31 May 22

Job Shock

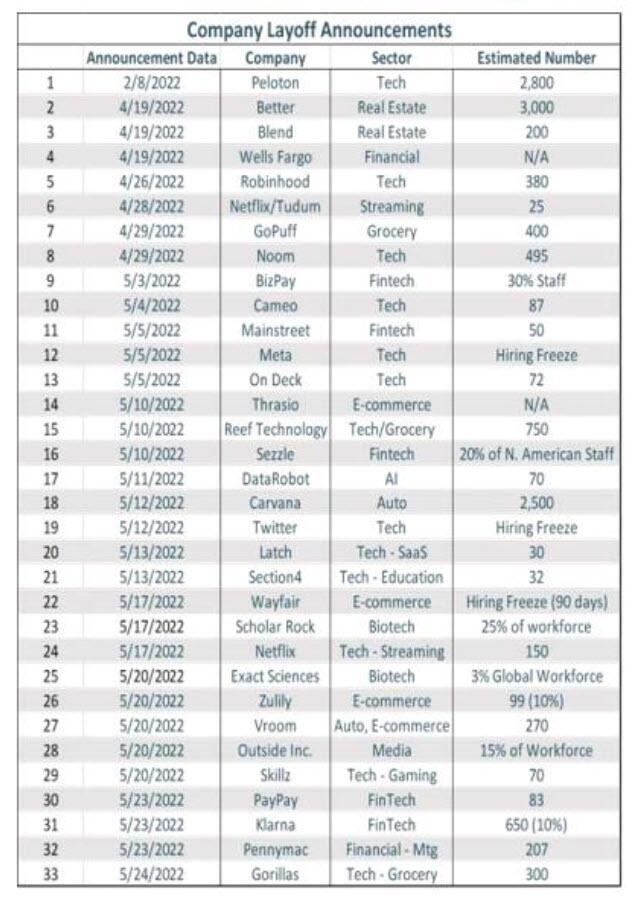

Zerohedge was its usual apocalypic self in this article about weakness in the jobs market. Clearly, a lot of new economy firms always had terrible economics, and now they cannot raise equity capital at zero cost, they are looking to find other ways of increasing their free cash flow. I am not sure that the set is representative of the wider economy, but the large quoted companies in the US are definitely battening down the hatches.

It’s odd that ZH implied that this news was good for the stock market bulls, but I guess if it reverses Fed tightening, it’s going to keep the bull market alive.

Thanks to Chartpoint.com for making me aware of this. Follow Alex Manzara there.

Jay Powell and market transactions

Fed Chair Powell Sold Up To $500K of Securities on Same Day as Bank Stress Test Results.

It’s worth following this to see the sheer scale of Powell’s portfolio. Sinclair Upton said that it was impossible for a man to understand something if his job depended on his not understanding it. I suspect that if you substitute “wealth” for “job” you can understand why Powell is in denial that the Fed has caused any inequality in the USA.

What to do about the inflation surge

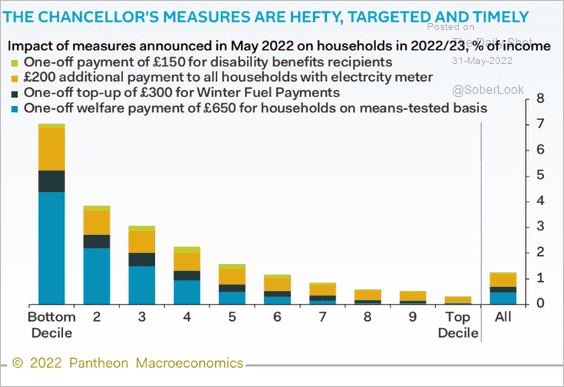

Inflation hits poor people hardest. By definition, they are not in a good position to negotiate higher wages. If they were, they would not be poor. They cannot easily shift their consumption to the future, when relative prices might be lower. They cannot usually substitute lower quality necessities (like food and fuel) for luxury ones.

It’s therefore appropriate that there is some redistribution, to share the pain more evenly. Much to my surprise, the UK govt. seems to have done this:

Increasing interest rates to slow down the economy (‘reduce aggregate demand’) will also have redistributive consequences. In the old days, governments controlled inflation by tweaking the rules around hire purchase agreements, which could be used to drive down the demand for cars.

(For full disclosure, I have a close relative who may have had some input into these measures. I have no idea whether or not he did.)

Inflation and investing

It seems to me that inflation will increase returns to those companies which have pricing power. The most perfect pricing power is oligopoly. I would imagine that a basket of defence contractors, tobacco companies, consumer staples and health care would do well. I’d say oil stocks, but they may be at risk of confiscatory taxes, at least in Europe.

Rudy makes a powerful case that inflation is measured wrong. I think he has a point. I don’t know what impact this mismeasurement has on Eurodollar futures. I wish I did. I suppose that eventually, price increases in ordinary goods will overwhelm any amount of hedonic adjustment. Who knows? Not I!

Wrap

The equity indexes “ran out of steam” today. Other markets were pretty quiet. The 10Y yield is 2.84%. Pretty much unchanged.

Druck on the Fed creating inequality (you need to slide to the 38 min mark and listen from there). Stan is no lefty ideologue!

Image

Julie Blackmon pic.twitter.com/1eHDEHbUWT

— Daniel Brami (@Daniel_Red_Eire) May 31, 2022

Comments !