Tuesday 28, June 2022

Inflation and commodities

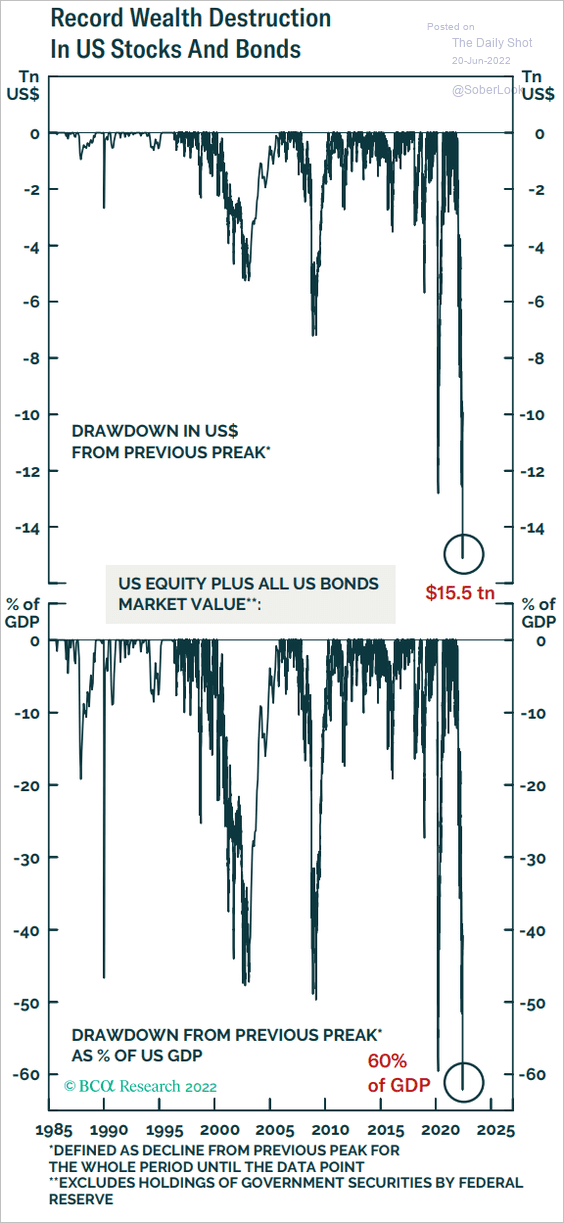

Kuppy talks about ‘Project Zimbabwe,’ by which he means the incontinent money printing of central banks in response to the pandemic, wobbles in the polls, the market getting twitchy … well, more or less anything that might make politicians look bad. The logical response …

read moreThere are comments.