Morning thoughts

It’s oppressively hot in the UK: not something I often say. The main driver of all price moves today is the dollar, which continues to sag. DX is down 0.46%, which is pushing all other prices up, at least in commodities. Equities are getting a boost, but mainly bouncing back from the violent falls yesterday: $ESTX50 is up 1.2%, but still well down on the week. Quarterly economic data seems to be confirming what (surely) we all knew perfectly well: that the Covid lockdown had caused major damage to developed economies. The Far East equities seem becalmed. Normally, a weak dollar is great for the Hang Seng, but maybe these times are different. The bad economic headlines from yesterday seem to have been somewhat forgotten by the bond market. The yields have ticked up across the curve, but slightly more at the long end, giving me renewed hope that there will be some steepening. Back in the eighties, regular newspapers were full of discussions about through what channel inflation came into the UK. I remember being persuaded that the exchange rate was very important, at least for the UK, which is a fairly open economy. Of course, the US is a relatively closed economy, so can stand a substantial depreciation of its currency without suffering much price inflation.

An article in the FT today was arguing that a weak dollar translates into higher asset prices of (nearly) all classes, but especially emerging market equities. I can see the logic, but I am not going to rush out to buy them.

Silver and gold are getting more airtime. Quite a few commentators are in effect saying “would you go long this far into a rally?” The problem is that investors seem increasingly reckless, and have so few appealing alternatives, as longs but are yet to see the possibilities of going short (which, to be fair, nearly always implictly involves going long dollars which is not a comfortable positionto be in).

Fleck is long Alamos Gold ($AGI). Gold miners have done well lately, and Fleck knows what he’s talking about when it comes to selecting miners. Might be worth a punt (not investment advice). My list of miners is available for all to see. The dispersion in weekly performance is really something. This suggests that diversifying by holding a basket of these would be worth doing, but only for sound companies. $SILV looks tempting.

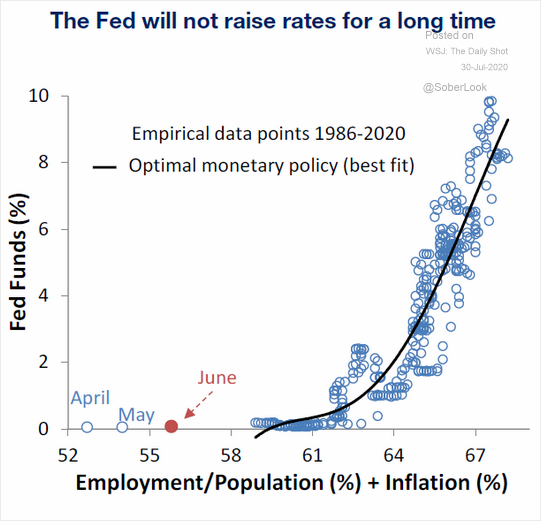

from the Daily Shot.

from the Daily Shot.

Science factoid

Calico cats (and tortoishells) are almost invariably female. The study of the genetics of calico cats seems to have been going since 1948. The skin of a calico cat is a mosaic of cells some of which express on X chromosome, the others expressing the other. Wikipedia has the details. I learned this from this excellent podcast. Women really are the stronger sex: at any age their chance of dying is about 20% less than the chance of a male of the same age. The difference is the extra genetic weaponry in their spare X chromosome.

Words of wisdom (from Charlie Munger)

The big money is not in the selling, but in the waiting.

Closing bell

$AMZN up ~10%. Wonders will never cease. Generally equities up, commodities too (including precious metals). Yields flat. Dollar up against most major currencies.

Have a relaxing weekend!

Comments !