Tuesday 5, April 2022

Elon and Twitter

I am a fan of Twitter. I follow a lot of those who are ultra-sceptical of Elon Musk. I wonder if they will be able to continue to tweet without their content being hidden by Twitter’s rather unsatisfactory search capability. Even more, I worry that such sceptics will not get recommended to anyone, even those who are equally sceptical.

It would be hilarious if Elon were banned from Twitter. I guess this just got a lot less likely.

1) Elon is so cash poor he still bought the Twitter position

— Gustavo Litovsky 📶🇺🇦 (@agusnox) April 4, 2022

2) imagine the guy buying a 3.6B position in another company instead of investing in his own which supposedly will own the world with robots. Twitter is garbage next to that

Labour markets

Unemployment is a terrible metric. It’s supposed to measure the number of people who want to work, but cannot find jobs. It probably was OK in the 1930s, but it’s no good now. Benefits paid to people who are unemployed encourage people to register, which might lead the figures to overstate the number who are truly idle. We’ve all heard of those who claim but work cash-in-hand. On the other hand, a lot of people have an income which is (i) high enough to mean that they will not receive benefits, (ii) is high enough to mean they don’t need any state support, (iii) such that it’s embarrassing to register. Huge numbers of professionals set up limited companies to employ them, but don’t really get enough income to justify the effort. A lot of highly qualified women with children have kids and then realize in their forties that they’d like a job, but they don’t want to work alongside people who are only a bit older than those kids.

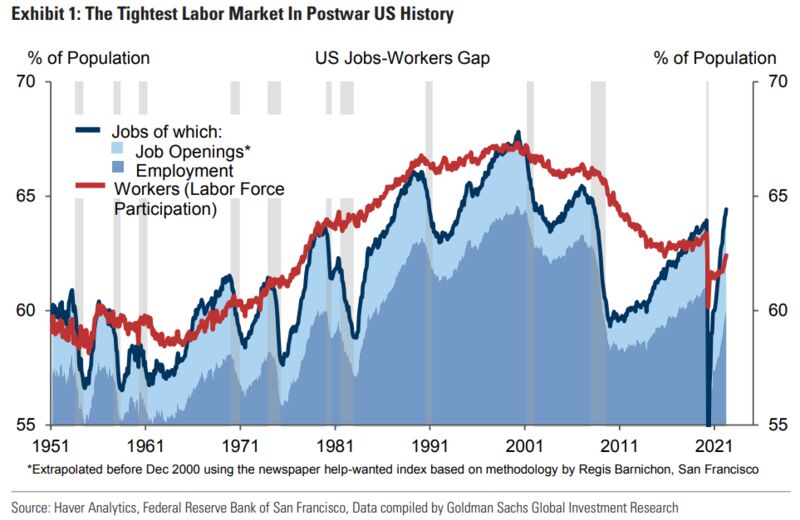

Anyway, the US now seems to be in a region in which the number of job openings and those already in employment comfortably exceeds the size of the workforce. Obviously, these numbers are somewhat suspect. If all the baristas in all the world woke up tomorrow as Google AI coders, the world would not be a worse place. Probably. Anyway, if we really are in a regime where we are above, or about to exceed full employment, inflation might well follow (you knew it was coming!).

Central banks can keep a lid on inflation, but only with a supportive fiscal policy. This might be hard to achieve, if inflation takes off. Maybe that’s what is driving everyone to crypto.

The role of central banks

Central bank governors are masters of the universe. They have found a magic potion, capable of keeping markets going up forever, allowing governments to finance ever-increasing deficits, fixing racial inequality, and reversing global warming. And, moreover, they can do all those things on their own. Or maybe not. Eric Leeper, who is a smart guy, says that monetary policy only works when fiscal policy is constrained so that government debt doesn’t spiral out of control.

The main point that a lot of people make is, “Hey, fiscal policy has first order distributional consequences and those should be in the hands of elected officials.” I agree with that. But you know what? Monetary policy has distributional consequences too. But somehow we’ve decided that’s okay. We’re not going to put that in the hands of elected officials.

In the USA, everyone credits Volker with finally slaying the dragon of inflation. In the UK, the fiscal tightening, with Geoffrey Howe’s excessively tight 1981 budget is more generally recognized as the catalyst for reversing the direction of price rises. Generally, when the IMF sends in its hit squad, they focus first on fiscal policy. The problem is that politicians want to be loved, and more importantly, to be re-elected. This time may well be different.

We attribute to Volcker the success of disinflation. And what people seem to forget is that after the 1981 tax cut which was very large, there were then before the end of the decade, five tax increases. Well, that is exactly the fiscal support that you need for that disinflation to be successful. And another way to think about this is that tight monetary policy has to be followed by tight fiscal policy if we want to really put it in simple terms. And I think that by and large, in the post-war period in the United States, we have seen exactly that pattern of behavior.

Not so much in the ‘70s, but then we weren’t really seeing tight monetary policy in the ‘70s either. And we saw what the consequence was. But now my concern is that the situation is really very different. When Volker was doing this debt as a shared GDP was about 25%, now it’s 100%. If the Fed has to, as Larry Summers is now saying, has to raise interest rates to about 5% to fight off the current inflation, that’s going to raise debt service by about a trillion dollars.

Eric Leeper on the Interactions of Fiscal and Monetary Policy

Economic policymakers are at sea on inflation

Tweet of the day

(OK, this was a few days ago. I’m still catching up.)

Tech Rout Leads To Record 34% Loss At Tiger Global's Hedge Fund https://t.co/dAnuDQlANu

— zerohedge (@zerohedge) April 2, 2022

Wrap

There was some kind of Fed announcement today. Lael Brainard said that the Fed would press ahead with quantitative tightening (QT) (i.e. letting the balance sheet run off, replacing bonds with reserves). In spite of the fact that there is no respectable theory that says that QE or QT make a blind bit of difference to the real economy, the speech did cause the dollar to rally, and real assets to fall, including equities and most commodities (certainly energies).

Although a tightening move should drag down yields, in fact the market is convinced that the Fed controls the bond market, and so yields duly rose. The 10Y is now at 2.556%.

Credit is being hit. $IBXXIBHY (the high-yield corp. bond index ETF) fell by 1%, which is quite a lot.

This was a bad day for long-duration (real) assets. The $NDX duly fell more than 2%.

The market’s response seems to imply that it is convinced that the US govt. will run a primary surplus far into the future, and that the central bank will keep real rates negative. Historically, in the west, this seems a decent bet, but it’s taking a lot on trust. It also assumes, again with some evidence, that the those who suffer from inflation (Jeff Bezos) will triumph politically over those who benefit from it (benefits claimants). Again, probably, but there is a material risk that this is wrong.

Image of the day

This is Oxford, but … Old Brasenose Lane?

— Anne-Marie Chameau (@AnneChameau) April 5, 2022

Comments !