This day, as it happens

E.On

I like this stock. It pays a heavy dividend (4.7%), it’s cheap as it was four years ago. It sells stuff that’s going to get more expensive (because of green energy), it’s in a region which is a world leader in terms of carbon emission reductions, it’s got an EV to EBIT of about 1. Not advice, but worth looking at. Probably the peers are good too, especially RWE. There may be a play in terms of legacy carbon credits granted to these generators, dating back to the time they had loads of power stations burning lignite. With such a heavy dividend, long-dated call options will be cheapish. IV is in teens, I think. It’s a reflation play, of course, too.

Old Uncle Moneybags

Berkshire Hathaway has been criticized for paying too much money to the CEOs in waiting, by governance jobsworths. This reminds me that Warren’s days as CEO are numbered, and Charlie Munger’s more so. Many years ago, Warren predicted that his dying would be the best news ever for the BRK A stockprice, and I think his analysis is spot on. Almost certainly, his successors will start doing all the things he has resisted doing: spinning off bits which are questionable (e.g. for ESG reasons), paying dividends, buying back stock, granting massive share options to the CEO (which necessitates the buy back).

Iron ore is going higher

Big producers are BHP and VALE. Metallurgical coal is a complementary commodity.

An economics lesson from a Nobel laureate

Paul Krugman writes a piece about why core inflation is important but why core components may be different now to what they were in the 1980s. Krugman is a wonderful teacher. I think he can come across as an apologist for the Fed, and is certainly the antithesis of Rudy von Haverstein, another great commentator. It is really very important to read both points of view, before coming down on one side. For what it is worth, I don’t think that Rudy and Paul are as far apart as they probably think they are.

Gold to copper ratio signalling complacency

Yes, well, it’s not as though there were any other signs that investors are complacent about everything.

Yes, well, it’s not as though there were any other signs that investors are complacent about everything.

IOER (Interest on excess reserves)

This includes a discussion of why the way to get money into the real economy is to stop paying commercial banks for depositing saver’s money at the Fed. Want to Boost Bank Lending Ratios? Raise the Fed Funds Rate shows that the idea that banks

More inflation drumbeats

@carlquintanilla

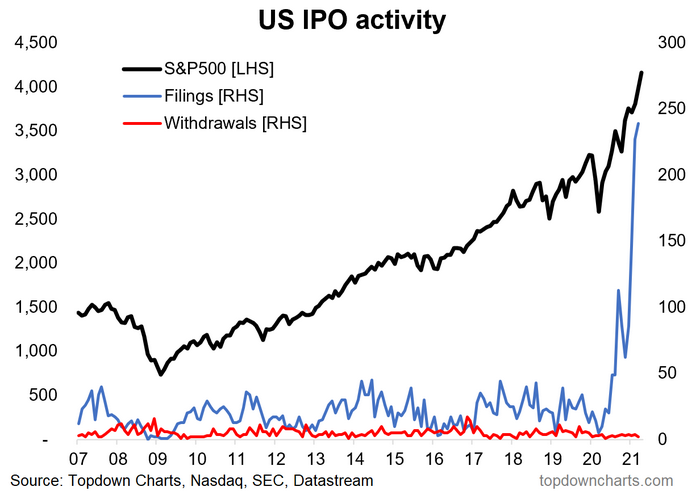

IPO Mania

Topdown Charts has identified a number of great charts to show the explosion in IPO activity in recent months. A lot of very clever stock promoters, hucksters and investment bankers have decided that this is a great time to sell out. In a normal economic exchange, both buyer and seller end up better off. Mike Munger calls this a ‘euvoluntary’ transaction. For securities transactions, this is not the case: a tradeable security offers no benefits other than a future stream of cashflows. The two parties to the transaction simply get cash. Making unheroic assumptions about their own lending and borrowing costs, both should end up with the same net present value when discounted to now. So, the discrepancy of value comes down to differing expectations of future cashflows. One party in an IPO transaction probably has a better idea of what the company will do than the other, and that party is the insider. Don’t forget that IPOs now are mainly about insiders and early investors cashing out: they are not about the company raising money to buy more physical capital.

Anyway, take a look at this chart from the post, and wonder what comes next:

Wrap

The bull and the bear continue to do battle. Markets largely recovered the ground they lost yesterday.

- DXY weakish: 91.133,

- US 10Y stalled at 1.58%,

- SPX up 0.78%, up about the same,

- energy commods down quite a bit, gold up 0.94% (a lot!), silver up 2.76%, food pretty strong.

Henry, 58, invested $10K in a bluechip company 35 years ago. This investment is currently worth $20K

— Jerome Powell (@alifarhat79) April 21, 2021

Chad, 23, invested $10 in Dogecoin two weeks ago. This investment is currently worth $20K

Few understand this

Please read the whole thread: you’ll be glad you did.

“There was a sense in which the Fed in particular was deliberately trying to ignore the reality of inflation of housing costs or just hoping that people wouldn't notice, because it went against the general narrative of what their policy was attempting to achieve.”

— Rudy Havenstein, Cryptid Thought Leader. (@RudyHavenstein) April 20, 2021

- Nick Halaris pic.twitter.com/qbyp07xArZ

Comments !