Crazy Cathy’s Ark may have sprung a leak

There is a lot of muttering about how once ARK Innovation’s ETF starts getting redemptions, the illiquid holdings will implode. In some cases, ARK Innovation holds a very high part of the free float. This will test Prof Plum’s thesis that once passive funds start to get redemptions, there will be a vicious spiral of price declines, as there are no active managers left to buy when passive is selling.

The Street has noticed this, and one guy has even gone as far as to track ARK’s holdings. You can get his stuff here, but I extracted the current holdings of the Innovation fund, which you can see below.

| Stock | Ticker | Shares | Value | Stock Price | Weight |

|---|---|---|---|---|---|

| ORGANOVO HOLDINGS INC | ONVO | 129 | 383 | $1.46m | $11.30 |

| SYROS PHARMACEUTICALS INC | SYRS | 4 | 923 | 270 | $45.20m |

| BEAM THERAPEUTICS INC | BEAM | 827 | 516 | $79.84m | $96.48 |

| COMPUGEN LTD | CGEN | 9 | 765 | 352 | $102.63m |

| CERUS CORP | CERS | 18 | 561 | 050 | $125.66m |

| FATE THERAPEUTICS INC | FATE | 1 | 346 | 779 | $128.59m |

| PINTEREST INC- CLASS A | PINS | 1 | 607 | 953 | $135.97m |

| NANOSTRING TECHNOLOGIES INC | NSTG | 1 | 817 | 303 | $136.01m |

| TWITTER INC | TWTR | 1 | 867 | 325 | $136.63m |

| PALANTIR TECHNOLOGIES INC-A | PLTR | 5 | 235 | 739 | $140.06m |

| TERADYNE INC | TER | 1 | 087 | 453 | $141.13m |

| MORGAN STANLEY GOVT INSTL 8035 | 149 | 066 | 762.57 | $149.07m | |

| SNAP INC - A | SNAP | 2 | 303 | 791 | $162.30m |

| SERES THERAPEUTICS INC | MCRB | 7 | 826 | 230 | $164.74m |

| HUYA INC-ADR | HUYA | 6 | 698 | 323 | $190.63m |

| STRATASYS LTD | SSYS | 6 | 509 | 675 | $231.48m |

| SYNOPSYS INC | SNPS | 943 | 182 | $238.82m | $253.21 |

| PACIFIC BIOSCIENCES OF CALIF | PACB | 7 | 066 | 036 | $262.29m |

| PACCAR INC | PCAR | 2 | 825 | 248 | $263.68m |

| NOVARTIS AG-SPONSORED ADR | NVS | 3 | 055 | 354 | $264.29m |

| REGENERON PHARMACEUTICALS | REGN | 583 | 682 | $273.18m | $468.03 |

| MATERIALISE NV-ADR | MTLS | 5 | 615 | 831 | $282.20m |

| VERACYTE INC | VCYT | 4 | 713 | 927 | $289.95m |

| IRIDIUM COMMUNICATIONS INC | IRDM | 7 | 207 | 235 | $292.54m |

| TAIWAN SEMICONDUCTOR-SP ADR | TSM | 2 | 323 | 174 | $299.92m |

| SEA LTD-ADR | SE | 1 | 229 | 659 | $309.64m |

| EDITAS MEDICINE INC | EDIT | 6 | 480 | 400 | $318.45m |

| 10X GENOMICS INC-CLASS A | TXG | 1 | 808 | 669 | $318.49m |

| 2U INC | TWOU | 7 | 843 | 155 | $351.92m |

| PAGERDUTY INC | PD | 7 | 353 | 689 | $352.32m |

| INTERCONTINENTAL EXCHANGE IN | ICE | 3 | 316 | 476 | $369.52m |

| NINTENDO CO LTD-UNSPONS ADR | NTDOY | 4 | 744 | 137 | $376.78m |

| LENDINGTREE INC | TREE UW | 1 | 192 | 018 | $389.03m |

| INTELLIA THERAPEUTICS INC | NTLA | 6 | 286 | 778 | $399.65m |

| TWIST BIOSCIENCE CORP | TWST | 3 | 072 | 492 | $415.68m |

| KE HOLDINGS INC | BEKE | 5 | 943 | 672 | $419.39m |

| IOVANCE BIOTHERAPEUTICS INC | IOVA | 11 | 026 | 310 | $447.67m |

| PROTO LABS INC | PRLB | 3 | 027 | 621 | $462.98m |

| UNITY SOFTWARE INC | U | 4 | 339 | 516 | $479.99m |

| TENCENT HOLDINGS LTD-UNS ADR | TCEHY | 5 | 504 | 147 | $499.39m |

| DOCUSIGN INC | DOCU | 2 | 078 | 734 | $506.38m |

| PURE STORAGE INC - CLASS A | PSTG | 20 | 758 | 747 | $530.80m |

| ZOOM VIDEO COMMUNICATIONS-A | ZM | 1 | 400 | 691 | $543.69m |

| TWILIO INC - A | TWLO | 1 | 369 | 409 | $562.27m |

| EXACT SCIENCES CORP | EXAS | 4 | 192 | 700 | $581.57m |

| PAYPAL HOLDINGS INC | PYPL | 2 | 456 | 482 | $650.97m |

| SHOPIFY INC - CLASS A | SHOP | 533 | 529 | $693.72m | $1 |

| INVITAE CORP | NVTA | 16 | 996 | 887 | $726.11m |

| CRISPR THERAPEUTICS AG | CRSP | 5 | 910 | 692 | $799.72m |

| ZILLOW GROUP INC - C | Z | 5 | 030 | 034 | $849.42m |

| BAIDU INC - SPON ADR | BIDU | 2 | 799 | 423 | $903.12m |

| SPOTIFY TECHNOLOGY SA | SPOT | 2 | 800 | 355 | $941.79m |

| TELADOC HEALTH INC | TDOC | 4 | 958 | 966 | $1 |

| SQUARE INC - A | SQ | 5 | 112 | 423 | $1 |

| ROKU INC | ROKU | 3 | 697 | 575 | $1 |

| TESLA INC | TSLA | 3 | 525 | 023 | $2 |

| # Is the market beginning to turn? |

Alex Manzara thinks so. A lot of the people I follow do. However, I am experienced enough to realize that just because a lot of people predict something, this doesn’t make it more likely to happen. In fact – especially if they are the more thoughtful commentators – it seems less likely. Maybe we’ll see even higher highs as the vaccine is rolled out. But the demographic trends are negative, the scarring is real, and a lot of people have died and those who haven’t will not want to rush out to spend. In fact, they have acquired the savings habit during the lockdown and may well decide that it’s one they will keep up. If this drains demand, we’ll see poor growth (‘the paradox of thrift’) and people will want to save more. Banks have had a happy time lending on credit cards at 30% and borrowing from central banks at zero or negative rates. We may even see a flattening of the curve, and further Japanification. Certainly, negative rates and yield curve control may come in. The fact that most central bankers have vehemently denied that these tools will ever be used is all the more reason for fearing that they will be.

An EV company with profits, and prospects?

I’m deeply sceptical of EV companies in general. Bluebird ($BLBD) might be an exception. You decide.

Crumbs

Tether paid a fine (along with Bitfinex) for fraud. It’s still a very valuable cryptocurrency. “Cryptofraud” might be a better term. https://www.ft.com/content/1d3b5027-ce7e-470f-8d7a-866746f8079d

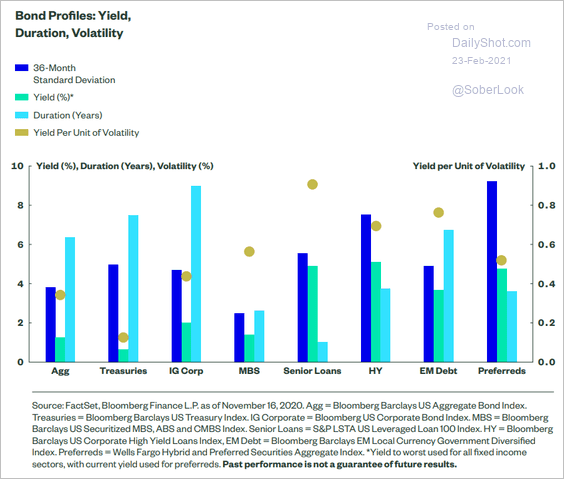

Generally, volatility is just duration. Credit complicates this. Preferreds are really equity. I need to think about this.

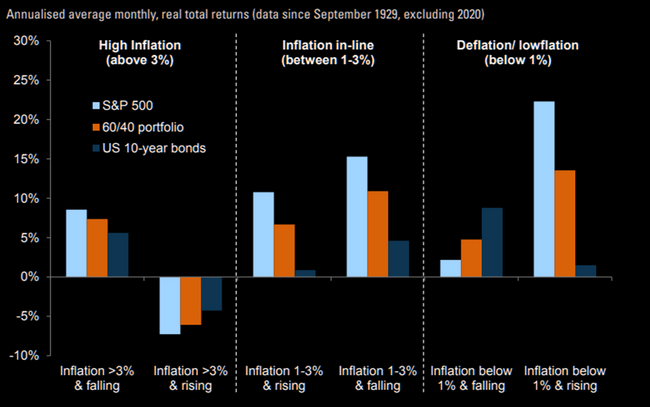

As Warren Buffett observed, a long time ago, once inflation ticks up to a more than a slight nuisance, the cost escalation imposed on capex overwhelms the price pickup on sales.

while inflation has been very low, there is a positive correlation between it & SPX price. This can break down, as per the above.

Stimulus

Lacey Hunt is a legend. His interview on Macro Voices is a classic exposition of what he stands for, which is:

- too much debt destroys growth,

- the fiscal multiplier declines to less than one as debt goes beyond ~80% of GDP,

- Japan shows that you cannot borrow your way out of a recession,

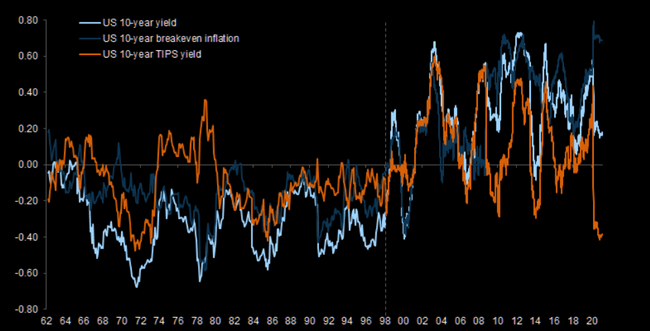

- inflation will not happen as a result of unconventional monetary policy,

- deflation is a much bigger risk than inflation.

There is a huge amount of talk about stimulus recently. El Erian has written about it in the FT. His argument is that the Fed cannot reduce monetary loosening, because this will create too much market instability, but it will create lots of political problems because it will continue to exacerbate inequality. Powell is professionally obliged to deny all this, because to acknowledge the risks is to increase the chance of them being realized. I imagine he cannot wait until he is safely out of the hot seat giving Zoom talks to Citadel for $850,000 a throw and the next Fed chair is in the hot seat. (Which is bound to be a woman, presumably Lael Brainard.)

However, Michael Burry, who is as much of a hero to the autists from Wall Street Bets as Elon is, has written that inflation is coming. You can read more about it here.

Wrap

Today was a short-duration risk-on day.

- most equity markets higher, but Far East markets down, SPX up 1.2%, more than NDX, up 0.8%,

- Apple ($AAPL)really stuck in a down trend,

- DX down to just over 90. If it breaks 90, I think it’ll go down further; ZAR down, as the govt. lurches from crisis to crisis,

- 10-year yields up across the board, apart from a few Far East countries (which might have closed 15 hours ago).

The newsflow was not dramatic. Even though Powell’s testimony yesterday said nothing new, it’s still making headlines. There is simply no new important data.

Opinion

The one thing I have learned from watching markets for a very long time, is that they can not only remain irrational longer than one can remain solvent, but that they can become irrational without any rhyme or reason. We have seen an explosion of value in bitcoin. Nothing about the real economy, the behaviour of central banks or the nature of bitcoin can explain this behaviour. It is purely the result of herd mentality, or – if you prefer – reflexivity, as defined by George Soros. A lot of people read and dismissed The Alchemy of Finance because it seemed to simply say that in securities markets, broadly defined, people would start to buy because they saw the price moving. In other words “if you see a bubble forming, hop on it!” Commentators simply thought that this was an interesting observation, but had no practical application. I think it can have a practical application, but it probably doesn’t fit Warren Buffett’s definition of investing.

Of course, the $64T question is: Which assets are in a reflexive bubble, and when will these bubbles burst? Nobody knows, even though many pretend that they do. Nobody wants to listen to a person explaining why he doesn’t know, which is why not many of you are reading this.

Comments !