Tuesday 4, April 2023

Same observations, different conclusions

Inflation is an obsession with most economists, which is weird, because most of economics deliberately tries to ignore it and focus on real variables. For most ordinary mortals, money is what they spend their valuable time trying to earn. For economists, money is simply a means to an end, a measure of the ability to consume, which is, after all, ‘the sole purpose of economic activity’ as Keynes said.

GDP is carefully measured in real terms. Economists are concerned about real production (steel girders) and real consumption (hamburgers), and want to eliminate the effect of a rather unstable unit of account. The problem is that inflation redistributes real resources. When a worker saves money all his working life, he wants to consume an amount of future production which is equivalent to the real resources he has forgone consuming during the time he was more productive. Any phenomenon that redistributes wealth (the ability to consume in the future) is fair game for politicians to argue over.

Rudy Havenstein

The real Rudy H (aka Rudolf E. A. Havenstein) was the president of the Reichsbank during the hyperinflationary period between 1920 and 1923. But his re-incarnation as a substack pundit (https://substack.com/profile/22041356-rudy-havenstein) is who I am really thinking about. He is incandescent that the Fed has generated a vast pool of money (reserves at the Fed, amounting to around $9T, or getting on for half of US GDP) which has created inflation which has impoverished ordinary workers in the USA and which, in terms of the basket of goods that they consume, been much higher than the 2% rate that is their supposed target. Rudy is a ranter, and extremely angry about the Fed, and its apologists, but manages to remain readable and rational. He ire is mainly aimed at the bankers, such as Jamie Dimon, who have benefited so enormously from the Fed’s policies.

L. Randall Wray

Randy Wray is a thoughtful proponent of Modern Monetary Theory (MMT). I don’t know where his position is on the wide spectrum of economic thought. He is influenced by Chartalism, a sort of precursor of MMT. There is a general acceptance of the idea that one way or another inflation comes about because demand outstrips supply. For a commodity, such as oil, it’s clear that if OPEC restrict supply, and the rest of the world does not do something to damp down demand, the price of oil will go up. When the world comes out of an enforced shutdown resulting from a pandemic, activity can go up for quite a long time before factories run out of capacity and start raising prices, rather than raising production. Wray argues that the government can create money out of nowhere, and raise spending on important public works until we get to a point where inflation starts to bite, whereupon the government can cut it off by taxing producers to bring demand back into equilibrium with supply.

Summarizing MMT in a paragraph is a challenge, and there are a lot of subtle implications of MMT that I have failed to mention, but the above is my understanding of how it works. Of course, it relies on the government doing the right thing, and increasing taxes is never popular, so those who argue that MMT will inevitably lead to runaway inflation might well be right, but I think that the basic theory is not as bonkers as most mainstream economists portray it to be.

Treasury Orthodoxy

I am not at all sure if the Treasury really does believe in balanced budgets. At the very least, I imagine that it would feel very comfortable with a budget deficit, as a percentage, around the same level as the potential growth rate of the economy (so the debt would be stable as a percent of GDP).

For a long time, central banks and western treasuries were mostly concerned about getting inflation higher (this is Rudy’s bête noir). I suspect that they think that they believe that as long as governments have a credible plan for repaying, in real terms, debts they have run up, currencies will remain strong and inflation will remain subdued.

The Truss/Kwarteng ‘mini-budget’ of last autumn was a sort of aberration from this, justified as an assault on a sort of straw man caricature of 1920’s treasury orthodoxy.

Far be it from me to speak on behalf of the Treasury. Liz Truss and Kwasi Kwateng talked about how the Treasury was ‘holding back’ the economy by promoting austerity. My suspicion is that this is totally wrong, although it is certainly the case that chancellors like George Osborne had a fetish for reducing the gap between spending and tax revenues, which, surely, had a baleful effect on the growth rate of the economy. In a way, Kwateng’s ‘mini-budget’ was an endorsement of MMT. Like Dick Cheney, Kwateng believed that “Deficits don’t matter.” What’s odd is that MMT, in a disguised form, such as Corbyn’s ‘Green New Deal’ (https://theecologist.org/2019/may/31/corbyn-and-radical-green-new-deal) was considered by Starmer so radical and quasi-Marxist that he dumped it immediately. Rachel Reeves could be Gordon Brown in drag, and is just as orthodox.

Bill Gross

Bill is possibly the most successful bond investor of all time. He has ridden the long wave of collapsing interest rates that is attributed to Paul Volcker for forty years. I have a sneaky suspicion that he was just better at juicing his returns by selling volatility than any of his peers, but he’s clearly a smart guy. But he’s wrong! Years ago he described gilts as ‘sitting on a bed of nitroglycerine’. Well, they still haven’t blown up. Well, maybe for a few days when we had a maniac for a chancellor, but not really. Can that go on forever? Probably not. If something cannot go on forever, will it stop. Yes it will!

Lacy Hunt

Lacy Hunt an economist who has consistently forecast falling inflation, since the 1980’s, and has been consistently right. Nobody quite understands his reasoning, but they admire his consistency and his unassuming charm. (As I understand it, his main argument is that interest rates, in a world where saving and investment are in balance, have to equal the marginal utility of capital; as the population gets older and no more low-hanging fruit remains to be picked, from the tree of innovation, this marginal utility declines. The net result is a slowing down of the economy and a falling inflation rate. I have not done his arguments justice. This quote from Barron’s may help:

According to Hunt, over indebted economies have certain telltale characteristics. Jumps in economic growth, inflation, and high-grade bond yields prove short-lived because debt constrains economic activity. Difficulties in making debt payments, in turn, push economies into frequent downturns and hurt productivity. Monetary policy loses effectiveness as the debt overhang stunts expansion of the money supply, slows monetary velocity, and quenches the animal spirits of producers and confidence of consumers.

https://www.barrons.com/articles/no-inflation-in-sight-say-two-bond-masters-1455944528

Jeff Snider

Jeff Snider is, in terms of his embracing of the web, podcasts, his public profile, the opposite of Lacy Hunt. He also concludes that inflation (and the Fed) is a paper tiger. I am reluctant to even try to summarize his argument, but my attempt goes like this:

-

most dollars in the world are created outside the control of the USA, and are just ledger entries on banks and shadow banks reflecting contracts denominated in USD but not involving US banks other than in a residual clearing function.

-

the Efficient Market Hypothesis works, and the very subdued long-term yields on US Treasuries give us confidence that any spikes in inflation will be short-lived. Jeff is a good guy, but he is in danger of over-selling his theory. Rates have gone up since the pandemic, and are not guaranteed to go back down to two and a bit percent again in the short term. Many commentators argue that the 2% Fed inflation target was arbitrary and would benefit from being updated to 3 or 4%.

Snider could simply say “Markets have changed their mind, and are now forecasting moderate inflation,” but he somehow doesn’t. I guess this is a tough thing for a bond analyst to say. Putting out research reports saying “sell everything” doesn’t work too well.

Milton Friedman

This week, Nigel Lawson died. He was an adherent of Monetarism, which argued that inflation was, as Friedman said “Always and everywhere a monetary phenomenon.” Friedman came up with this crackpot idea after working on statistics for the US money supply over many decades. Even though Monetarism isn’t taken seriously as an alternative to Keynesianism (as subsequently updated), it does seem to be the basis of the idea that governments can leave the control of inflation to central banks.

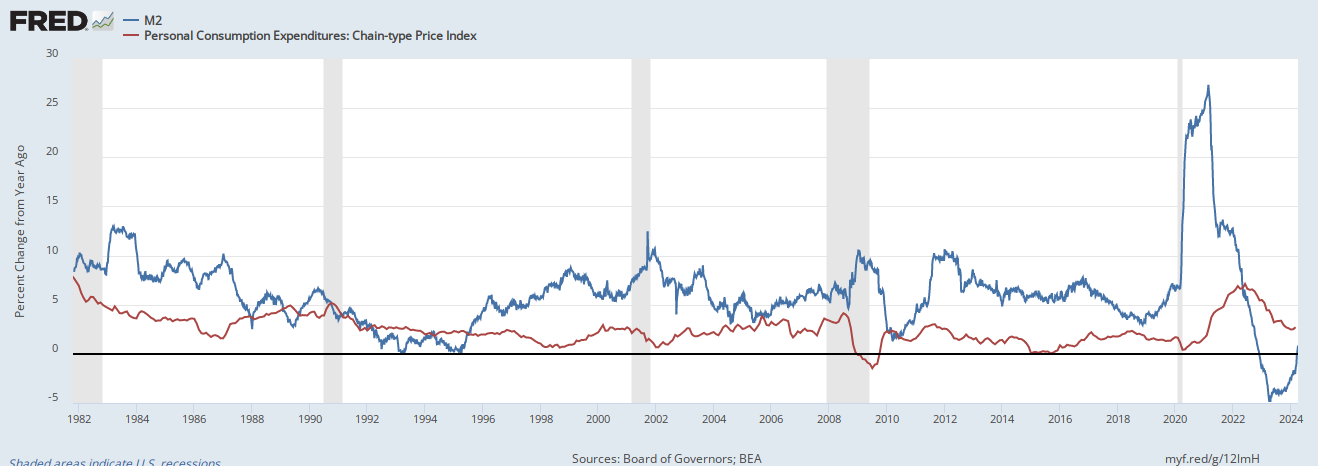

I am a huge admirer of Milton Friedman, but I have reluctantly come to the conclusion that he promoted this theory to overshadow his exact contemporary, Paul Samuelson, the arch Keynesian. The following is a chart of M2 vs PCE inflation (the Fed’s preferred measure). Even with the famous ‘long and variable lags’ fudge factor, the money supply growth simply does not correlate with inflation.

.

.

Kuppy

Harris Kupperman invented what he called “Project Zimbabwe”

Conclusion

What will happen to inflation? I have no idea, but I know that the experts above will not change their predictions, or theories, whatever happens. Maybe we should just accept that it is too complex to predict.

Comments !