Today as it happens

Digital shovels

Elmer Spud, probably not his real name, is worth following. He’s written this interesting piece arguing that although crypto is a digital Ponzi scheme, it might be worth investing in the exchange on which the worthless tokens are traded. He’s cautious and nuanced, but I think the basic thesis might be sound. In an ideal world, I think it would be good to hedge away part of the crypto correlation risk, by maybe shorting some BTC, but that’s tricky, given how volatile the stuff is.

Wall Street on Parade: shameless plug

If you don’t already subscribe to Wall Street on Parade, you should do so now. It’s run by a married couple, the Martens, who are indefatigable in their pointing the finger of blame for the state we are in. It’s free, and well written and documented. The latest issue is a classic. It introduces Jim Grant, another Fed skeptic and bond bear. Whether you agree with him or not (and who could disagree that long-dated yields will go up eventually?), both the Martens and Grant are worth following, but also seek out bond bulls, to understand that you need a divergence of opinion to have any market.

1.Grant’s Interest Rate Observer came into the world in 1983 to help its readers to buy low and sell high, or the other way around. We are seekers after investment value, poppers of bubbles and students of unintended consequences.

— GRANT'S (@GrantsPub) November 18, 2020

And the 2021 risk management innovation award goes to … Credit Suisse!

Almost unbelievable, but true.

And the risk innovation of the year (believe it or not) goes to Credit Suisse

It is a great irony reading;

“Risk Awards 2021: new analytics dash helped bank get ahead of op risk breaches during Covid crisis”

A few excerpts from the Risk.net article from February is almost a parody given what CS has experienced over past weeks (full article here);

“…based on monitoring controls in real time, and reducing the lag in responding to and shutting down operational incidents before they turn into potential loss events.”

“You had individuals at every level of the organisation – our CEO, our executive board, our board of directors – all wanting real-time information throughout the course of that. This tool allowed us to pull that together very quickly – and that was only because we built it in such a way that it could leverage those analytic capabilities and the [underlying] data platforms,”

“They were able to zone down to a specific desk,” adds Barkley. “In some cases, they had calls two to three times a day to determine how those controls were doing.”

Risk management is a complex area of finance and trading. Most banks have sophisticated models to monitor risk, and CS’s DNA system (the new risk dashboard) is probably great, but the problem with the Archegos position has little to do with identifying the risks, but is all about how you manage the risk practically.

You do not need advanced models to monitor risks like the Archegos exposure was. For that you need a simple excel sheet that anybody can follow. The problem arises when you do not act in time.

Think of the Archegos risk as basically somebody “booking in” a few huge trades in your book and you need to manage that position.

Anybody that has worked at/run a prop/market making desk knows you need to take of this risk asap. You can have all the correlation models you want, but when somebody hits you in size in names like the “Hwang basket” you need to act immediately. This has nothing to do with failed risk management systems, but the lack of taking action.

Obviously, you suddenly realize this stuff is illiquid, and what most people tend to do is to start hoping for the bounce instead mechanically exiting the position.

A stop loss hurts, but that is the definition of the stop loss. Holding the position and hoping for a bounce is not risk management, especially as you already identified the risk.

We will probably never get the full picture of what happened at CS, but we would not be surprised if part of the strategy was “let the stocks bounce and we will sell some”. Nobody believed that the Hwang basket could implode the way it did, but that is beside the point.

Real risk management requires action and not hope.

Ironically the risk award to CS was probably a good pick, but if you have models people don’t follow, you will end up in trouble sooner or later.

Sometimes you need to keep it simple, in risk management as well. We have shown the table a few times, but people tend to overlook the most basic principle of risk management and focus on fancy models instead.

It is easy to lose 50%, but it is very hard to make “back” the 100% needed to break even…

Shamelessly copied from The Market Ear.

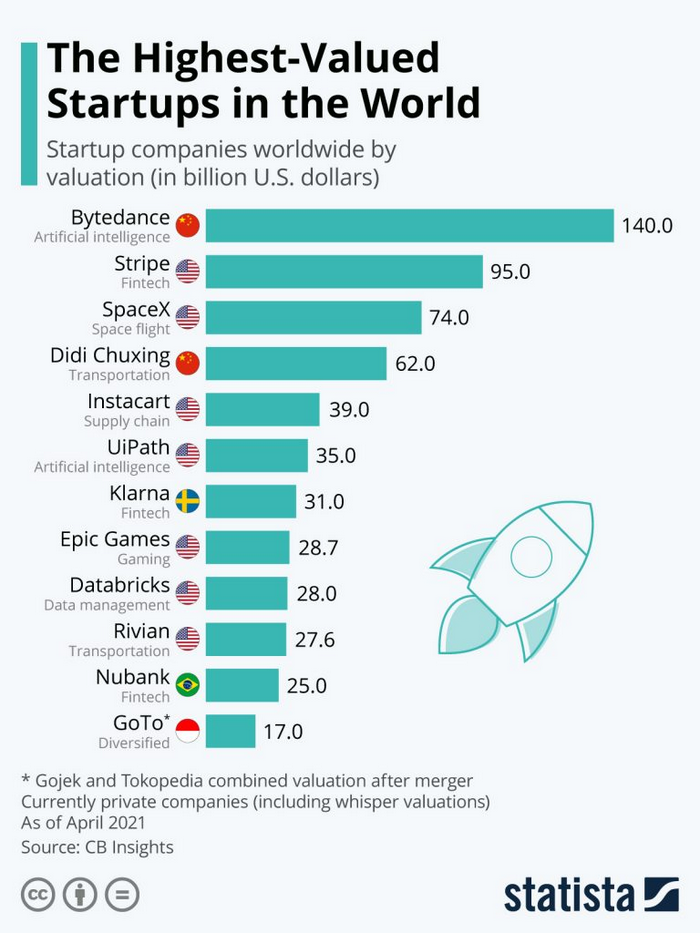

Highest valued startups in the world

Well “valued” is a loaded term. Someone bought a share, and the price of that share was multiplied by the total number of allocated and issued shares of the company concerned. It’s not as though anyone would pay these sums for the equity of these companies .… surely!

Capital Gains games

The equalizing CGT rates with income tax rates is something that was done in the UK in the 1980s. By a free market chancellor, who was part of a right wing government. Nobody thought it was too bad, as far as I can recall. It’s so easy to convert income to capital gains (invoice through a company and sell shares in the cash shell at par), that it just seems the right thing.

Taxation

Read this post about taxation by Edward Harrison.

It’s about the “tax grab” proposed by Biden. It gives an historical perspective, showing that the highest marginal rate of tax between about 1943 and 1963 was around 90%. Harrison, quoting a Michael Hudson, explains that the reason was … Henry George!

He says the original premise of the income tax law was based on 18th and 19th century classical economics and the price theory of economic rent. First and foremost, Hudson says that meant to the economists of the late 19th century and early 20th century that America would get rich through productivity gains that came from the work of highly paid labour. … However, to the degree one made considerably more than the average income, Hudson argues it was assumed in the early 20th century that this was the result of rent-seeking or monopoly privilege of the sort we saw during feudalism. Therefore this income was largely taxed away.

In other words, this was never to “soak the rich,” it was to make the economy more productive.

Then Milton Friedman became influential and

But this whole idea of high marginal rates to deter presumed rent-seeking faded after the Great Society programs of the 1960s and the inflation of the 1970s. The thinking increasingly became the opposite of the era that preceded the 1970s. Allegedly, excessive and wasteful government spending was pushing up demand and overheating the economy, causing inflation. And because the private sector was seen as more efficient, the right thing to do was reduce government spending and taxes right along with it so that people could keep and allocate their capital as they see best.

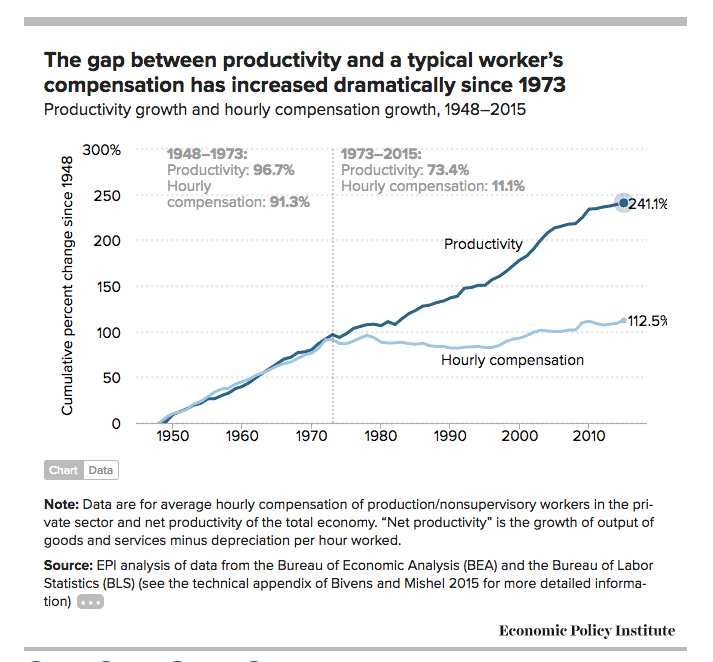

The result was that we then got the famous “jaws of death:”

That’s what income and wealth inequality is all about. It’s about a world in which a rising tide was supposed to lift all boats, but it ended up lifting the bigger boats a lot more than the others. And the smaller boats took on water and are busy bailing that water out lest their boat sinks.

You just need to read the post. It brilliantly summarizes the flaws in recent tax policy.

Wrap

Pretty risk-on/reflation trade day:

- curves steepen across the board, any currency, any maturity pair,

- all US indices rise, VIX crushed. Russell 2000 had its day in the sun: up 1.9%,

- all sectors positive except the very defensive staples and utilities,

- 10Y steady at 1.57%,

- BTC is down to 51.3K.

Canada is starting to reverse loose monetary policy, like New Zealand. The pace of economic recovery suggests that rates will have to rise soon, globally.

Techie stuff

It seems that it is now possible to make windows use UTF-8 as a default encoding. This is the link. I have done this, and it appears to work. For me, I expect it to make powershell work much better with pipes etc. ‘Better’ in this context is ‘more unix-like.’

Dominic Cummings

This is quite a forceful statement from Cummings accusing Boris of scapegoating him. Cummings clearly doesn’t play by the rules of Whitehall and is clearly the anti-Cameron. Maybe it’s just me, but I would infinitely prefer to have a pint in a pub with Cummings than with Cameron. I instinctively feel that he’s telling the truth in this post (but have no objective basis for this feeling). If I’m right, it will damage Boris.

Comments !