Chart: 5Y Breakeven rate

The market (various measures) seems convinced that inflation is going up. I’d spend all day writing this if I linked to everything I see that says this. But still, in bond prices, the evidence is far from overwhelming

Crumbs

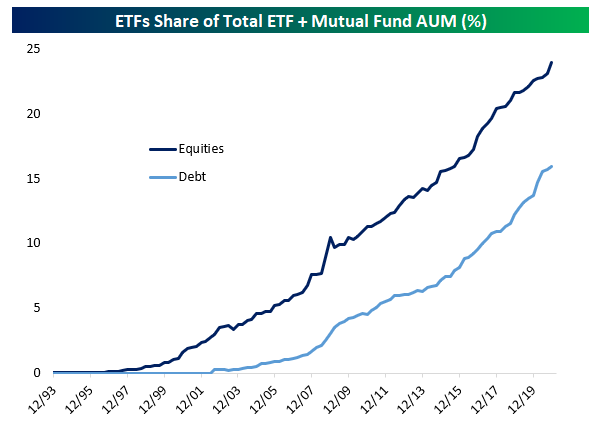

The rise of ETFs (which are mainly, but not entirely, passive) is going to end up destroying the buy side of Wall Street. And if the buy side is gone, the sell side is in trouble.

Wrap

Reversal of reflation trade seen today. NDX strong performer, and bonds. Driven by a dismal rollout of vaccine in Europe, and some new lockdowns. They may well be right. The market has changed its mind about deflation.

The SLR changes are having an impact on the demand for bonds. There are mutterings that this is likely to be a temporary reversal, but with TSLA rallying 6% on an analysis by a party (ARK) that are both talking their book, and have no credibility, it’s dangerous to act on that.

Commodities have had a tremendous run over the last six months, with the exception of natural gas and precious metals. Today the price movement was mixed, but no pickup in silver or gold, in spite of a lot of tweets predicting a silver breakout.

Turkish Lira took a huge dive as another central bank governor was sacked by Erdogan. Other currency movement was muted. DXY was down 20bp. Not material.

Thoughts

I was reading about Danone the other day. The CEO has been forced out, although I doubt if he’ll have to go on the dole. The guy is known for his focus on environmental matters, but the commentator said that his mistake was to spend too little on advertising. The assumption was that products didn’t matter much for profits, but if you stopped adverting, you’d lose money. It got me thinking that the same goes for stocks. Tesla is exhibit A, but there are plenty of others. The SPAC crowd understand this. Chamath is a celebrity (admittedly with some industry credentials). A lot of the other stocks have sponsors who don’t have a clue about investing or business, but know very well how to get their picture in the paper (and their interview onto CNBC). It’s a rolling series of bubbles, but if it’s carefully tuned, it can go on practically forever. There are companies that move their ethically dubious business model from country to country, making a lot of money in each from a cookie-cutter operation, until people realize that they’ve been duped. The risk is that we’ll end up with an economy entirely composed of such companies, which doesn’t sound like a good place to live.

The damage done by monopolies

This post by Matt Stoller is mind blowing. It clearly demonstrates how corrupt the Obama administration was in enabling the dominance of the FAANG. It references this article, which is first class. It’s been obvious that “vertical search” (like Yellow Pages, aka Yelp) would suffer in competition with Google, but Google actively stuck in a knife and twisted it. Politicians and the FCA were captured by the companies they were supposed to be regulating. It’s a familiar story, but it retains the ability to make me angry.

Investor Amnesia and Meetups

I’m near London. I am not averse to a few drinks. I was wondering with anyone would be interested in setting up a FinTwit group in London once lockdown is over. There are a few of these already, but only in the USA. DM me on Twitter (@francismansell).

Ex-Blackrock exec starts row over value of sustainable investing https://t.co/S9c4TIeNSz

— Reuters Commodities (@ReutersCommods) March 22, 2021

At the end of January there were:

— Billy Bailey (@wrbailey8) March 22, 2021

1.45 million realtors

but only

1.04 million homes for sale which is the lowest since 1982 @WSJ

1/ How it started….. pic.twitter.com/kO2ggQh8UP

— Shill LeBeau (@Lebeaucarnew) March 21, 2021

Thoughts

The world is becoming more international. The web, social media, investing, news, political movements, identity politics, climate change, pandemics, cryptocurrencies, fintech are all global. But our laws are all stuck in nation-state silos, with no global mechanisms for enforcement or dispute resolution. Not only do we not really have international law, to the extent that ordinary citizens can access it, the institutions that might interpret it are subservient to the interests of nation states.

The consequence is that we have extreme variance in inter-country welfare, which are vastly worse than intra-country equality, but national politicians have no remit, or incentives, to reduce them. We just get starvation levels of poverty, desperate people risking their lives and their life savings to cross lines drawn on a map. We salve our conscience by sending bags of surplus grain (themselves a consequence of terrible, distorting agricultural subsidies that benefit rich western landowners) to starving peasants in Africa. No politician ever dares to make the case for a more rational immigration policy.

Comments !