The day

Bear baiting

The latest Bear Cave letter is out. https://thebearcave.substack.com/p/the-bear-cave-62

I strongly suggest you sign up.

I’ve extracted some of the tips.

NYSE:QS

Fantasy battery technology. Another Theranos, this time for batteries.

NASDAQ:NTGR

Netgear, home hi-fi hardware, eroding sales, tired product.

NASDAQ:EQOS

Diginex: another crypto exchange Ponzi. HK based, which increases risk.

NASDAQ:LFMD

LifeMD. Telehealth co. which uses unregistered doctors to dispense OTC medications.

Takeover arbitrage

Koneko Research published a report titled “Long SOHU Short SOGO” Koneko argued,

“The current market price of SOGO implies a high likelihood that its $9/ADS acquisition by Tencent will be successful while the current market price of SOHU implies a very significant likelihood of failure. A hedged position has a high probability, but not a guarantee, of an attractive return regardless of the deal outcome.”

Tricky to implement, imho.

NASDAQ:RIOT

Another crypto Ponzi.

The hyperactive Chamath

He’s sponsored an insane number of deals.

Einhorn and the Arch Egos

Someone picked up on the fact that Bill Hwang was pumping $GSX and that this is straightforward stock market manipulation, which the SEC should do something about. Except we know it turns a blind eye to any activity that lifts the price of Ponzi stocks.

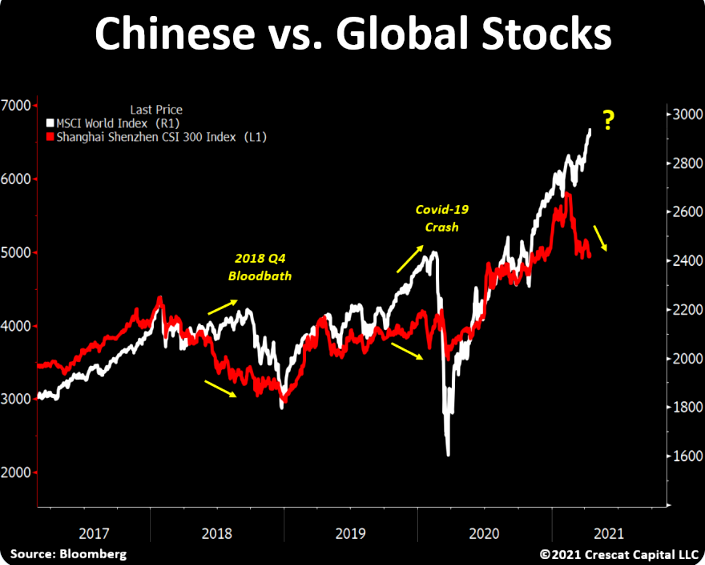

Chinese puzzle

There are a lot of very overvalued Chinese stocks. There have always been a lot of very overvalued Chinese stocks. The question is: why is the market behaving differently now? From TME.

Bitcoin represents freedom from the Fed

… on the other hand, maybe not.

The Fed and inequality

Central banks maintain that their job is price stability, which they have defined to mean a steady decline in the purchasing power of money. The Fed has the famous “dual mandate” to maintain “full employment.” Now they all want to fix climate change, and abolish racial inequality. Truly, they are omnipotent in a way nobody would have believed in the 80’s.

The weird thing is that productivity has been low, and inequality rising, more or less the whole time that central banks have appeared to have control of inflation. Inflation, like unemployment (and hence “full employment”) are highly abstract words with a multiplicity of definitions. Certainly, full employment does not involve getting unemployment down to zero, or labour participation much above sixty percent.

We are in an era where returns to capital have been huge compared to returns to labour. If you don’t believe me, take a look at WTF happened in 1971?. Something needs to change, before we see a serious breakdown in civil order.

Twttr

BREAKING NEWS: Markets plummet as asset managers rotate in safe havens such as Tesla and Doge

— Simple Jack Capital👨🦯📉 (@SimpleJackCap) April 20, 2021

$AAPL 1970-2011: Look at all these revolutionary products$AAPL 2021: Apple announces new iMacs in a bunch of fun colors

— Sven Henrich (@NorthmanTrader) April 20, 2021

Wrap

Equity markets, especially in Europe have fallen a lot. FTSE, MIB, IBEX and Nikkei have all fallen considerably more than 1%. Bonds have barely moved. Commodities have dipped a bit, but there is no real trend. Natural gas is back where it was last August ($2.7 per MMBtu). Oil is down about 1% (between WTI & Brent). US equity markets are down again, by 60bp, but the SPX is still up more than 50% YoY, so we’re not exactly in a bear market.

Supposedly, the reason is that Covid cases are still not under control in the many countries in Europe where the vaccine roll out has been poorly executed. Northman Trader thinks it’s because nobody from the Fed has been on TV pumping risk assets.

Comments !