Morning Call

UK GDP headed down by more than 20% in the quarter but the FTSE goes up. Well, both entirely predictable, but still, in a way, shocking.

Joe Biden (or his minders) announce that it’s Kamala Harris, to just about nobody’s surprise. I guess this probably increases the risk of Biden winning (compared to which choice?) which means more stimulus, and more profits, and more EBITDA.

Softbank somehow manages to post a profit. I have no idea how, but it’s all mark to fantasy …

There are clouds on the horizon:

- highest net buying in US equities since the sell-off (early march) [although, see this] which shows flows into SPX fund flows trending down!

- “Fear” has not closed this low since the Corona crisis peak..VIX and V2X implosion feeding through the system.

- JPM Prime Brokerage: Net Exposure: Level at 99%-tile since Jan-2018.

- GS Prime Brokerage: Net leverage at 77.4% (99th percentile)

- Put/call ratio at extreme

- major positioning unwind / killing of generals. Tech+MoMo+Growth+SaaS - the absolute leaders of this rally - up against some serious selling

- Cross-asset price action showing major reversals (silver, gold, bonds)

Bonds are definitely down, at the long end. USD is stronger than would be expected, although opinions differ (this article argues that although the USA isn’t the military force it once was, it’s still geopolitically dominant and therefore is the issuer of the global reserve currency by default.

Today I Learned

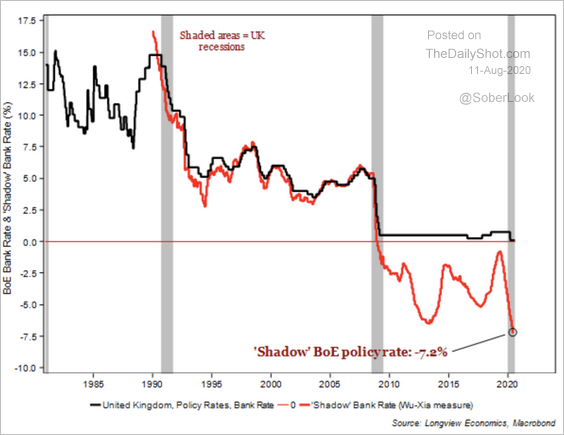

What a shadow rate was.

It seems that the UK shadow rate has never been lower:

I also learned, although I was already vaguely aware of it, that the Fed does a lot more talking about buying corporate bonds than actually doing it. It certainly annoys the hell out of ordinary mortals that the Fed is helping Tim Cook finance the buybacks that save his stock awards from diluting Apple’s shareholders.

Closing Bell

Another classic risk-on day. All equity indexes (that I noticed) were up. The NDX is unstoppable, up 2.5%, but the others are close behind. The VIX is down to 23 (the future’s price), implying a tiny realized vol. The long bond is down, gold and non-soft commodities are up (a bit). My “fraud” stocks nearly all up, especially $NKLA, which is up nearly 6%. (Note that I am not suggesting that the officers of these companies are in any way guilty of fraud, or that anything I say is intended to be anything but ironic comment).

Comments !