Extend and Pretend goes wild

If you reclassify debt enough, it never goes bad. So creditors never have to worry … do they? The funny thing is that credit card debt went right down, which probably mainly just reflects a crash in consumer spending. When Milton Friedman was in his prime, money was currency, and bank deposits. Now credit card balances must qualify as what he would call “close substitutes for money.” If the numbers are right, then we are probably going to see an inflationary crash, in spite of all the CB credit produced.

If you pay firms to “employ” workers to sit at home, you can keep unemployment rates low. So taxpayers don’t have to worry about funding the scheme … do they?

Wirecard — more than meets the eye

This article talks about Wirecard being “looted” before the fraud was discovered. There is something more to come out from this scandal. The thing I don’t understand is how a very high profile German company (and DAX constituent!) could have got away with such brazen fraud for so long. It has to be more than lazy auditors. Someone in a position of power was telling the authorities to hold back. Tesla next? Who knows? It’s not an original thesis.

Close of play

It’s too hot to follow the markets in this weather. I would say that risk assets were generally a fraction higher, almost certainly driven by some statement by the Treasury to the effect that they’d continue supporting markets. The NDX was down a bit, but other US and world markets generally up ~0.25%. Most commodities higher, including the hydrocarbon complex, except NG which was down after a charging higher last week. European sovereigns drifting higher, as the ECB keeps the presses rolling.

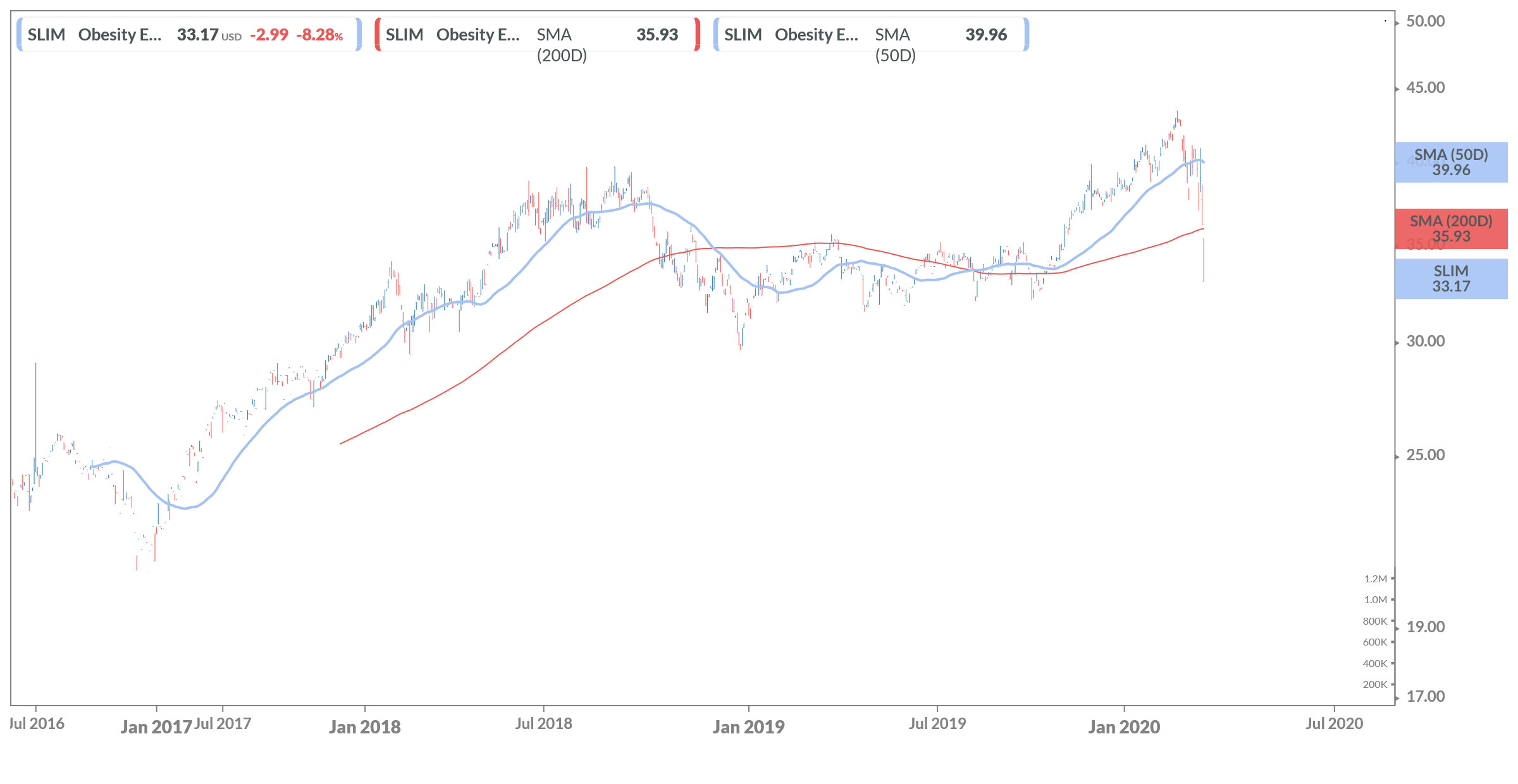

Obesity Index is going down rapidly, like a fat man jumping off a very high diving board .

$AAPL catching a bid in the face of grim fundamentals, but that’s the whole point of the market nowadays.

.

$AAPL catching a bid in the face of grim fundamentals, but that’s the whole point of the market nowadays.

Comments !