13th April: not a Friday

Corporatism

A few commentators have been pointing out the collapse of capitalism into corporatism for years. Zingales and Raghuram did an excellent job. Tepper and Hearn did a slightly less good job, but more readably. Matt Stoller is doing a fabulous job, but against the massed forces of corporate America, the odds are heavily stacked against him. The CMA (Competition and Markets Authority) is predictably ineffective, tackling minor breaches but avoiding taking on any big industry with a high level of concentration (such as internet retail, credit card processing, government outsourcing, FTSE-100 auditing, housebuilding, building underwriting, casualty insurance, broadband infrastructure providers, off the top of my head, ignoring global monopolies such as internet search, smart phone operating systems).

What is weird is that no politician even acknowledges the existence of the problem. The Left seems to believe that capitalism is largely unchanged since Karl Marx was in his pomp and is the font and origin of all the ills of the world. The right seems to think it is similarly unchanged but that the competition delivers untold bounty to ordinary citizens, and that “It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own self-interest. We address ourselves not to their humanity but to their self-love, and never talk to them of our own necessities, but of their advantages” is still a good description of how commerce operates.

Part of the problem is lobbying. The revelations in the wake of the Cameron-Greensill-Gupta Family Group fiasco gives a glimpse behind the curtain, and it is far from edifying.

AML

I don’t suppose anyone is particularly surprised by this. Politicians pat themselves on the back, for passing laws that get approval from the USA. Bankers get a better barrier to entry (who wants to start a bank if you have to recruit hundreds of expensive AML compliance officers?). Corporate lawyers get extra fees for having to spend more hours finding the loopholes in the system (which their firms drafted in the first place). Oligarchs have their control of the distribution of dirty money strengthened. Retail bankers and lawyers get some performative virtue signalling, playing their role in beating terrorism. The police and other authorities get to claim that huge resource (conveniently not out of their budgets) are being spent on preventing money laundering.

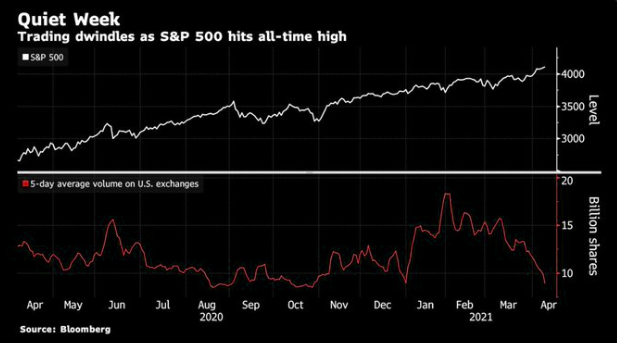

Low Volume

Volume is always in a single asset. People are always buying something. The problem is that they stop buying SPX and start buying BTC. Until they really need to keep their savings in something 100% liquid. Risk asset levels are a measure of confidence in the future.

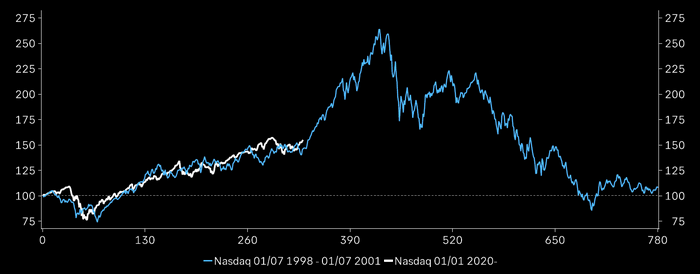

This time is … the same?

Wrap

Generally another risk-on day.

- commodities, including gold, generally up. Food weaker than metals,

- DXY down, 91.82,

- equities making more all time highs: NDX up another 1.2%,

- Most momentum stocks up: $TSLA up 8.5%,

- 10Y down to 1.62%, in spite of weak DXY.

The BLS announced that measured CPI was 2.6%, but the work done by Bullard yesterday neutralized any effect on the market. There was a fairly strong auction for 30Y bonds, possibly yesterday.

6 people in 6.8 million affected by this J&J clotting issue

— EnergyCynic (@EnergyCynic) April 13, 2021

This whole pandemic has revealed how AWFUL governing bodies are at cost-benefit analysis (lockdowns, etc)

I don’t think it’s cost benefit. I think it’s the politician’s asymmetrical incentives.

Comments !