6 Sept 2021

Better living through electric cars

The USA, like Europe, is determined to replace ICE cars with BEVs (battery electric vehicles). Consumers are waking up to the limitations of these cars, which results in sales being weaker than forecast. The result, inevitably, will be bigger subsidies, especially since union jobs are at stake. That’s why Biden’s presser excluded Tesla, a non-union shop, but included representatives from much smaller EV makers which do run union shops. Biden may be gaga, but he knows which side his bread is buttered on: as the article says “You dance with them that brung you!”

Repo madness part 2

We all know that the Fed has been creating a lot of money. This article tries to set the scale of the money creation into some sort of contex. It takes a pessimistic view, but my take is that as the dollar is a reserve currency, this train is not stopping any time soon.

An important anniversary, only a few weeks late

The US wakes up to the expense of the Afghan war

# The US Could Have Paid Every Single Afghani the Average Wage for 150 Years and Saved Money. Yep, you read this right. I don’t even know if the calculation is accurate, you just know that US spending dwarfed any conceivable output of the Afghan economy, including lucrative opium growing. Well, even for heroin, must of the value is added by the supply chain, not the grower.

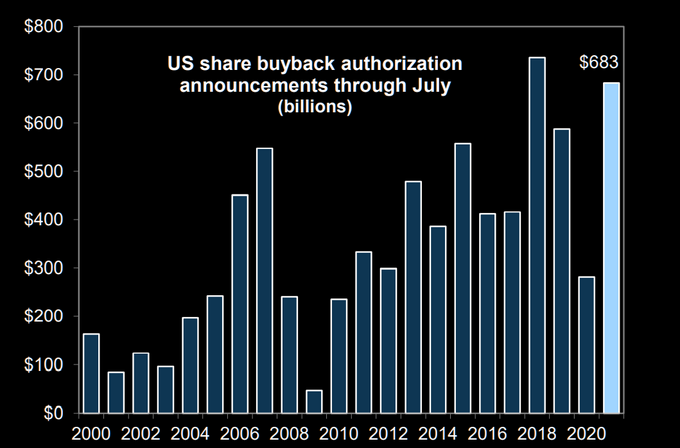

Maintaining the bid

Buybacks now account for around two thirds the cashflow return to shareholders for shares in the SPX. This is more than I remembered. Some detail is provided here [warning: pdf download] by Yardeni Research. This is pretty extraordinary, as until 1982 buybacks were prohibited by US company law as being a form of stock price manipulation. I’m afraid to say that all the evidence is that they are indeed a stock price manipulation. By bidding for stock whenever the price falls, US equities have achieved far higher P/E ratios than stocks in markets where this practice is illegal. The negative real interest rates on corporate debt in the last ten years has turbocharged this practice.

Well, a tsunami of buybacks are coming, so in case you were thinking of shorting anything, beware!

Well, a tsunami of buybacks are coming, so in case you were thinking of shorting anything, beware!

Just in case it needs to be said, nobody is doing buybacks for commodities.

Buy stocks in suppliers to the EV industry

This article points out that auto manufacturers are pouring an insane amount of money into factories to buy electric vehicles. Many commentators have expressed scepticism that there will be enough buyers. But one thing is certain: the factories being built will be equipped with robots and paintshops, and even if nobody buys the cars, the firms that build robots and paintshops will be paid. Interesting plays might include $ROK.N (Rockwell Automation), $DUEG.DE (Durr AG), 000333.SZ (Midea, which owns a chunk of Kuka), KU2G.DE (Kuka AG), 6954.T (Fanuc) and MG.TO (Magna, parts rather than factories). If you have some inside knowledge of this industry, HMU.

Fed rates are too low, according to the Taylor Rule

Via The Felder Report.

Computing the cost of Wars

It’s not as easy as it should be.

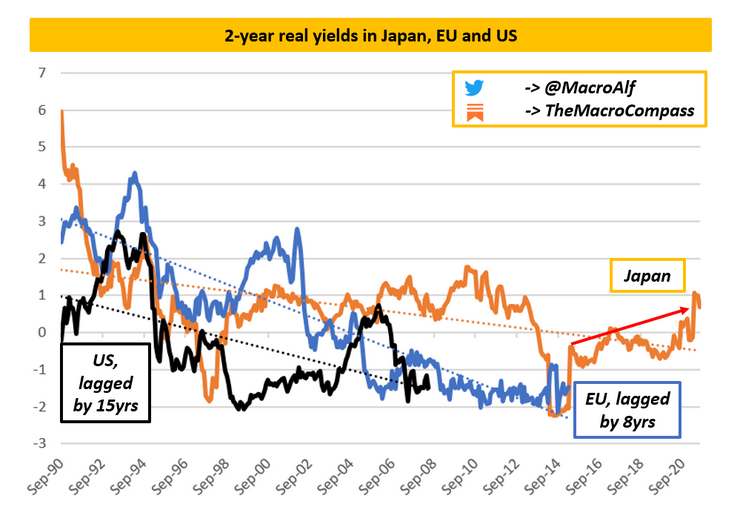

Is Japan that different?

A brilliant post by Macro Alf says “it may be.” Japan has never managed to get real private sector rates down as far as it needed to restart the private sector levering up, as it did in the early 90’s. All the QE and Fiscal policies have failed to get the private sector borrowing and consuming. This is a very fine overview. As it says at the end, the big unknown is CBDC. I await their arrival with bated breath.

Macro Alf is one of my favourite commentators. His substack is free, but it would be worth paying for if it were not.

Do Audits matter?

Probably not. Auditors always claim that they are not employed to detect fraud. It’s a bit unclear what they are there for, but the law requires audits to be done, and so they are done. The incentives for auditors to probe deeply are totally absent so, surprise surprise, they don’t. But they (or other group companies) can get lots of lucrative advisory fees, as long as they don’t rock the boat.

The war in Afghanistan was run by clones of the Pointy Haired Manager

In War Machine, McMahan comes to Afghanistan with a spirited can do attitude and a frat house of hard-partying yes-men, after having ‘kicked Al Qaeda in the sack’ running special operations in Iraq. He is obsessed with inspirational speeches and weird bureaucratic box-ticking, under the amorphous concept of leadership. This kind of leadership, though, isn’t actually working with wisdom and foresight, but is more like management consulting. Prior to arriving in Afghanistan, for instance, McMahan created a system, with the acronym SNORPP to coordinate military assets. At night, he cozies down to read books on management excellence, the kind that Harvard Business Review publishes as sort of Chicken Soup for the Executive’s Soul. He is also the author of a fictional book with the amazing title, “One Leg At a Time: Just Like Everybody Else.”

Wrap

US markets were largely closed today (Labor Day). Futures did seem to be open, but there can’t have been much volume. German factory orders increased by 3.4%, MoM, which gave a boost to EU equities. Aluminium and lumber futures were strong, oil was weak, uranium continues its upward trajectory. $U.UN:TSE (Sprott Physical U Trust) was up 5.44% last week, and is likely to rise tomorrow. Evergrande bonds were suspended on one of the China exchanges.

There was an interesting article in the FT over the weekend about Zhang Beili, former wife of Wen Jiabao, former PM of China. It’s all written up in a book called Red Roulette but the TL;DR version seems to be that the PRC is a kleptocracy, just like all the other notionally communist countries. If you are a follower of Bruce Bueno de Mesquita, this will not come as a surprise.

Comments !