore fees), so they are talking their book. Just because they are, it doesn’t mean that they are wrong.

Tesla still a Ponzi

This article recaps all the things that make you go “hmmm” about Tesla. They are all well known, to me at least, and none of them have dented the stock price. But now the broader market seems to be finally on the point of going down, maybe the day of reckoning for Tesla is nigh.

Wrap

No clear driver but today was very risk off. The usual bump in SPX, NDX at the end of the week failed to materialize. It was the “quad witching hour” so maybe there was some sort of gamma squeeze at work. Nearly every index was down, apart from Japan (and that might be a timezone thing). Most stocks too (but not Tesla: maybe a short-squeeze thing). Yields were up a few basis points. We haven’t seen panic yet, neither have we seen a flight to safety. DXY is up, 93.2, with the inevitable damage to commodities across the board.

Basically, it was a good day to be in cash. The markets have been conditioned to expect a bounce after a Friday like this. My best guess is that we’ll see one again, but these are strange time. The US runs a constant current account deficit, which means that the countries that export to it are awash in dollars. Those dollars are going to end up somewhere, and the destination of choice for decades has been US mega-cap equities. At some point that will change.

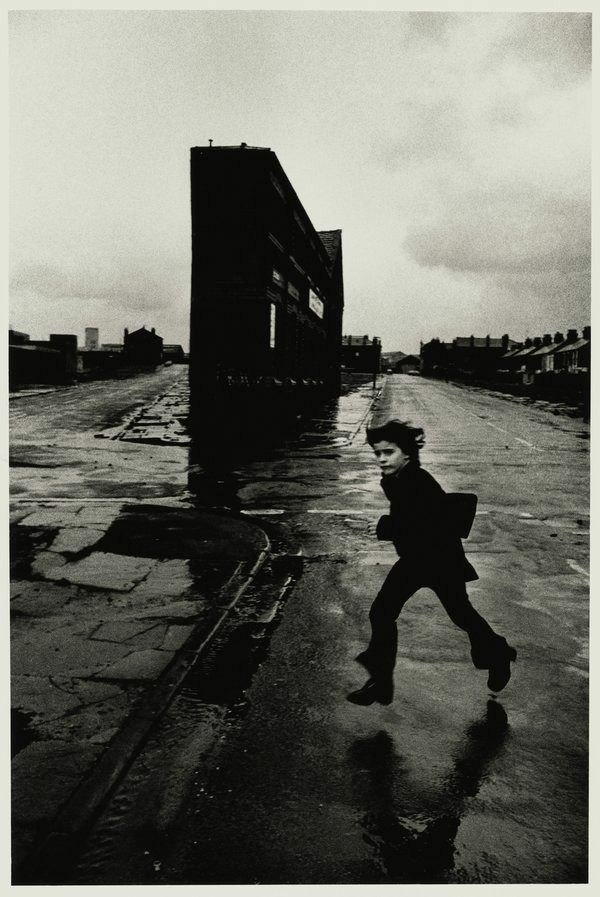

Image of the day

Comments !