Friday 29, April 2022

Is Bill Hwang a dope?

Bill Hwang has been arrested. He managed to leverage up positions in half a dozen big US stocks to around $35bn gross exposure. That’s a lot. He ended up owning well over half of ViacomCBS, a big US broadcaster, with something approaching 700mn subscribers in the recent past, according to Wikipedia. Anyway, he got very rich on paper, by buying a lot of stock and watching the price go up, and then got very poor, as the stock price collapsed. As Matt Levine points out, it’s not obvious why this was criminal. He is accused of ‘using Archegos as an “instrument of market manipulation and fraud” with “far-reaching consequences for other participants in the United States securities markets”,’ but given that he ended up poorer, and no investors were harmed in the exercise of his unsuccessful trading, it’s not obvious that he had any criminal intent.

He was a bad trader, and lost a lot of money, for himself and for the banks that lent him money, but it’s not a crime to borrow money from a bank and fail to pay it back. To lie to the bank about what the money is for might be, but from what I can tell, he didn’t do this. He borrowed from a lot of banks to invest in the same stocks. Each bank knew how much stock he was buying using its money. He just failed to mention that he was running the same sort of trading using loans from other banks. The cumulative effect was to give him huge holdings in some stocks, but these were not enough to make the prices go up forever. If they had been, Archegos would have remained as unknown as it was before it went bankrupt and Bill Hwang would be a very wealthy guy.

Matt Levine’s point is that Hwang is not a ‘dope’ and that if he wanted to execute a fraud, he had plenty of opportunity to collect a lot of the money from these loans, move it offshore, and retire to the sunset in somewhere like Grand Cayman or Lebanon. One of what Somerset Maughan called “sunny places for shady people.”

Well, it’s interesting, but I feel that it’s not remotely the scale of fraud that fElon M*sk engages in on an almost weekly basis. I’d better be careful what I say, because I understand that this guy is known to be highly litigious, while I am highly indigent.

Tight or loose?

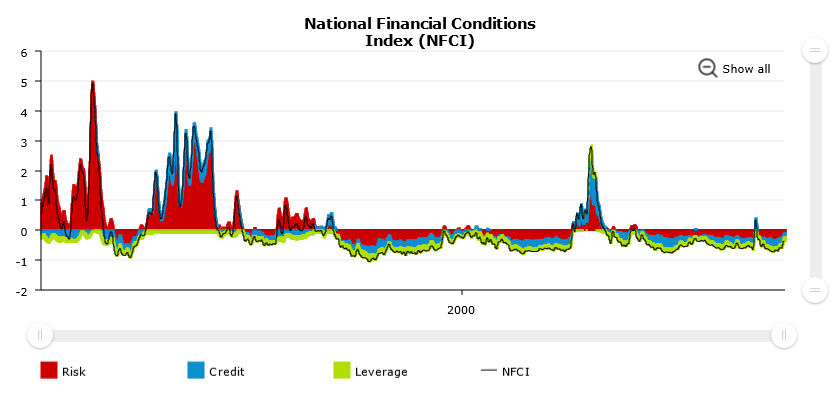

The Chicago Fed has an indicator of financial conditions. It goes back a long time. It shows that conditions now are extremely loose compared to the early 1980’s. J Powell is no Paul Volker.

The Principal Agent problem

Roger Lowenstein points out that senior management in Goldman Sachs are corrupt. I don’t think he uses the word. He just points out that they have structured a compensation scheme that enriches senior management for deploying shareholders’ capital. It just points out that when a firm ceases to be owned by its principals, it’s almost impossible to design an agency agreement which is capable of standing up to the incentives facing the agents who now have the principal’s money.

I don’t think that GS is particularly reprehensible, it’s just more obvious because the firm was until relatively recently a real partnership.

Lowenstein is a great author. I think that Substack is a new venture for him. I wish him well. Disclaimer: I met his uncle, many years ago.

Wrap

Equity markets plunged at the end of the week. The NDX was down nearly 4.5%. The market is very volatile, though, and actually the close was no lower than the low of the 26th, mid week. Commodities were all over the place: WTI crude was down 1.2%, Brent was up 1.7%. Bonds were still behaving as though we are in a risk-off regime: the 10Y Treasury yield was up 10bp to 2.92%.

Will this result in a generalized and sustained market crash? Inflation will drive down labour costs, which might increase demand for capital. It seems that volatility is growing all the time, although the VIX, measuring implied volatility, seems still quite moderate.

Image

Maia Flore pic.twitter.com/VvSqnQjHc8

— Daniel Brami (@Daniel_Red_Eire) April 30, 2022

Tweet

😄😄😄 pic.twitter.com/0Rv74FzwK4

— Carlo Kitty Casio (@INArteCarloDoss) April 28, 2022

Comments !