Crumbs

- Citi issues Muskian research on Bitcoin. Basically, some weary interns plundered the content of the Ponzi-like 99Bitcoins.com and turned it into a 108 page Citi report, complete with absurd claims such as that 36% of all US retailers accept BTC as a means of payment. Never forget that an investment bank wants transaction flow and the commissions that follow from them, much more than it wants you to get rich. For a follow up hatchet job on FT Alphaville, read this. Believe me, you won’t regret it.

- DoorDash ($DASH) has come to the end of its lockin period. Expect insiders to sell.

An uncomfortable question for the DASH bulls: Might the third-party delivery model be fundamentally flawed? One legacy player’s experience could prove instructive. Domino’s Pizza CFO Stuart Levy declared on last week’s earnings call that: “In 60 years, we’ve never made a dollar delivering a pizza. We make money on the product, but we don’t make money on the delivery. So, we’re just not sure how others do it.”

Interestingly, Sears & Roebuck never made money, even though they were the Amazon of their day. Amazon likewise makes no money on its retail sales side. B2C is a tough gig.

- Sarkozy has been convicted of corruption in public office. Why can’t the UK ever manage this. Oh, I forgot, because nobody could ever commit such a crime here.

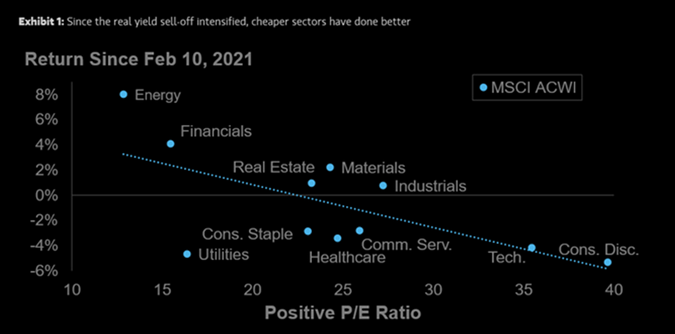

- Some rotation since 10 Feb into value sectors. Note how much $ACWI (cap weighted global equities) has performed so well. Suggestion is that European equities are due for a rerating. This chart has reversed somewhat over the last few days. From TME.

Bearcave tips

Citron Research published a bullish video and report on Esports Entertainment Group (NASDAQ: GMBL — $297 million), an esports betting company. Citron highlighted Esports Entertainment as a potential acquisition target for GameStop or other gaming companies.

White Diamond Research published on Blue Bird Corp (NASDAQ: BLBD — $699 million) and called the company “an undervalued electric vehicle manufacturer… with $100 billion of Federal contracts in its grasp.”

Gotham City Research tweeted bullishly on Criteo (NASDAQ: CRTO — $2.09 billion), an ad tech company with “transformational change” and a chance of a potential buyout.

The Hobbes’s Newsletter published on Blink Charging (NASDAQ: BLNK — $1.66 billion), an EV charging company that is up over 1,500% over the last twelve months. The newsletter called the company “a $1.8bn pump-and-dump scheme with negligible sales ($4mm LTM), questionable management, and customers actively avoiding the brand.”

Hindenburg Research published a critical Twitter thread on SOS Limited (NYSE: SOS — $778 million), a Chinese blockchain cloud company:

Culper Research also published on SOS Limited and wrote,

“SOS is a China-based reverse merger which has languished since its April 2017 IPO until its torrent of crypto-related hype has taken shares up over 600% at their peak. However, we find the Company’s claims regarding its supposed cryptocurrency mining purchases and acquisitions to be extremely problematic, if not fabricated entirely.”

In response, SOS said the reports “were purposefully designed to manipulate the price of the Company’s shares, with the aim of causing a stock price decline in order to economically benefit the short sellers.”

Potential Accounting Problems at SCI

Service Corporation International (NYSE: SCI — $8.09 billion), a funeral and cemetery company, received two SEC comment letters and held two phone calls with SEC staff according to comment letters made public last week.

The SEC comment letter said, in part,

“In discussing your trust investments on page 40, you also state that your market-sensitive instruments and positions are considered to be ‘other-than-trading’. Please tell us how you concluded the cash flows related to your trust investments represent operating activities, rather than investing activities.”

In a 19,036-word response (inclusive of exhibits) the company wrote,

“Our financial reporting for preneed funeral and cemetery contracts with customers has been the subject of significant research, deliberation, consultation, and discussion with the Staff and the Office of the Chief Accountant over the last 15 years. State laws generally require… funds collected for preneed funeral and cemetery merchandise and service contracts to be placed into merchandise and service trusts… The Trusts hold investments in marketable securities that we have generally considered other-than-trading…”

SCI later made small changes to its accounting “based on further conversation with the [SEC] Staff.”

Comment letters are public informal correspondence between public companies and the SEC about accounting or disclosure issues. Other companies with notable recent comment letters include JOYY Inc (NASDAQ: YY — $9.55 billion), a Chinese video-based social media platform, and The Children’s Place, Inc (NASDAQ: PLCE — $1.01 billion), a U.S. retailer.

Why do people buy T Bonds?

I attempted to answer this here. I occasionally post on Reddit, but this was a bit longer, and I thought it was worth sharing. I do believe that bonds are a bad bet, but I am not naive enough to believe that there are no good reasons for buying them.

Wrap

Largely a day of reversals. It’s very unclear what is happening. The long rally in commodities seems to have stalled. Bonds are catching a bid. Equity markets were weaker, again, with all the major US indices falling, including the Nasdaq. None are up more than 3.5% on the year (the SPX) and all are lagging the major Euro markets, some of which are up over 10%.

Although ethanol rocketed over 5%, the more conventional hydrocarbon commodities were all down or flat. (OK, I’m a chemist. I know that ethanol is not a hydrocarbon!) Grains and precious metals moved up together. Generally, commodities benefited from a weaker dollar.

Hindenburg Research @HindenburgRes

Hindenburg Research @HindenburgRes

Comments !