Stock of the day

$TRUP:NMQ. Medical insurance for pets. I think it’s mad, but it may be lucrative. Do your own research, but its cashflow turned very positive last year, admittedly mainly through financing.

Wrap

Markets just haven’t had any clear direction recently. Equities, which have been going up the first half of 2020 are no directionless. Even the NASDAQ 100 index hasn’t recovered its all time high achieved more than a month ago. Periodic scares push bonds up, but the threat of inflation pushes them down again (in price). Natural gas has reached dizzy heights, but can’t manage a trend lasting more than a couple of days. Oil is pricey, but volatile. The VIX bounces around but is probing all time lows, but it’s a while since the SPX made an all-time high. DX had a good bull run, but now is faltering, presumably because of inflation fears. Foreign exchange seems directionless, because every country is determined not to be pushed into recession by an exchange rate which rises steeply against the dollar. Thus QE has become universal. Equity markets globally seem to continue to benefit. There is a case for thinking that there will be some mean reversion in global equity markets. But the under-performance of the rest of the world over the last five years has been monotonic and relentless. It would be a brave trader who bets against it!

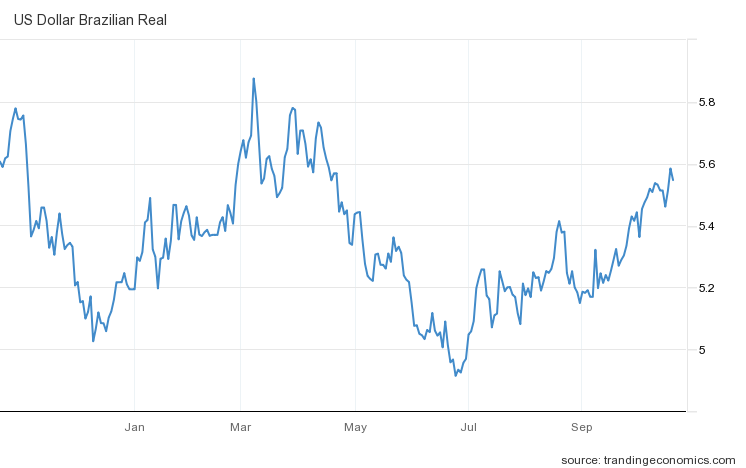

Today, equities were generally up, with a risk-on sentiment benefiting from the launch of a Bitcoin ETF. Arguably. Energy commodities were up, except lumber and steel. Bonds were as flat as a pancake. The dollar drifted down a bit on a trade weighted basis. The biggest move was USD.BRL:

Image of the day

Whereof I cannot speak, thereof I must remain silent

But that would make for a boring blog, right? For me, the problem with cryptocurrencies is that I just don’t don’t have a framework for valuing them. I know a bit about valuation of equities, bonds, currencies, even commodities and derivatives of the above. But crypto seems to derive its value purely from sentiment. It is not an asset in the sense it does not translate into a stream of future cashflows in any sort of real currency. It is not physical capital, like a factory (or a hand tool) that provides utility. It is just a record of ownership of … nothing. The usual argument is that this makes it equivalent to a five pound note. The difference is that there is only one Bank of England, and there is only one currency that is legal tender: a unit of account in which taxes and fines may be settled. I know I’m betraying my boomer mentality, but if crypto currencies can multiply without limit, how can any one have real value? Just because BTC was the first, doesn’t guarantee it’s the best.

Comments !