2023-01-12

Equity markets and their headwinds

This calendar year has started with a burst of gloom:

-

Rising interest rates, driven by central banks trying to fight labour shortages by making capital more expensive,

-

central banks promising to double down on their fight against inflation, in spite of the pain being caused by the war in Ukraine and the galvanizing effect it has had on energy prices,

-

yield curves generally, but especially in the USA, have become even more inverted. This has been relentless since last spring and shows no sign of reversing,

-

consumer debt levels have completely reversed the drop seen over the lockdown and are now very high,

- a lot of firms, especially tech firms, are announcing widespread redundancies. Services are still catching up with the mass layoffs over lockdown, and unemployment is very low, but this is a lagging indicator,

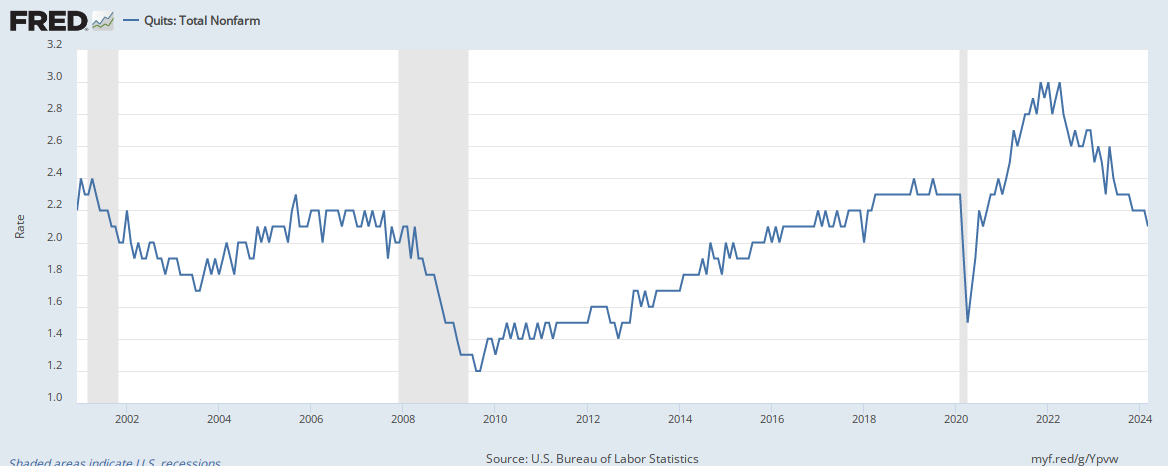

- quit rates are elevated, but coming down:

-

M2 is crashing in the USA and the UK is coming down:

source: tradingeconomics.com -

housing prices are under pressure, initially in the UK in the form of a collapse of transaction volumes, and

-

credit conditions are looking tighter (BoE survey),

- the IMF is practically forecasting a world recession, > “The risks that we warned of six months ago have materialised and our worst-case scenario is now our baseline scenario,” said Ayhan Kose, the World Bank economist responsible for the report. “The world’s economy is on a razor’s edge and could easily fall into recession if financial conditions tighten.”

So, a recession is here, or at least just around the corner but equity markets are totally sanguine about this. Is it really all in the price? Are equity markets so far-sighted and omniscient? I somehow can’t believe it, but passive flows into market-cap weighted equities might just keep driving prices higher and we might really end up with a soft landing. Just like fiat currencies only have a value because people believe in them, equity markets are really quite similar. Maybe it’s the time to go long, but if you do, buy some out-of-the money puts. Just in case.

Comments !