WSB

These guys just pile in on high short-interest stocks to pop them higher. Current targets are GME, AMC, BB, BBY, NOK. AMC IV is 392%! This is kind of insane, but fascinating. At some point there will be a day of reckoning, but with AMC up 11% in pre-market I’m not going to bet against it. If you want some ideas, try lowfloat stocks or high short interest stocks. Not investment advice!

Pandemic drives inequality

Nothing suprising there but will this translate into more stimulus?

US Residential is a buy

Available stock is at very low levels. Probably immigration will pick up. Maybe a post-pandemic baby boom?

Kiss goodbye to closing the deficit

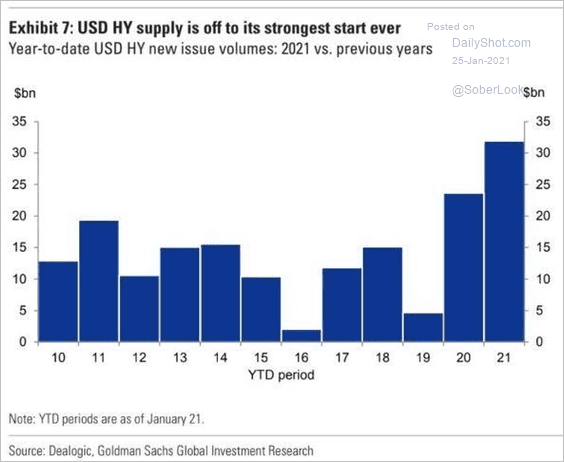

Bearish for High Yield?

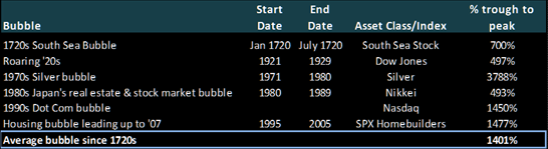

Bubbles

The 5 major financial bubbles since the 18th century have seen their relevant asset class rise by an average of 1400% before the crash. So, do not worry, if your particular position is not up 1400% yet you are fine, nothing bad will happen - just keep on buying.

Citi:

CITI strategist sees a bubble, (perhaps) but argues it can get much bigger. It is a new chapter in the “bubble bubble but absolutely no trouble” book that the market currently is writing. CITI: “Global equities are looking increasingly frothy, but current performance and valuations still lag previous mega-bubbles. The NASDAQ now trades on a CAPE of 58x compared to 113x in 2000, and Japan’s 83x in 1990. Investors worried about excess valuation should look outside US equities. And there is no bubble versus bonds. Past equity bubbles hit much higher valuations than now, but with bonds at 5-6% not 0-1%. Bonds were an obvious alternative once those bubbles burst. They are not now. And bubbles don’t burst easily. Perhaps equities are currently vulnerable to any hints of higher rates or QE tapering from central banks. But history suggests that bubbles can inflate even as rates start to rise. They are much more robust than we all think…”

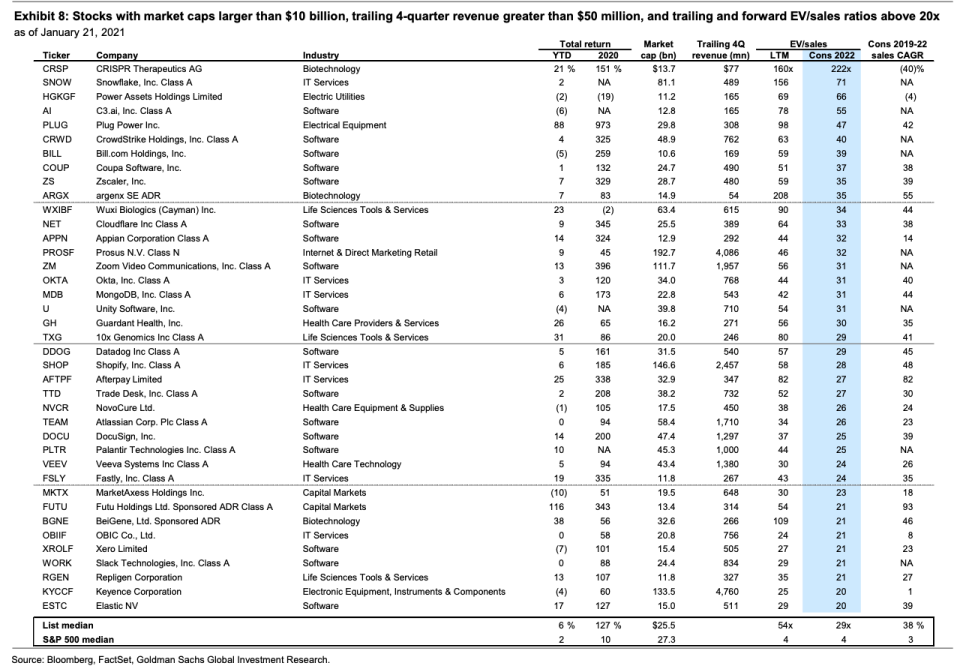

Even Goldman thinks that things have got bubbly:

The above is a list of stocks trading at EV/Revenues > 20. Earnings? Busineses don’t need to earn a profit. This is the 21st Century FFS.

European cheap labour in the UK

This article by Sarah O’Connor explains why it’s perfectly rational for UK workers to choose not to do the work that is normally done by seasonal migrant fruit and veg. pickers who have previously come to the UK. It’s not so difficult to understand:

- the minimum wage means that you have to pick damn fast to be worth employing,

- if you are Bulgarian, you can spend half your year in a very cheap place,

- you have to work long hours and weekends, but have six months off: this just doesn’t suit locals,

- you may have to move from farm to farm, living in very basic (but free) accommodation on the farm,

- the economics of food production in the UK, plus the political allergy to having rapidly increasing food prices mean that this is just always going to be a tough gig, compared to being an estate agent.

I saved this outside the paywall here. It will disappear in a month or so. Sorry, FT.

Fame at last!

The Sounding Line gave me a shout-out here. Taps Coogan is always worth reading. And it’s free (donation encouraged). I strongly suggest you check it out.

Wrap

Basically, fairly risk neutral. Core Eurozone yields crammed down, US & UK pretty flat, EM going up. Everything else unremarkable.

$GME up 92%. Insane.

Comments !