Saturday 9, April 2022

Green Agenda

This tweet caught my eye. I don’t know or care if Obama believes in AGW and its likely effects on sea levels. I care about the fact that this person, who was given great power and continuing influence, as well as huge wealth, through the support of the Democratic Party, now cares so little about this party that he (seemingly) engages in ostentatious displays of wealth, which erodes the support for his party in the constituency (the poor) that it purports to represent.

— Rothmus 🏴 (@Rothmus) April 9, 2022

Image

Jamie Heiden pic.twitter.com/5sWf430neH

— Daniel Brami (@Daniel_Red_Eire) April 9, 2022

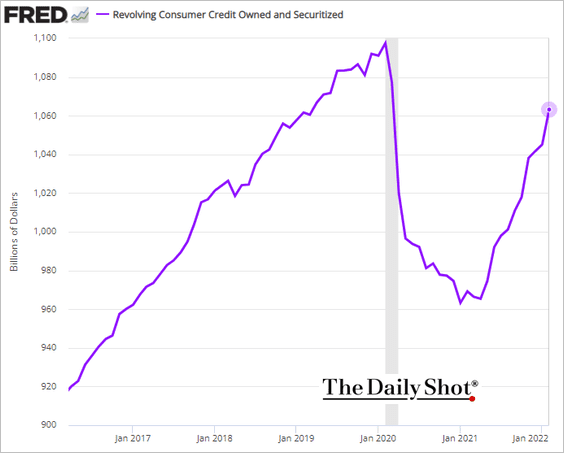

Consumer credit

The pandemic saw a collapse in borrowing, because people could not go out and spend. The best they could do was order electronic devices from Amazon and takeaway meals from Uber Eats. Now things are very different.

These people have incomes, but they are feeling the impact of inflation. They will look to strike or find a new, better-paying, job.

Truth

Dr. Gregory House : There’s a reason that everybody lies. It works. It what allows society to function, it’s what separates man from beast.

Dr. James Wilson : Oh, I thought that was our thumbs.

Dr. Gregory House : You wanna know every place your mom’s thumb has been?

Dr. James Wilson : I’m sorry I missed rehearsal. Am I taking the “truth is good” side? Don’t you usually take that part?

Dr. Gregory House : Lies are a tool, they can be used either for good… No wait, I got a better one. Lies are like children. Hard work, but they’re worth it. Because the future depends on them.

Dr. James Wilson : You are so full of love… or something.

There are good reasons to lie. Mankind cannot tolerate too much honesty. But there are also bad reasons to lie. Market commentary is frequently tainted with the bad reason. When some random substack newsletter author tells his subscribers that such and such a stock is a steal, he probably believes it. He has also probably already purchased some (or done the equivalent, such as selling puts or buying calls). It’s understandable: he’s sharing the benefits of the research he did, in exchange for what will probably be a very modest uplift in the price of the stock. Unless he’s Jim Cramer or Elon Musk.

People lie to kids. They tell them that anything is possible, that the American Dream is still alive and well. It’s rational to tell kids that they world is their oyster, and that they should follow their passion. This is kind, but it can be cruel. Most kids will never make it to be an opera singer, or a pop star, or a premiership footballer. Even the most talented kids will wilt in the heat of the sort of competition that exists at the top.

Very many kids go to university, study for masters and doctoral degrees. Orders of magnitude more young people obtain advanced degrees, but the idea that they will all better off as a new cohort is simply wrong, unless jobs that will increase in productivity as a result. The reality is that professional job openings in accountancy and law will decline because artificial intelligence will eventually be more widely introduced. Speaking as someone who has endured more than his fair share of the paper-bound and glacial process of buying and selling houses, it’s cle,It is taking longer than expected, but just imagine how many counter staff banks employed forty years ago, relative to now. Universities do not, as far as I can tell, attempt to match what they teach to demand for jobs. They might argue that nobody knows what the pattern of demand might be in a generation’s time, so they can’t be expected to design courses with it in mind. But in practice they teach vast numbers of students “Business studies”, which is just about the opposite of a training someone to think and be analytical.

The worst sort of lie, though, is the one that shirks our duty to give honest evaluation and feedback. When we want to know, we want to know. To praise someone for average achievement is not a kindness. It is a dereliction of duty.

Tweet of the recent past

Waste of funds. We just use the same chip that was implanted w the vax. https://t.co/Kn2WI1uxLe

— Rich Handler (@HandlerRich) April 7, 2022

Wrap for the week

Yields continue to rise, although erratically. The dollar continues to be strong, $DXY now close to 100. Commodities quite mixed. Oil down, gold up, but neither by much. Stocks fairly level. Down on the week, but not by a lot.

Comments !