So, sell everything … ?

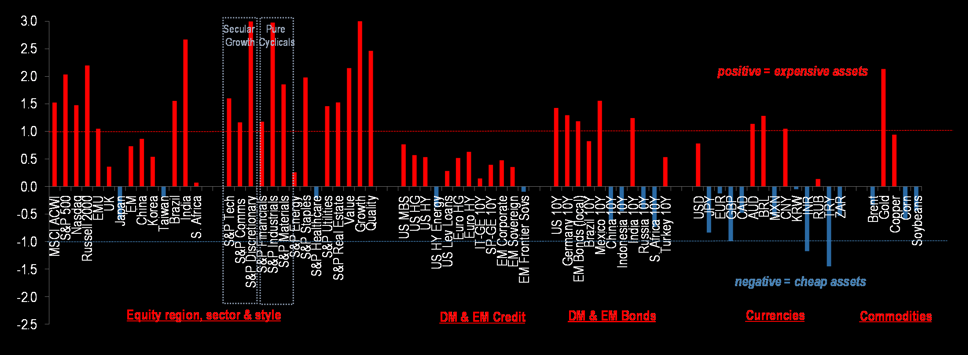

Maybe go long TRY, WTI, Corn, Soy, INR, ZAR, Energy HY, SPX Healthcare, Taiwan or Japan?

Short the rest of the SPX?

… Risky!

Market Thoughts

Apart from the slightly jokey comments above, I think it might be worth looking at $T (AT&T) and some of the US banks. The banks will benefit from a steepening yield curve. AT&T is an old technology stock that probably has some undervalued assets in the form of wayleaves and cables. Data is all very well, but you need wires and fibre to move it around.

Canada is interesting. It was in reasonable shape before Covid, and it’s monetary stimulus has been huge. It’s stockmarket is dull energy and grains, but with demand (hopefully) boosted by stimulus, it looks a lot safer than the SPX. The other thing is that Biden will (surely) be more willing to restart and expand the scope of NAFTA.

Specific recommendations which have crossed my radar: $BK, $MMM, $COP, $WFC, $ABBV, $TOT. Not mine. No research done by me. Do your own, but generally might benefit from inflation and rotation.

After insane pops, $DASH and $ABNB must be overvalued, but until they start a clear downtrend, they probably should be left alone.

$DIS has rocketed because it’s subscriber numbers are already at 73M, after only 12 mos. This is fine, but I can’t see how both $DIS and $NFLX can be at very high levels, if the thesis is that one will become the Amazon of streaming.

$CVS (healthcare, administering vaccines, but may be damaged by BidenCare).

I subscribe to a lot of newsletters. Every single one nowadays says that we’re in a bubble, and it’s going to pop, and the pin will be inflation taking off. As a natural contrarian, I get very worried when there is such a consensus.

The big test will come at the end of the week, when options expire and $TSLA joins the SPX. It is a top 100 stock, by market weight, and will force selling of all the other 499 stocks in the index, not to mention the one that it is displacing (which nobody cares about now). Tesla is the largest stock ever to be added to the SPX, which is likely to cause instability.

Wrap

Generally a risk off day. Bonds generally flat (slightly steepening). Dollar weakish, EUR at 1.21. Not sure how much further this can go. Gold continues weak, now at 1829. Agricultural commods up a tiny bit. Energy stronger, especially that most hated of energy commodities, coal. Volatility slightly raised.

The Untouchables

I watched an enjoyable film tonight, “The Untouchables” with Kevin Costner and Sean Connery. It was very watchable, and nothing that follows is in any way intended to discourage anyone from watching an enjoyable and well made movie. My problem is that the story is about as believable as Snow White and the Seven Dwarves. The plot is a classic cops vs robbers yarn, with the good, represented by Elliot Ness and his incorruptibles vs evil, represented by Alphonse Capone, played with deadly menace by Robert de Niro. The idea is that Capone has, single-handedly, turned Chicago into a cesspit of depravity, and once Ness has bypassed the corrupted police force, he can arrest Capone, have him tried and send him to prison, returning Chicago to its prelapsarian state of grace. I think that the grip of Capone and the other gangs weakened when Prohibition was abolished, and the economic rents available to bootleggers were competed away by legitimate sales of alcohol. Crime exists because it pays. The more it pays, the more crime is committed. It’s a net pay, because criminals have to pay the price of getting caught. Or, rather, the expected price, which a function of the probability of getting caught. My guess is that Capone’s henchmen were pretty quick to realize that they could continue to access the cash flow from his operation, in his absence, and wasted no time in slugging it out to determine who would be the new capo. But Gary Becker’s theory of criminal behaviour has no place in a Hollywood movie, not least because the merest whiff of it would kill the film stone dead at the box office.

Comments !