19 Oct

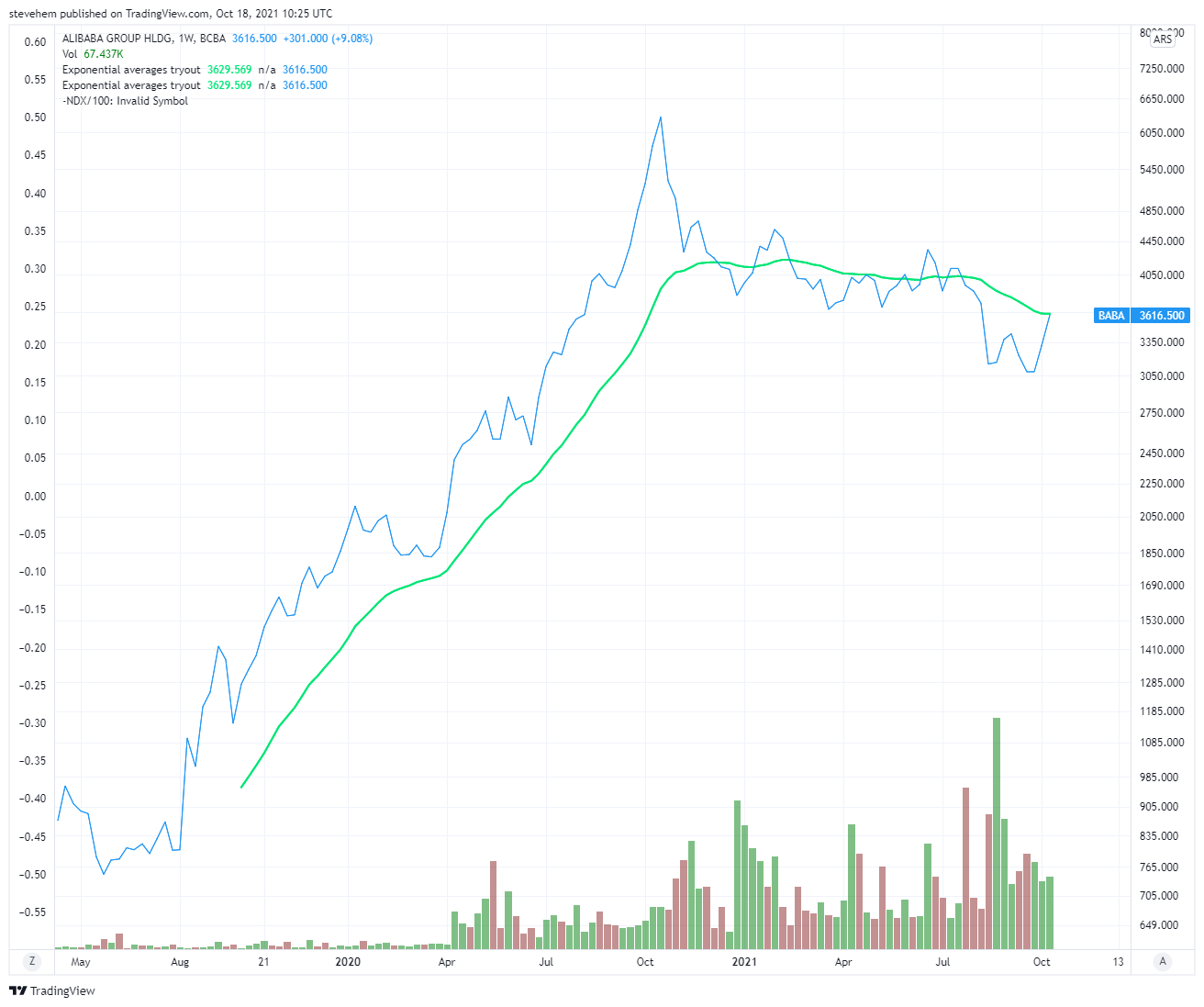

Stock of the day: $BABA

Aikya has a great take on why Alibaba ($BABA) might be a stock to avoid. It has been a massive success story, but it has a few red flags. Stocks that go up spectacularly have a habit of falling spectacularly.

Cost Disease Socialism

Noah Smith’s post for today is all about what he calls Cost Disease Socialism. It’s worth reading, as is all his work, but it’s long. The key point he makes is that the new Left doesn’t want to socialize the means production, distribution and exchange. It wants to protect consumers by subsidizing necessities. The result is an explosion in the cost of these necessities (and the re-classifying of a lot of ‘nice to haves’ into necessities). The piece is specifically about Biden bill’s plans to subsidize healthcare, which is privately provided by lightly regulated hospitals but is already insanely expensive in the USA. He points out that when you subsidize something, it gets more expensive. Exhibit A is tuition costs at universities. The solution? Just give poor people cash so they can spend it on what they need! Somehow this never plays well with the politicians.

On a related note, the latest wheeze by our UK government is to promise to subsidize air source heat pumps. This is basically a bung to the rich, because nobody on a modest income will be able to afford the high performance insulation, house air-tightness, Mechanical Ventilation and Heat Recover and underfloor heating that you will need to heat a home economically with an air source heat pump. Not to mention that you really need a big garden to make one practical.

Powell reappointment

There is a drumbeat of stories which are negative for J Powell. This is typical. Is it partisan? Sure! Is it factually incorrect? I don’t think it is, or Powell would have sued. Is Powell an embodiment of evil? I don’t think so. Is Powell inclined to prioritize what is good for Wall St. over what is good for the bottom 99%? I am 99% certain he is. Is Brainard a lot better? I doubt it, but not reappointing Powell will send a message to her.

China Syndrome

Evergrande was terrifying. But it’s not as if anyone is unaware of the plight that it, and related developers are in. China has artificially held down its currency, so it can dominate export markets, for a very long time. The time to buy is when blood is running in the streets. It’s arguable that now is the time for real China assets. FXI is looking bouncy. Maybe a tentative bull strategy is worth looking at. China is not going to run out of CNH/RMB (why does the Chinese currency have two symbols?).

Wrap

Equities broadly higher. Dollar relatively strong, especially against emerging market currencies, although BRL weak and MXN strong. Commodities generally higher, the oil complex grinding higher: monthly gain now over 18%. Unsurprisingly, given these risk-on moves, yields are rising across the board. Eurodollar paused, but the 10Y now yields 1.64%.

$BTC up at near ATHs, confirming a generally risk on sentiment.

Image of the day

– Nadav Kander

– Nadav Kander

Comments !