Crumbs

Cassandra speaks, but nobody listens

Michael Burry is expecting hyperinflation, and therefore likes commodities, and uranium especially.

People say I didn't warn last time. I did, but no one listened. So I warn this time. And still, no one listens. But I will have proof I warned.

— Cassandra (@michaeljburry) February 21, 2021

The US government is inviting inflation with its MMT-tinged policies. Brisk Debt/GDP, M2 increases while retail sales, PMI stage V recovery. Trillions more stimulus & re-opening to boost demand as employee and supply chain costs skyrocket. #ParadigmShift https://t.co/kNT4memOVt pic.twitter.com/Bdw1CDn3Yf

— Cassandra (@michaeljburry) February 20, 2021

There is a residual interest in silver and copper. Real assets are clearly a safer bet than nominal ones, and short duration assets are safer than long duration ones. All we need now is for the market to wake up to these obvious facts.

Lyn Alden:

Lyn has produced her Feb newsletter. It’s mainly about inflation, money supply, the interdependence of the Fed and Treasury to actually create new money. It’s long, but there are only twelve a year, and so it’s not that much to read. She has a great quote from Druck:

I would say my overriding theme is inflation relative to what the policymakers think. But, because of the policymaker response, which could be very varied based on the vaccine and how they respond to various metrics, I found it’s better to have a matrix.

So, basically the play is inflation. I have a short Treasury position, primarily at the long end. Because the Fed could drive me crazy, and not let that come to fruition, I also have a large position in commodities. The longer the Fed tries to keep rates suppressed, so they’ll have stimulus in the pipeline, the more I win on my commodities. The quicker the Fed responds, the quicker I might have a problem with my commodities.

And then because of the juxtapostion of our [US] policy response vs Asia, I also have a very, very short dollar position.

-Stanley Druckenmiller, 2/3/2021

News headlines

- A Boeing 777 had an engine disintegrate mid-flight. Probably bullish for the stock.

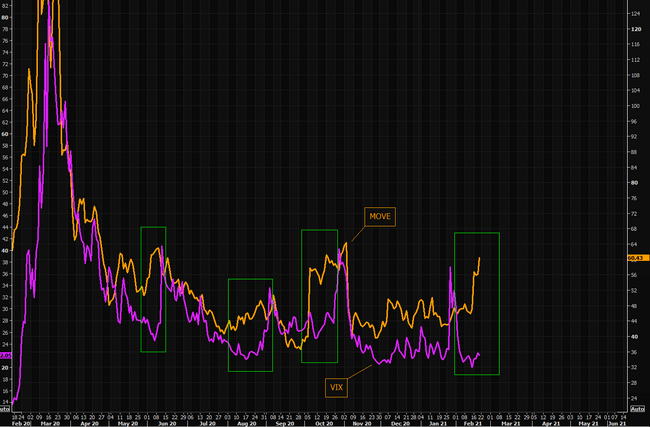

- [ ] - the MOVE index (bond vol) is suggesting that equity vol is about to pick up:

Bond Canary

LQD, an ETF of investment grade bonds, was one of the assets the Fed started buying back in March. It’s wilting now. It could be the shape of things to come. In a recession, credit weakens before govt. debt, because bond portfolio managers increase their weighting of safe assets.

Wrap

The market is behaving spookily predictably, as if it has just woken up to the implications of Yellen’s fiscal stimulus combined with Powell’s monetization of debt. This makes no sense, as this has been a wholly predictable development since the beginning of November.

- DX down to 90.096,

- nearly all commodities up significantly, the energy complex more so because of drilling holdups in Texas, WTI up to 61.58,

- US equities mixed: DJI hits another ATH, but NDX down 2.6%. TSLA down 8.6%,

- Bonds across the piste have modestly higher yields; US 10Y now at 1.37%.

The question is, will this all reverse violently tomorrow, or will it continue?

Norilsk Nickel (a bit platinum producer) down nearly 8%. No idea why.

Comments !