Crumbs

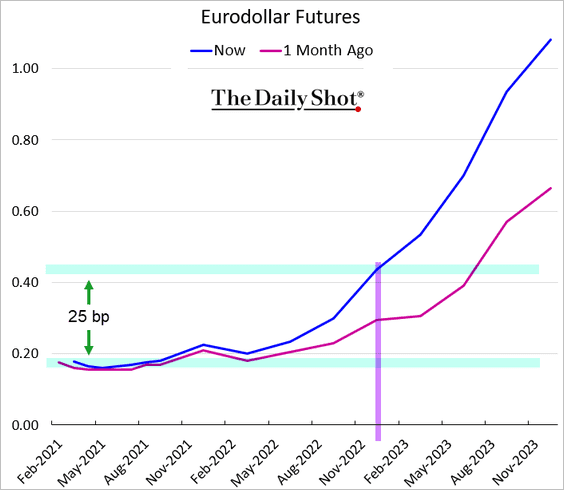

Eurodollar futures sound deadly dull and boring. Their implied vols (~0.8%) back that up. But they are starting to move, and when a Panamax sized ship of this size starts moving, it’s damn hard to stop!

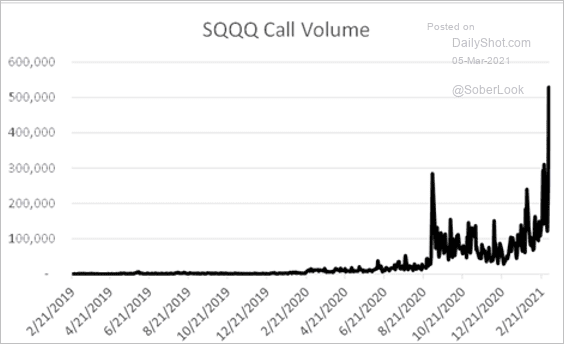

It’s easy for retail traders to short the Nasdaq. These levered short products have terrible rebalancing risk, and really are not suitable for taking a long term view, but for a short term punt they are tailor-made for the RobinHood crowd.

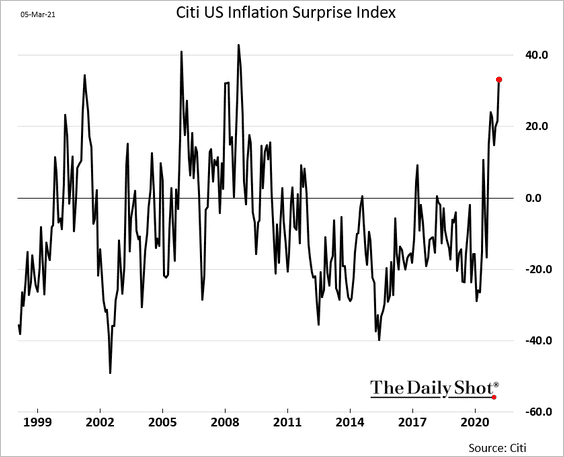

The sheer number of articles and charts pointing out the rise in inflation is enough to convince ordinary workers that it is coming, which in turn might be enough to support industrial action to increase their wages. In the UK, although health care workers were exempted from the pay freeze imposed on the rest of the public sector, they are planning to strike over the current 1% pay offer. I think they are well paid by the standards of most workers in the private sector, but I strongly support their strike action, because escalating wages in the public sector will eventually push up wages in the private sector. This is ‘trickle down economics’ that really works.

Bitcoin

Is Bitcoin a Giffen Good? Long thought piece from “strat star” Inigo at Bernstein:

“The recent rapid price increase of bitcoin begs the question: does scale beget acceptance and make bitcoin behave like a Giffen good where demand and price are positively correlated? We think that bitcoin fails the technical test for a Giffen good in that any positive link between price and demand does not derive from an income effect. What could drive a positive link, however, is the fact that as it grows in scale then other assets become less good substitutes. The main source of demand for bitcoin as a potential store of value in institutional portfolios is the belief that we are in a new policy world where debasement risk is real. An increase in the market cap of bitcoin removes barriers and gives it the aura of apparently being a more “mature” asset and also, crucially, implies implicit acceptance from lawmakers despite concerns, for example about its role in money laundering. However, there are two aspects that threaten a negative link between scale and demand. The first is bitcoin’s status as arguably the most anti-ESG assets imaginable (alongside SPACs perhaps). Increased scale would worsen the power-consumption problem for questionable social utility. The other potential risk is if bitcoin was a risk to the implementation of monetary policy. This is a distant prospect at present but is a non-linear function of its scale. It seems ludicrous to talk about an investment product as having a positive relationship between demand and price (aren’t we meant to buy low and sell high?) However, in the near-term to the extent that scale implies more acceptance, then such a link could be possible. We think that a fundamental valuation of bitcoin is impossible and reject claims for such a narrative, e.g. by assuming a given pool of investors allocate a certain proportion of capital to it. However, comparing it to such asset pools can be instructive for scaling. The value of bitcoin is approaching half the value of gold held for investment purposes. Maybe this is not a basis for argument but as it approaches the same size as gold thesis creep will occur. We are not ready to claim that an asset that has been accepted for a couple of years is better than one that has been accepted for 5000 years. We are still at an early stage in the institutional adoption of crypto in asset allocation. We think its use can grow but it does warrant a discussion of the link between price and demand for this asset” |

The UK Budget

The Chancellor promised to balance the budget, but kept a lot of pandemic support going. He provided accelerated capital allowances, which should help deploy some of the recent excess saving into productive assets. He pumped up the UK housing market again (it’s a tradition that every budget speech must have some sort of bung for the UK housebuilders). The threatened increases in rates of capital gains tax were missing. He froze tax free allowances: it seems a reasonable assumption that his economists predicted a general increase in wage levels sufficient to make this worth doing, which is nice. He put off the fuel duty escalator again (this is a very long standing tradition in budget speeches, going back probably to the time of William Gladstone).

Overall, it probably could have been worse. Inflation is pretty muted, there has to be a massive output gap, even in our inflation-prone economy. We shall see how things pan out, but gilts barely moved, which suggests that hedge funds are not too worried.

Amazon store in Ealing

I can’t say I’m motivated to visit Ealing just to get the Amazon experience.

The emperor has no clothes

Jesse Felder speaks truth unto wealth. Nobody listens, apart from those who already agree with him.

Alex Manzara on Fed Mistakes

He has this to say about what is happening in the fixed income market currently. It’s worth reading, as the weekend post always has a bit more to digest than the weekday ones. My attempt at a summary:

- The Fed is like an elephant: it never forgets its mistakes or repeats them,

- it always learns the wrong lesson of the past,

- it’s counting on a spike of inflation soon as transitory, but in his view it is not,

- Eurodollar options are getting pricier, indicating that the market is demanding more downside protection,

- shorting Treasuries is not for the fainthearted, because the Fed has many ways of screwing up your trade,

- the SLR exemption (some relaxation of liquidity rules for banks introduced about about a year ago to support the Treasury market) will expire at the end of this month, but he expects that some equivalent regulation will be put in place to offset its impact and support prices,

- supply issues in commodities will feed into inflation as well as demand boosted by the various fiscal measures.

Overall, then, like about a hundred commentators this weekend, AM expects yields to rise. Unlike them, he’s much more awake to the possibility that the obvious trades to take advantage of this may end up losing money.

Comments !