- inflation

1 Sept 2021

Pic of the day

Evergrande

“Evergrande is the largest player in the largest sector in the Chinese economy. Evergrande owns 231 million sq meters of land in 234 cities. Evergrande is the largest Chinese issuer of dollar-denominated corporate debt in the world, with a balance sheet of more than $350 billion.”

– From Epsilon Theory.

Is $350 billion a lot? Hmm, I think so, even today. China is a paradox, wrapped up in an enigma. It is a communist country which has an absolutely stonking stock market, that has defied gravity for decades.

The country has a lot of physical infrastructure, real investment in real things. But most of this was financed with debt, much of which must be close to default. The problem is that a major economic downturn would be extremely embarrassing for Xi Jin Ping, and nobody even pretends that the central bank is independent, so probably this debt will continue to be fine, at least systemically.

China is hugely important for the world economy, as a source of supply, but also as a source of demand. If it goes down, there is no way that the US and the EU will avoid going down with it.

Let’s hope Xi Jin Ping has had both his vaccinations, and that he didn’t have the Sinopharm one!

This is the link.

Commodities

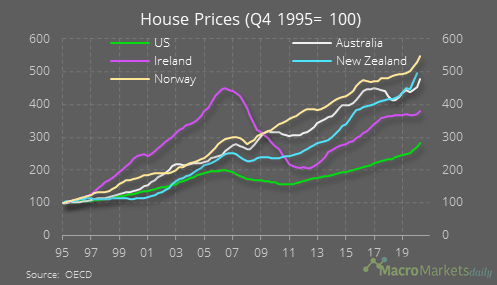

House prices

House price inflation continues to outpace wage inflation.

House price inflation continues to outpace wage inflation.

Wrap

Generally pretty risk on. Bonds flattish, no big moves in currencies, aluminium and natural gas on the move, China bouncing back (intervention?), house construction sector strong.

Big up moves in $INMB, $RRC, $SD, $TECK, $BTU.

Vol crushed. As per usual.

Comments !