Crumbs

- Miller Value Partners Deep Value Strategies include Brighthouse Financial ($BHF), Wells Fargo ($WFC) and Gannett ($GCI). I don’t know much about the last, but the first two are financial sector stocks that have had a rough time lately. They seem to be trading below book value.

- Fairholme Fund: big positions: $JOE, $FLHM, $FNMA, Imperial Metals Corp.

- Bonsai Partners — big positions: Redbubble, Micron Tech, PushPay, Travelsky Tech, LKQ, Taiwan Semi, Illumina. Illumina does genome sequencing etc. It is very solvent, but at a P/E of nearly 80 on a forward basis, it’s very expensive.

- Yacktman Asset Management: Tyson Foods ($TSN), Pepsi-co ($PEP), Ingredion ($INGR). Consumer staples focussed.

- Insiders are very bearish,

- Retail REITs may have hit a bottom,

-

Kuppy’s Event-Driven Monitor this week is touting: $USDP, $REP SM, $LGND, $ARQT, $LRN, $WBA, $CVV, $FGPRQ (yes, bankrupt) and various SPAC warrant arbitrages. Perfect for those of you who like living dangerously! FGPRQ has a m. cap of $75MM, so qualifies as a nanocap. $WBA is Walgreens Boots Alliance: you’d think it had value in a pandemic.

$MO is locking in the most favorable rates in its existence for 30 years. Combined w buybacks of 8% yielding stock, it effectively locks in future dividend increases.

— Oh Come On! (@BluthCapital) February 2, 2021

Plus it can sell 10% of $BUD after 10/10/21. $12B now if bought back reduces div burden by $1B forever pic.twitter.com/bOWi5gp2o9- Alex Manzara always comes up with an interesting weekend post. Last week’s was no different. His comments range from a look at the underperformance of commodities relative to stocks over 30 years, and the meaning of the famous “Cross of gold” speech, by William Jennings Bryan in 1896. In fact — and I hadn’t understood this — it was a cry for looser monetary conditions. It’s amazing to think how little has changed in well over a century.

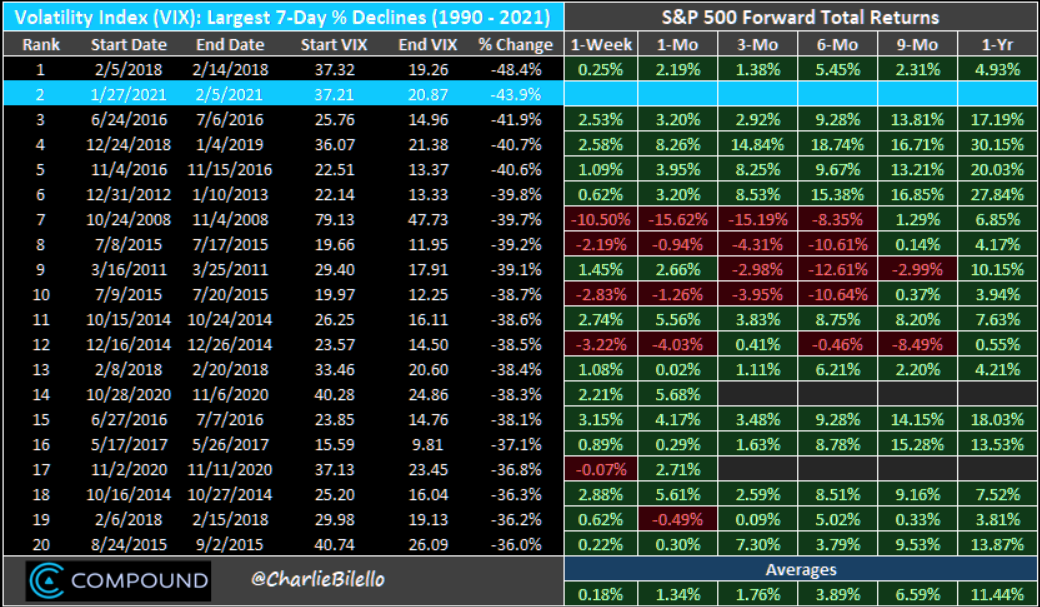

- VIX continues to crash.

Wrap

Massive risk-on day. Supposedly explained by the fact that the stimulus bill in the USA is going to be passed, but really just because of a burst of FOMO:

- European bond yields generally up, except Italy, US 30-year is now yielding more than 2%,

- almost all commodities up, except a couple of lightly traded foodstuffs (cocoa, coffee, milk & sugar!!), nickel at a six-year high,

- nearly all US and European equity markets up,

- most currencies flat, although AUD was up 0.38% vs USD, presumably because of the strength of commodities,

- Bitcoin has gone ballistic, as Elon Musk says that Tesla has purchased $1.5B worth of it (more than it spends in a year on R&D!).

Tweet of the day

SPACs have been very lucrative for the sponsor.

— Michael Batnick (@michaelbatnick) February 8, 2021

“The average SPAC sponsor return less concessions, forfeiture and vesting over the last two years was 648%.”

From Michael Cembalest at JPM pic.twitter.com/OxCgvYJeKX

Comments !