Market update

After the Fed meeting yesterday nothing much has changed. Nasdaq (NDX) and BTC are down now, govt. yields up a bit in everywhere except GER (down) and USA (flat). The energy complex is up on some refinery capacity being taken out (and, I think, the reserve being lower than full). The exception is NG, which is down, but only after a stonking run. Convertibles are up. I read in the paper that convertible arbitrage is now a game worth playing for hedge funds after years of no interest. The article implied that the driver was increased equity vol, but that’s not obviously the case in the main market. I guess the third division companies that issue convertibles might have experienced some high vol. lately. I took a look a longer chart for gold. It is supernaturally flat: down 7bp in the last month, with very little intervening volatility. It is as if it’s tracking interest rates…

I am not a subscriber to Shadow Government Stats, but it’s latest report strongly suggests that the policy announced at the FOMC meeting will result in an inflation spike. MMT does not believe that government spending can be financed by money printing without limit. Practitioners have always stated that once the spending has started bring the economy near to its production frontier then it’s appropriate to drain demand via tax rises to control inflation. I don’t think that we’ve quite reached “Mainstream MMT” but we’re getting damn close to it with the latest announcement, and it’s hard to see Biden moving swiftly to raise taxes, especially three years into his term. OK, maybe I meant Kamala doing something that would stop her becoming the first elected (black) woman POTUS.

There is a (UK) Monetary Policy Committee meeting today. The Economist expects no change of policy, which sets the Bank of England alongside virtually every central bank on the planet. At some point rates will have to rise but it doesn’t seem that it’s going to happen any time soon.

Micro futures

The CME is launching micro contracts in DJI, Nasdaq, Russell 2000 and SPX. This is to fight back against RobinHood, presumably, which must be draining some commission income from the exchange.

Alibaba cloud computer

This sounds interesting, but the article is devoid of any practical details of the device.

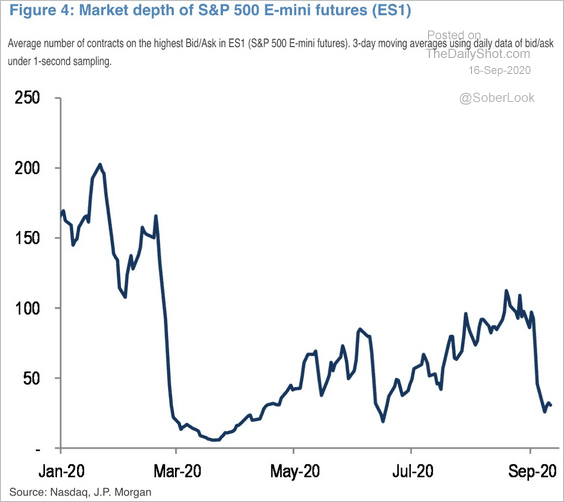

SPX liquidity

This indicates a lack of both buyers and sellers of the future. Maybe they’ve moved to the micro version, or they just can’t tolerate the volatility and lack of direction. Liquidity is an odd concept: it’s the confidence that one can have that there are willing buyers and sellers for an asset under the full range of future states of the market. It is not simply that now there are lots of buyers and sellers. As someone once said, it’s hard to define but you’ll know what it is when you haven’t got it.

Commodities

My old thinking about inflation was that the way to profit from unanticipated price escalation was to short long-dated government bonds. The problem with this strategy is that this is a rigged market: the counterparty is a central bank someone that can keep buying longer than you can remain solvent. It may be possible to buy inflation linked bonds, but these are already extremely expensive. It occurred to me that commodities may be an alternative route. Of course, commodities can be very volatile for short-term ‘technical’ factors, e.g. arising from supply holdups, bad weather etc. But cheap exposure can be obtained via futures (don’t do this at home!) or ETFs. As always, this is a recommendation to do some research, not to trade. But looking into this seems worthwhile at the moment. I follow Andrew Hecht. He is almost a perma-bull, but he writes interesting stuff.

The End Game

I listened to (most) of Episode 7 of this podcast. The amazing thing about this is that all the guests agree that the current financialization of everything is going to end in tears, but none really have a clear idea of what the end will look like. One thing that everyone seems to agree about is that as financial assets grow without any limit, no CB can ever let interest rates go up. The big question is whether they will stay at zero or will go downwards forever. My bet is that they are pushed down into deep negative territory, but this will have a big impact on the value of movable assets (such as collectable coins).

Comments !