Don’t Fight the Fed

Kuppy writes that it’s pointless going short in these markets. This is more or less the summary of a series of podcasts with Grant Williams, Bill Fleckenstein and others. They are all fantastic, but to really have your mind blown, listen to this one which features the legendary Lord of the Dark Matter (LOTM).

I listened to the podcasts with the LOTM and with Mark Cohodes. The key personnel as far as I’m concerned are:

The big question is “How will it all end?” Nobody really knows, but nobody thought that stocks would ever go down.

Seriously: what is the point of analysts?

This post

Today’s Markets

Commodities up almost across the board, miners too. Metals most. Even softs are picking up momentum, although soybeans are down a tiny fraction. Nearly all global equities are up, some by nearly 1%. ADP payrolls are very disappointing but this is probably the reason that equities are up: more unemployment leads to more money printing. Not coincidentally, the DX is down 0.82% as I write. Even the yield curve responded, a tiny bit. The steepener is on! (But don’t bet the ranch: in fact don’t take anything I say as advice about anything.) This is a very dangerous environment to be short any real assets or long any money assets. To make money, your asset has to fall in price faster than money loses its value. It’s like hitting a target that is not only moving, but accelerating, erratically.

and Finally

-

The $TSLAQ of Packaged Foods. Most definitely, but not in a good way!

-

Why tech stocks seem to be the only ones keeping the SPX afloat:

-

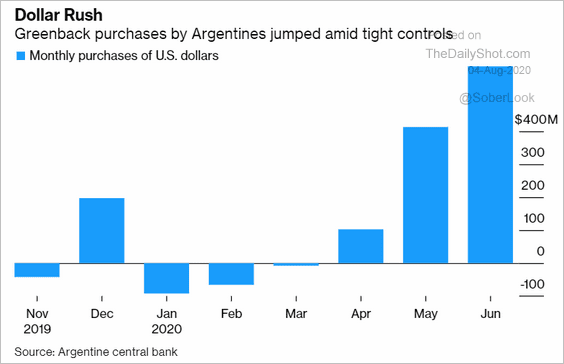

Why Latam currencies are likely headed down, even against the USD:

-

Crude production craters. This has got to be bullish for Natural Gas, right? Well, probably wrong, but it is logical that NG, which is often a barel

Comments !