Crumbs

Lacy Hunt: still bullish after all these years

Lacey Hunt has produced a new quarterly report for Hoisington. Basically, he’s saying that there is loads of spare capacity, and the fiscal multiplier has actually turned negative (i.e. govts. deficit spending actively drains demand out of the economy). You can download it here directly from the Hoisington site. According to Hunt, fiscal spending fails to boost demand when:

- it is spent on services (or ‘benefits/entitlements’),

- it’s in a country with a flexible exchange rate,

- in a country with an open economy,

- in a country which already has a large govt. debt.

As he says, virtually all modern economies are highly indebted, and most meet the other criteria. Certainly, history shows that it’s a lot harder to spark inflation than many had assumed, but the idea that yields on USTs will simply continue to fall indefinitely seems hard to countenance too.

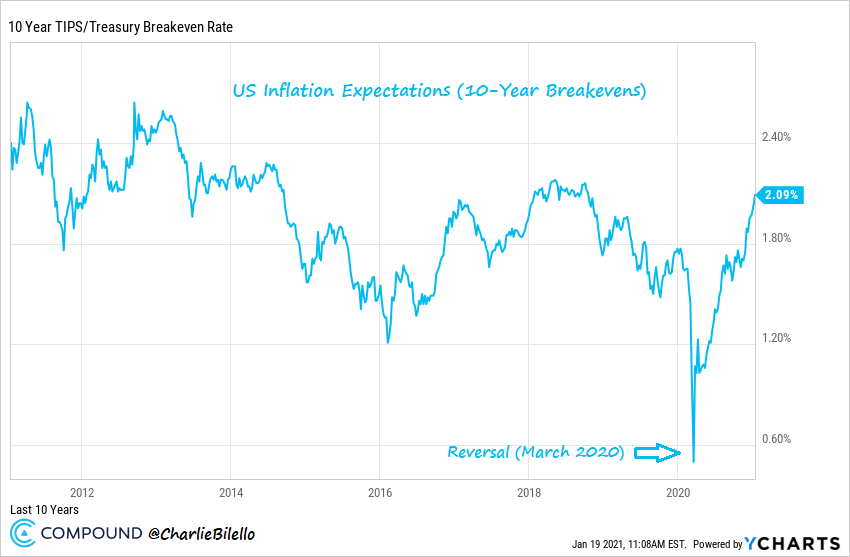

Charlie Bilello replies

Charlie’s latest post argues that the long straight road we’ve been travelling on over several decades is starting to change direction. Specifically in the following areas:

- Large Caps over Small Caps.

- US over International.

- Growth over Value.

- Tech over Everything.

- Long Duration over Short Duration (Yields Falling, Curve Flattening).

- Stocks over Commodities.

These trends have been very strong and very enduring, but the set of charts he has produced make a compelling case.

I’ll steal one, so you have to follow the link above to see the rest:

I know I never stop writing about inflation, but I’m not the only one fascinated to see what happens to it.

My own preference is for theory over practice (a crippling weakness, I know), but for this argument, I am inclined to look at the charts and conclude that something has changed. In the 70’s, nobody really seems to know, even now, what lead to the inflation surge. Maybe it was oil, maybe it was the end of financial repression. Who knows? But it’s not as though inflation is dead: just ask the Venezuelans.

Short ideas

These are mainly from the Bear Cave:

-

NDQ:EOSE — Eos Energy Enterprises: battery co. with no revenue,

-

ASX:TYR — Tyro payments: failed software upgrade that put half of the merchant terminals out of action, (very old tech).

-

NYSE:LMND — app-based insurance co.: insiders selling,

-

NASDAQ:CLSK — CleanSpark. Energy software co., insiders draining liquidity,

-

NASDAQ:KIDS — pediatric orthopedatrics co. Fraud? Culper.

-

NASDAQ:DOYU — fraud,

Actually, I think these are all from the same source, but I noted them in a separate file and I’m too lazy to go back and verify this now.

In the current fevered bull market, it’d be crazy to short the most egregious Ponzi scheme, but at some point the market will run out of steam, so it’s as well to be prepared.

There is an outlier: NYSE:STPK — clean energy storage systems. This is a LONG idea from Citron!

Wrap

Basically, a risk-on/low-inflation expectations day:

- nearly all commods up except precious metals,

- all US equity sectors up, especially comms and tech,

- credit and treasury yields up a little,

- Fixed income fairly flat, except converts and high yield, which are up (in price).

- global equity markets up (except Spain & Portugal),

- EUR is down against everything. USD down against almost everything (except EUR!),

News:

- Biden inaugurated,

- Harris sworn in,

- Amazon offers to deliver vaccines,

- Covid crisis declared over (by MSM),

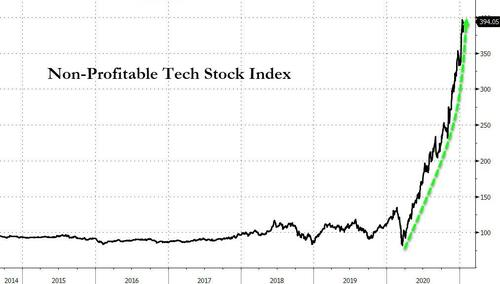

Chart of the day

to really catch a wave, invest in chronically loss-making companies!

Comments !