Capitalism without Capital

This post explains that companies do not function in the way they used to. They no longer transform savings into productive physical capital. They, in aggregate, are destroyers of physical capital. This trend has been observed for a long time, and conventional accounting measures sometimes fail to reflect economic reality: if an airline leases all its aircraft, and so lightens its balance sheet, its existence still is the reason those planes got built, even if their owner, in legal and accounting terms, is some Luxembourg registered private equity trust.

However, there is a problem, because physical capital is a complementary good to human labour, and work is a very rewarding activity for most humans. It does not just provide them with an income, it provides them with a sense of self worth and self respect. If we hollow out the physical infrastructure of the private sector, the consequences for the labour force, i.e. voters will be severe.

The Chancellor’s accellerated capital allowances might make a bit of a difference, but I do not see this trend being reversed by a tax gimmick. (I know the figures relate to the USA, but, surely, something similar is happening in the UK.)

Trade stocks sitting on the toilet

I’m not kidding! There is an advert which promotes this. Truly, parody is dead.

Read about why trading in penny stocks has exploded recently.

Crumbs

- An article about snowflakes, worth reading, and looking at, for a change,

- Bullish analysis for GDP from Nordea, albeit qualified by concerns about a services trade deal,

- Billionaire class getting nervous

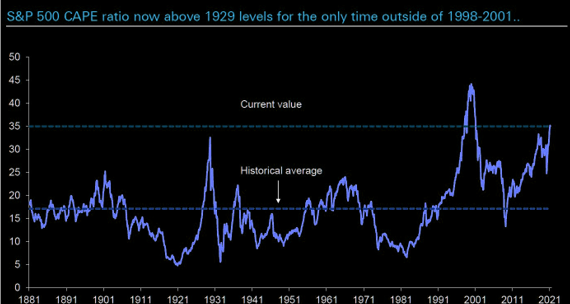

Yup, valuations don’t matter.

Yup, valuations don’t matter. Asian tech is looking sick. KWEB is chinese internet. This has had a huge run, but now it seems to be running out of wind.

Asian tech is looking sick. KWEB is chinese internet. This has had a huge run, but now it seems to be running out of wind.- The FT points out the galactic hypocrisy of allowing the purchase of Tesla cars with bitcoin

- It’s not a bug, it’s a feature.

The consulting firm McKinsey has agreed to pay nearly $600 million for its role in advising Purdue on how to push opioids sales, even at the cost of human lives. The details of their work are gruesome and should demand self-reflection among all those who work in big business. Has the profit motive gone out of control, and do business schools have a role to play in creating this culture?

Anand Giridharadas says yes to both questions. He’s the author of the renowned book “Winners Take All” and the publisher of “The Ink” on Substack. He joins us in this episode to discuss McKinsey, the culture of profits at all costs, and how businesses use philanthropy to distract us from the price we all pay.

Luigi Zingales and Bethany McLean host a wonderful podcast. These are not mad Bennites, they are a business school professor and respected economist, and an ex Bloomberg journalist. Every episode is worth listening to. The best part, for me, is the phone call that Anand has with Jamie Dimon. You can read about it here but it’s better to listen to Giridharadas tell the story in his own words. To Dimon’s credit, he did offer.

- Tesla offers option of buying a car using bitcoin but warns that you could lose $100,000 if you accidentally transcribe their bitcoin public key wrongly. What could possibly go wrong?

Wrap

Slightly inflationary, slightly risk-on:

- 10Y Treasuries at 1.63%, up a fraction,

- commodities mixed, oil down further, gold going down still,

- XLF up significantly as Fed says banks can resume dividend payments and buybacks,

- Bitcoin down a bit, DXY up significantly: 92.886, up 0.39%,

- EM equities generally down, probably on dollar strength.

Generally, a fairly low-key day.

Tweets

No joke - this hearing is very disturbing. The First Amendment is not safe. @HouseCommerce @EnergyCommerce https://t.co/2FN1phgPQN pic.twitter.com/vJGdv5pYpt

— Rudy Havenstein, listening to Nas all day. (@RudyHavenstein) March 25, 2021

Robinhood Markets Inc is building a platform to “democratize” initial public offerings (IPOs), including its own, that would allow users of its trading app to snap up shares alongside Wall Street funds, according to people familiar with the matter.

— *Walter Bloomberg (@DeItaone) March 25, 2021

Comments !