CCS viability

There is a good thread from TC which analyses the issues with CCS. Essentially they boil down to the economics:

- there is no real economic use for CO~2~ in the quantities it would need to be produced,

- the only economic use would be in increasing the yield from oil wells, but that’s not gonna get subsidies,

- it requires huge capital investment to build the infrastructure, which destroys value,

- it would need a lot of pipelines. People, and politicians, don’t like pipelines,

- universities may have shown prototype projects can work, but this is a million miles from doing something in the real world.

All this is correct, but I feel that TC underestimates the theatrical aspect of politics. The fact that something is woefully uneconomic (in the sense that it destroys value for the whole population) has never been a great barrier to stopping politicians doing something. Look at the endless money thrown at the military industrial complex, and the never-ending wars in Afghanistan and Iraq. The military industrial complex now has some strong competition from the green energy complex, and politicians know which of the two has the stronger buy-in from the voting public.

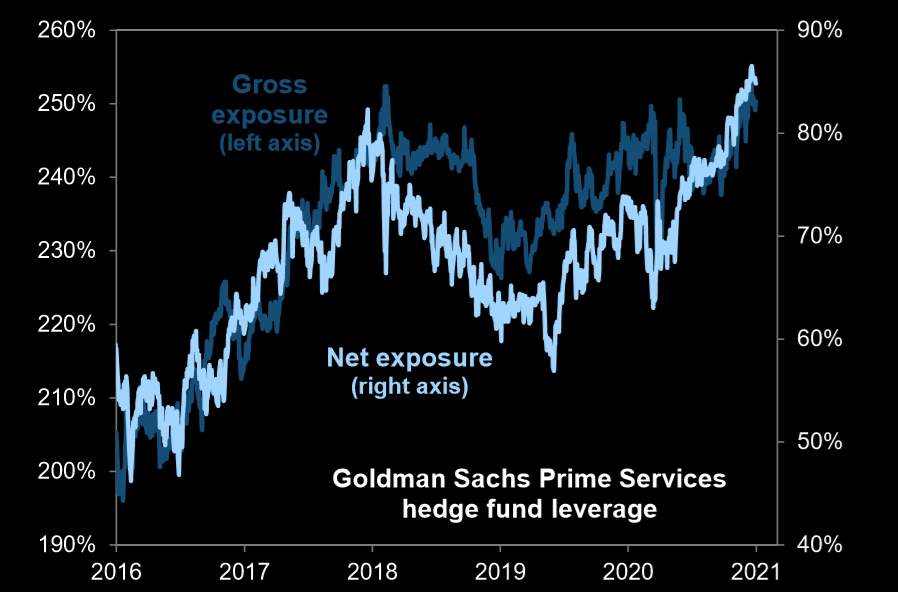

Hedge funds are ‘all in’

Inflation may get going

He said something similar, but at greater length in the FT, but focussed on the potential political difficulties of building growth and productivity (which, of course, go together, especially in a static working age population).

EM vs DM

It seems to me that emerging markets are simply in a better shape than developed markets. They don’t have the burden of a huge public sector (60% in the UK now) which will, eventually, translate into a huge tax burden. They have relatively little regulation, and are much less likely to intervene in private sector contracts (e.g. for labour or housing services). Obviously, EM has problems with corruption, which funnels resources to activities which do not benefit the majority, but this sort of sub-optimal allocation of governmental resources is not unknown in DMs.

All economies are moving towards being service based, but there is still a lot of manufacturing. Even in the UK, it amounts to 20%! EMs are more commodity production based, and with commodities still at decade old lows, this will help, because whatever happens in the West, we’ll need to eat, consume made items and use commodities for almost everything.

Certainly, the most egregiously highly valued of all DMs is the NASDAQ. Europe and the UK are probably not too bad.

These are not original thoughts, but they certainly chime with my outlook.

Comments !