13 Sept

House prices

House prices continue to soar in the US. Maybe this will reverse, maybe it won’t. The question is: what catalyst will prompt the Fed to tighten monetary policy? What constituency is ever going to clamour for a move that is very likely to spook stocks and “derail the recovery”? More importantly, what politician is going to benefit from the government having less money to spend on pork barrel projects, because suddenly the US Treasury is having to pay a lot more to Chinese holders of US T-Bills?

Interesting podcasts

I enjoyed The Market Huddle this week. Lyn Alden was on. Her monthly newsletter is worth a read. The August edition is now out. It’s free, and she is not talking her own book (much). I found her discussion of what she calls the petrodollar system interesting. It was reminiscent of stuff by Jeff Snider. It argued that the deal that was done between the US and Saudi Arabia enabled the USA to run up its current account deficit to mind boggling levels, confident that the reserve currency status of the dollar would be undamaged.

I am not alone in believing that the next crisis will start in the currency market, probably a loss of confidence in the dollar. At some point, the US will have to row back from its position that the dollar is its currency, but our problem. Where ‘our’ refers to the rest of the world. I have never totally bought the idea that the world is suffering from a severe shortage of “safe assets” by which the promoters of this idea mean US Treasuries. USTs are only a safe asset as long as the unit they are denominated in is stable with respect to other currencies. Eventually, European countries will start paying a positive real rate of interest on their debt, which could be awkward for Washington.

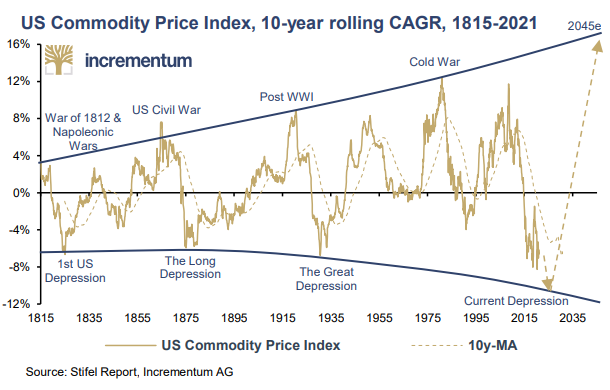

Lyn is bullish on commodities, especially oil.

Is Coinbase a bank?

I’ve used exchanges like Coinbase to buy crypto currencies. It never occurred to me to leave the currency with the exchange. My understanding was that you are supposed to get your own wallet, ideally disconnected from the Internet where you can store your coins. (Really, this is a matter of storing your private keys.) Most people, I’m guessing, don’t use coinbase like this: they leave their purchased “crypto” with Coinbase. Which it can use for other purposes. Just like a bank can lend transfer funds deposited by customer A to customer B. This is the essence of banking, but it obviously creates a situation in which customer A may not get his money back. The problem is fixed by the government indemnifying customer A against loss. Which is great for banks as it allows them to borrow at no cost. (Remember, deposits are loans to the bank.) But there is a cost: extensive regulation and restrictions on what sort of lending to customer B can take place.

Coinbase works like this, as far as I can tell, except the government does not get involved. So customer A is exposed. But customer A is either oblivious to the risk (probably) or has done a careful analysis of the creditworthiness of Coinbase and has concluded that there is an acceptable risk of default (highly unlikely).

Francine McKenna has written a long piece about this in The Dig. My take on all this is that Coinbase and co are going to end up being regulated out of existence (or forced into the arms of JPM or similar). We will see.

Rates are going lower, surely!

The Fed will never let markets drop again!

This is a great commentary by John P. Hussman. It points out the irrationality of investors now. Not the irrationality of thinking that liquidity produced by the Fed will always be at the ready to extinguish wildfires of assets going down in price. No, the irrationality of thinking that the Fed itself has the power to support markets, when we know it has failed so many times in the past. Read the article for examples, but one that caught my attention was the failure of The Maestro to reverse the 2000 dot com bust.

Mid October will see the Treasury hit its debt ceiling. Read more. I’ve seen a few commentators suggesting that this could be the catalyst to finally end the extraordinary bull run of the SPX and NDX. I’ll believe it when I see it, but I did buy a couple of OTM puts, just in case.

Wrap

The NY Fed survey of consumer expectations showed that expectations of fairly steep inflation were becoming embedded. The chart on this page shows that consumers expect more or less everything to have a rate of price increase between seven and ten percent. The exception, oddly, is gold, which is expected to respond only to the tune of 5%. Bonds barely budged. FX was pretty quiet too. Commodities were not strongly affected, although natural gas went up by 5% (in a day!). The hydrocarbon complex was dragged higher. I suspect that gasoline will be the next to pick up the trend. I guess the marginal buyer is still the Fed. But at some point, it will not be.

Stocks were not strongly affected, either way. Mild inflation is pretty good for stocks, as long as labour costs are kept under control.

Image of the day

Comments !