2023-01-19

Worth reading

Matt Levine is always worth reading. Signing up to his newsletter is about the highest return investment you can make in the world of finance (the fact that it’s free helps with the ROI). He manages to make complicated ideas in finance funny and easy to understand. Well, easier to understand than Brearley and Myers.

In his latest piece he describes that how a company that does nothing but take a cashflow and create value just by splitting it into a number of income streams, without making any changes to the aggregate distributable cashflow. OK, you probably know about securitization and how it lead to the 2008 Global Financial Crisis, and maybe even about the Modigliani-Miller theorem (which basically says that doing this should be impossible). But the way he explains how the magical value creation can happen is masterful. (It’s about regulators making rules about risk weighting of assets which are arbitrary and do not look through to the underlying riskiness of the assets.)

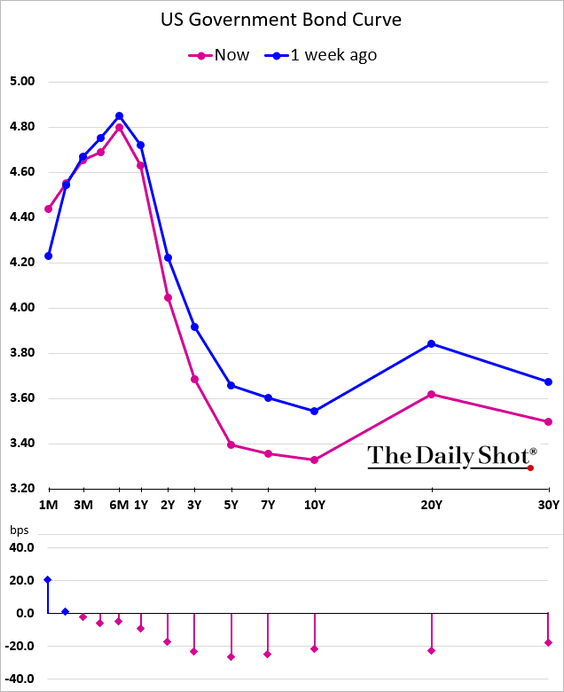

The weird shape of the US Treasury curve

This curve is not quite a predictor of future short-term rates.

The zero-coupon curve isn’t either, although it is if you assume a no-arbitrage condition.

The really steep inversion between 6 months and 10 years is remarkable:

140bp.

I don’t know if we’ve ever seen such a steep drop.

The market is betting the farm on the Fed doing a handbrake turn in a year from now.

The market knows a lot, but the Fed has a lot of firepower, and a lot of ego.

This curve is not quite a predictor of future short-term rates.

The zero-coupon curve isn’t either, although it is if you assume a no-arbitrage condition.

The really steep inversion between 6 months and 10 years is remarkable:

140bp.

I don’t know if we’ve ever seen such a steep drop.

The market is betting the farm on the Fed doing a handbrake turn in a year from now.

The market knows a lot, but the Fed has a lot of firepower, and a lot of ego.

Berkshire Hathaway

I try to write something about stocks on a Thursday. We seem so close to the point where the Fed starts to acknowledge that it’s going to reverse course, and so far along in terms of damage to the equity markets that it might just be time to think about going long something.

US equities always seem so darn expensive, especially the ‘growth’ stocks, but I’ve always had a soft spot for Berkshire Hathaway. It seems to me that Warren and Charlie can’t live forever, and when they die, or hang up their slide rules, the stock is going to rocket. The successor managers will not be able to resist the temptation to enrich themselves by splitting up and spinning of what has become a rambling incoherent (but very profitable) conglomerate.

I really wish no harm to come to those good ole boys, but perhaps they should take up golf and leave the management of Berkshire to the young ‘uns.

| Values | |

|---|---|

| Company | Berkshire Hathaway Inc. |

| Sector | Financial |

| Industry | Insurance - Diversified |

| Country | USA |

| Website | https://www.berkshirehathaway.com |

| Index | S&P 500 |

| Insider Own | 0.44% |

| Shs Outstand | 1.30B |

| Perf Week | -2.54% |

| Market Cap | 679.78B |

| Forward P/E | 20.15 |

| EPS next Y | 15.30 |

| Insider Trans | -0.10% |

| Shs Float | 1.30B |

| Perf Month | 2.12% |

| EPS next Q | 3.67 |

| Inst Own | 65.39% |

| Short Float / Ratio | 0.47% / 1.60 |

| Perf Quarter | 11.29% |

| Sales | 295.72B |

| P/S | 2.30 |

| EPS this Y | 20.10% |

| Short Interest | 6.08M |

| Perf Half Y | 8.73% |

| EPS growth next Y | 5.10% |

| Target Price | 362.00 |

| Perf Year | -4.88% |

| EPS next 5Y | 23.30% |

| 52W Range | 259.85 - 362.10 |

| Perf YTD | -0.19% |

| EPS past 5Y | 14.40% |

| 52W High | -15.51% |

| 52W Low | 17.74% |

| ATR | 5.35 |

| Employees | 372000 |

| Sales Q/Q | 9.00% |

| RSI (14) | 43.89 |

| Volatility (Week) | 1.42% |

| Volatility (Month) | 1.61% |

| Optionable | Yes |

| Rel Volume | 0.63 |

| Prev Close | 308.30 |

| Shortable | Yes |

| Earnings | Nov 07 BMO |

| Avg Volume | 3.81M |

| Price | 305.95 |

| Recom | 2.70 |

| SMA20 | -1.53% |

| SMA50 | -0.94% |

| SMA200 | 2.26% |

| Volume | 2,279,827 |

| Change | -0.76% |

I keep a sort of scrapbook of equity titbits here This is the simplest possible thing: just a collection of markdown documents. It started out just as a way for me to collate stuff I read about individual stocks. I like to follow stocks, because their varying fortunes give some sort of window onto the state of the economy in the real world, but they are so complicated from a valuation point of view that I am very reluctant to invest in individual names. Take a look and clone the repository and start contributing, if you feel like doing so.

Comments !