Crumbs

The market seems to be taking a risk-on direction as the world wakes up to the fact that Biden in the White House and the mere existence of a few effective vaccines does not mean that the world is returning to normal any time soon.

Generally, the markets have been risk off. Curves are flattening, equities are weak, as are commodities.

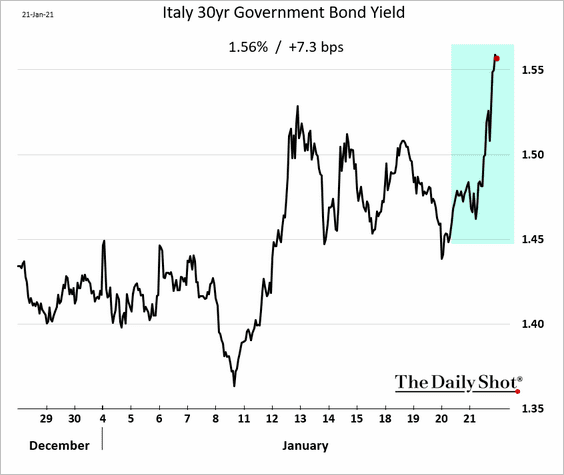

- Alex Manzara muses about eurodollar calendar spreads. Basically, he’s saying (if I understand this post correctly) that we are going to see longer-dated rates rising sooner than most people think.

-

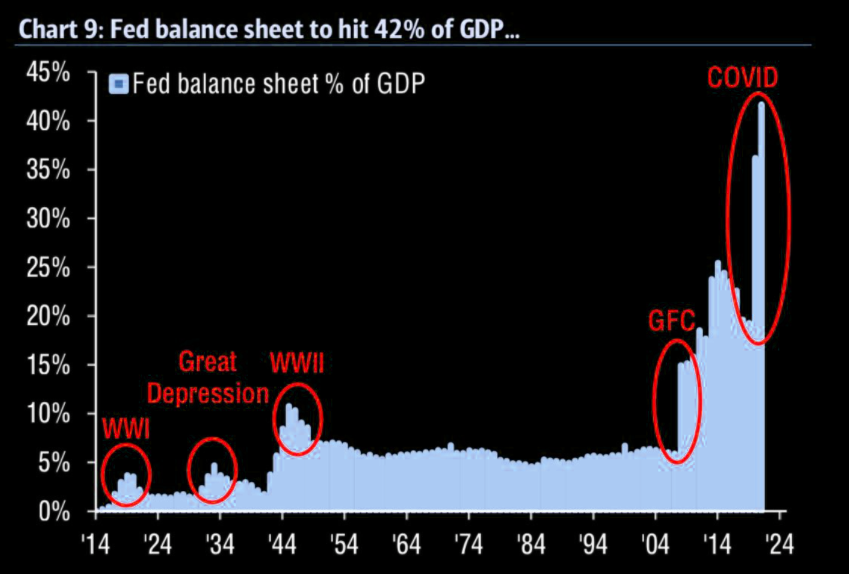

The Fed is pulling out all the stops:

-

$GME is genuinely insane. It’s up 2221% from it’s low of last year. It’s structurally unprofitable and sells DVDs with software on out of high street shops. OK, it’s a short squeeze, but wtf? The assumption is that the Wall St Bets crowd from Reddit have ramped it. Good luck to them, I guess, but someone is going to end up as bagholder.a

- $IBM is on a slow decline into irrelevance. It’s interesting how IBM was taking out regular advertisements in the Economist a few years ago announcing how it was so dominant in cloud computing. Obviously, the management understood what it needed to do, but failed to execute. Intel had better watch out that it doesn’t follow IBM’s path from dominant supplier of processor hardware to an also-ran. Interestingly, as the Grant’s article points out, it’s software, not hardware, that is really the scalable competitive advantage.

- The ECB seems determined to launch a digital Euro. There are an awful lot of crypto currencies: it will be a crowded field. I guess, though, that as stable coins go one from the ECB would be more credible than most,

- I think I’ve got the idea of what a cryptocurrency is, but when it comes to the fine distinction between BTC, Bitcoin Cash and BTV I’m stumped. BTC is going through the roof, but Tether (probably) is not. Understanding the difference might be important to avoid getting burned by Bitcoin. Unbounded Capital thinks that BSV stands above the others. I don’t know if this is true, but it’s interesting to hear the argument.

- Celebrated value investor chooses most hackneyed cliché in finance. It’s that bloody frog, that would actually hop out of a warming pan, just like a human would when it got a bit warm. He’s saying there are dangers in central banks ballooning their balance sheets. It’s amazing that someone that rich can be so … unoriginal.

- Another Kuppy KEDM is out. He’s recommending: $CXW, $VRNT, $AMC and $NGL (these two “‘death’s door stocks,” which might linger a lot longer than put buyers expect), $ODT, $DXLG (“Destination XL: clothing for fat people!”). This is not investment advice, but the service is great value at $0. It goes beyond the usual anodyne comments.

- Jonathan Ford points out the problems with the way that renewable energy is paid for by generators. The problem is the well-known one, that renewal generation can be fiercely intermittent, and a lot of non-renewable (or nuclear) energy generating capacity is required to keep the lights on.

- Wealth taxes are trickier than you think. The problem is that taxing wealth immediately reduces its value. “Radical Markets” by Weyl and Posner do examine this problem and have some answers, but it’s complicated.

Wrap (for last week)

- govt. bond yields start to ease back:

- EM equities have had a hell of a rally: maybe it’s time to ease back. Especially as commodities seem to be fading,

- All the US indexes were green, from NQ (4.19%) to the Dow (0.59%).

Wrap (for today)

Equity indices very twitchy today. NDX up, others sideways. Several of the big FAANGMAN names report their results this week. I assume this explains the move. Feb 10Y Treasury Note future settled at 137-01. Commodities mostly down, although nat. gas strong. Uranium participation up a whopping 7.8%! Overall, DBC (broad commodities ETF) has been pretty strong lately.

Crazy games with Wall Street Bets driving $GME and $BB to massive highs. $NOK and $AMC are next. A lot of people are going to lose their shirts, but if you must, check the bets here.

Thought for the day

“The future is already here, it’s just not very evenly distributed.”

Actually, the past is still with us, but more so. And the past that is with is, is a reflection of how difficult it is to make progress with so many things. Traffic in central London now travels more slowly than a hundred years ago. All the intellectual and economic effort expended to improve this lamentable situation has failed. Jet travel is slower now than it was in the fifties. Nuclear power is more expensive now than it has ever been. Most transport is as reliable on oil now as it has ever been. The same goes for plastics and ammonia (for fertilizer). Progress is hard. Governments have a very poor track record of achieving it by throwing money at the problem. Maybe recent developments in vaccines are the example that tests that rule. But success in vaccines was not achieved by government fiat.

Comments !